South Dakota Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

If you need to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest repository of legal documents available online.

Employ the website's straightforward and convenient search to locate the forms you require. Numerous templates for business and individual purposes are sorted by categories and states, or keywords.

Use US Legal Forms to find the South Dakota Assignment of Partnership Interest in just a few clicks.

Every legal document template you acquire is yours indefinitely. You will have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the South Dakota Assignment of Partnership Interest with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal business or individual needs.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the South Dakota Assignment of Partnership Interest.

- You can also view forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have chosen the form for the correct city/state.

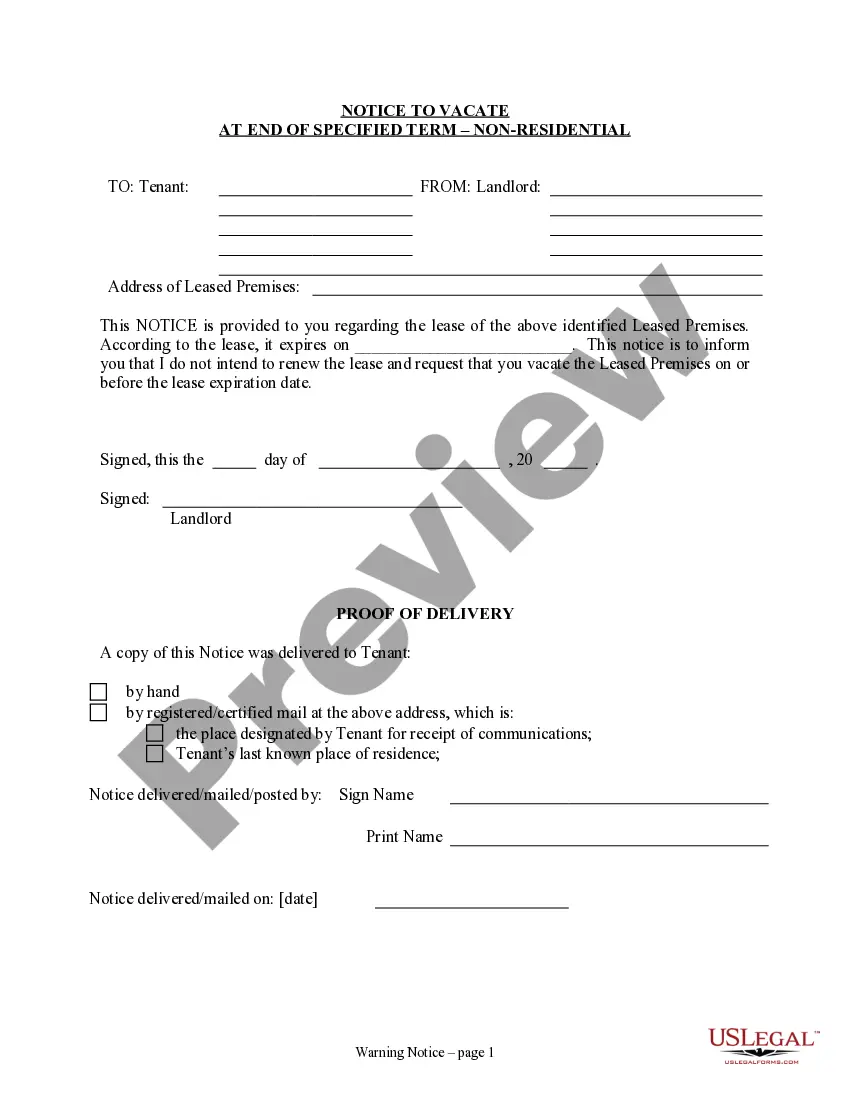

- Step 2. Utilize the Review option to check the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative variations in the legal form template.

- Step 4. After locating the form you require, click the Purchase now button. Select your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can utilize your Visa or Mastercard, or PayPal account to finalize the purchase.

- Step 6. Access the document in the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the South Dakota Assignment of Partnership Interest.

Form popularity

FAQ

South Dakota does not impose a state income tax on partnerships, making it an attractive option for business owners. This absence of state income tax allows partners to retain more of their earnings. When considering a South Dakota Assignment of Partnership Interest, this tax structure can influence financial decisions. It's advisable to consult a financial advisor to navigate the benefits and implications of partnerships in South Dakota.

The sunshine law in South Dakota promotes transparency in government operations. It requires public bodies to conduct their meetings openly and allows citizens access to records. While this law does not directly relate to the South Dakota Assignment of Partnership Interest, understanding local laws can benefit those involved in partnerships. Transparency is essential for maintaining trust among partners and stakeholders.

South Dakota does not officially recognize domestic partnerships. This can impact how individuals manage shared interests, including partnerships. If you are considering a South Dakota Assignment of Partnership Interest, understanding your legal standing is crucial. For those in non-traditional partnerships, it may be beneficial to consult with a legal expert to ensure proper rights and protections.

Yes, South Dakota recognizes common law marriage, which means couples can be considered legally married without a formal ceremony. To establish a common law marriage, couples must show their intentions to be married and demonstrate cohabitation. This aspect is significant within the context of the South Dakota Assignment of Partnership Interest, as it could affect property and partnership rights. It's essential to understand your marital status when engaging in partnerships.

The 22-42-5 law in South Dakota governs the assignment of partnership interests. It outlines the legal procedure for transferring a partner's interest in a partnership. This law ensures that all parties involved in the South Dakota Assignment of Partnership Interest are aware of their rights and obligations. Understanding this law can provide clarity and security when dealing with partnership changes.

Yes, the sale of partnership interest is reported on Form K-1, which partners use to report their share of income, deductions, and credits from the partnership. When completing your tax returns, it's important to accurately reflect any transfers made, including those related to a South Dakota Assignment of Partnership Interest. This ensures compliance with IRS guidelines and helps maintain accurate financial records.

To transfer ownership interest in a partnership, you typically need to draft an assignment agreement, which outlines the terms of the transfer. Additionally, parties involved should notify the other partners and update the partnership agreement accordingly. Engaging in a South Dakota Assignment of Partnership Interest will ensure that you follow the specific legal guidelines required in South Dakota.

Yes, the transfer of partnership interest can be taxable. When a partner transfers their interest, it may result in capital gains or losses depending on the adjusted basis of the interest being transferred. This is an essential consideration for anyone engaging in a South Dakota Assignment of Partnership Interest to ensure that they comply with tax regulations.

An assignment in a partnership refers to the transfer of a partner's rights and obligations to another individual or entity. In the context of a South Dakota Assignment of Partnership Interest, this process allows one partner to relinquish their stake in the partnership while potentially assigning their share of profits and losses to the new partner. Understanding this process ensures that all parties are aware of their rights and responsibilities.

To report a 751 gain associated with the South Dakota Assignment of Partnership Interest, you generally need to use Form 1065 and Schedule K-1. This information helps ensure accurate tax reporting for gains that arise from the sale or exchange of partnership interest. It is crucial to provide detailed information to avoid any complications with the IRS.