South Dakota Assignment of Judgment

Description

How to fill out Assignment Of Judgment?

Are you presently in a position where you require documents for either organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't straightforward.

US Legal Forms offers a vast array of form templates, including the South Dakota Assignment of Judgment, which are designed to comply with federal and state regulations.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the South Dakota Assignment of Judgment at any time, if needed. Click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the South Dakota Assignment of Judgment template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

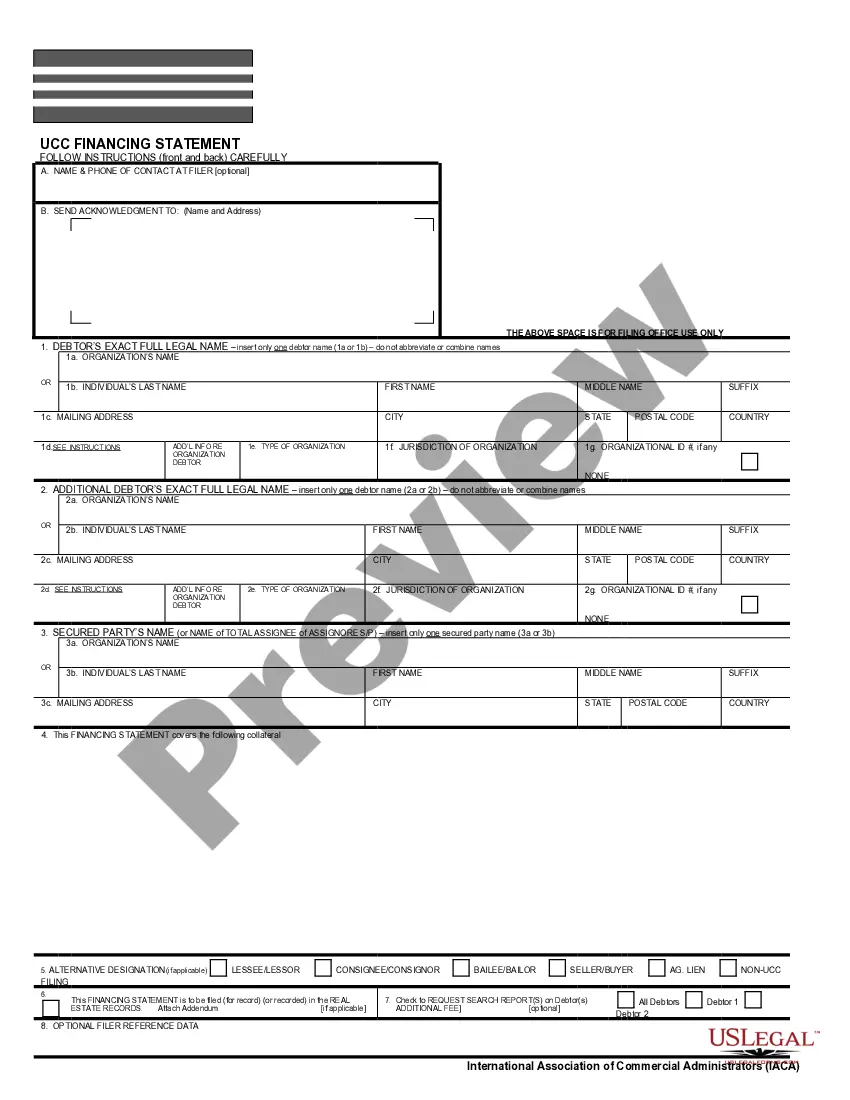

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right document.

- If the form isn’t what you are searching for, use the Search field to find the form that suits your needs and requirements.

- When you locate the correct form, click Purchase now.

Form popularity

FAQ

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

Interest is allowed on most judgments entered in the federal courts from the date of judgment until paid. The types of judgments generally fall under one of three statutes: 28 U.S.C.

If the liability of one party to another has been determined by verdict or order or judgment, but the amount or extent of the liability remains to be determined by further proceedings, the party adjudged liable may make an offer of judgment, which shall have the same effect as an offer made before trial if it is served ...

South Dakota interest rate laws generally defer to contract law. One exception is a 12 percent limit on judgments. Generally speaking, South Dakota's interest rate limit is 15 percent.

§ 15-35-810. A judgment becomes a lien on real property for a period of 10 years. S.D. Codified Laws § 15-16-7.

Interest begins on the date the judgment is entered. CCP § 685.020(a). When the judgment is payable in installments (e.g., child support awards), interest accrues from the date each installment becomes due. Post-judgment interest is not compounded unless the judgment is renewed.

Execution of Judgment Once an execution is turned into the Sheriff's Office, the following procedures take place: The plaintiff fills out a questionnaire about the defendant including their known property and bank accounts. The plaintiff pays a $95 fee. The fees are added to defendant's costs.

Interest, Costs and Attorney's Fees Post-judgment interest is payable on all judgments at the statutory rate. SDCL §54-3-5.1. The statutory rate in South Dakota is currently 10 percent per annum. SDCL §54-3-16(2).