South Dakota Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC

Description

A distributional interest in a limited liability company is personal property and may be transferred in whole or in part. The following form is a agreement whereby the sole member of the LLC transfers his 100% interest as such member to another party.

How to fill out Agreement For Sale Of All Rights, Title And Interest In Limited Liability Company LLC?

Are you presently within a situation that you require paperwork for both enterprise or individual reasons nearly every day time? There are a lot of legitimate papers layouts available online, but getting ones you can trust isn`t straightforward. US Legal Forms offers a large number of type layouts, such as the South Dakota Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC, which can be composed to satisfy federal and state needs.

When you are already familiar with US Legal Forms web site and have an account, basically log in. Afterward, you are able to obtain the South Dakota Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC template.

If you do not come with an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is for the right area/area.

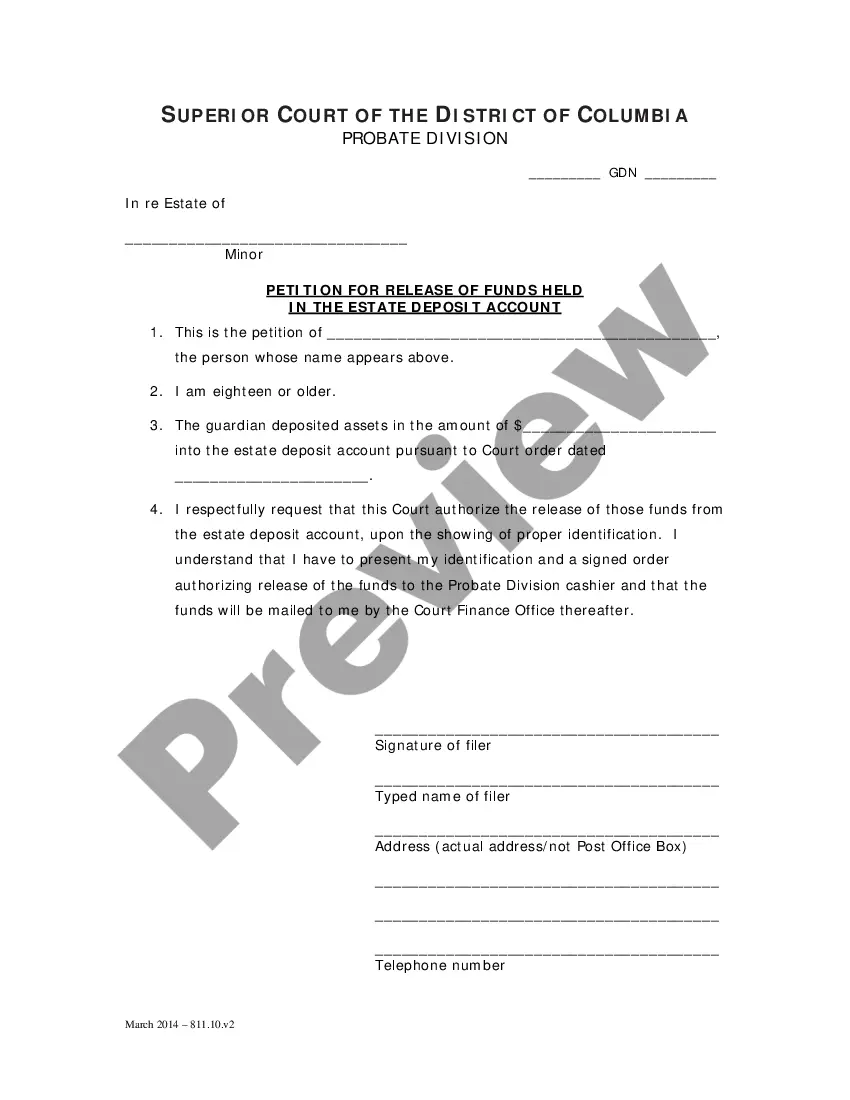

- Take advantage of the Review key to examine the form.

- Read the explanation to actually have selected the appropriate type.

- If the type isn`t what you are looking for, utilize the Search industry to discover the type that fits your needs and needs.

- Once you find the right type, click on Acquire now.

- Choose the prices plan you want, fill out the required info to produce your account, and pay money for your order with your PayPal or bank card.

- Pick a practical file format and obtain your version.

Locate every one of the papers layouts you possess purchased in the My Forms menus. You may get a extra version of South Dakota Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC at any time, if needed. Just select the necessary type to obtain or produce the papers template.

Use US Legal Forms, probably the most considerable selection of legitimate types, to save some time and steer clear of blunders. The services offers appropriately manufactured legitimate papers layouts that you can use for an array of reasons. Create an account on US Legal Forms and commence creating your lifestyle a little easier.

Form popularity

FAQ

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Starting an LLC in the Mount Rushmore State comes with its own unique financial dynamics. South Dakota stands out as an attractive option for business owners due to its lack of state income tax.

In South Dakota, all misdemeanors carry a lengthy seven-year statute of limitations. Most felonies also have a seven-year statute of limitations. Class A, B, and C felonies do not have any statute of limitations.

Your operating agreement should be kept on file at your business location. An operating agreement is not required in South Dakota state but can still be important when starting an LLC. An operating agreement can include provisions on: Rights and responsibilities of members.

To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

How do I change my South Dakota LLC name? In order to change your LLC name, you must file the Amended Articles of Organization with the South Dakota Secretary of State. This officially updates your legal entity (your Limited Liability Company) on the state records.