South Dakota Open a Bank Account - Corporate Resolutions Forms

Description

How to fill out Open A Bank Account - Corporate Resolutions Forms?

Are you presently in a situation where you require documents for either business or personal purposes almost constantly.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the South Dakota Open a Bank Account - Corporate Resolutions Forms, which are designed to comply with state and federal regulations.

Once you locate the right form, click Acquire now.

Choose the pricing plan you want, provide the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Open a Bank Account - Corporate Resolutions Forms template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

- Use the Review button to examine the form.

- Read the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that matches your needs and requirements.

Form popularity

FAQ

Yes, a foreign corporation can do business in the US, but it must comply with federal and state regulations. This often involves registering as a foreign entity in the states where it plans to operate. To streamline your entry into the US market, consider managing your documentation with South Dakota Open a Bank Account - Corporate Resolutions Forms.

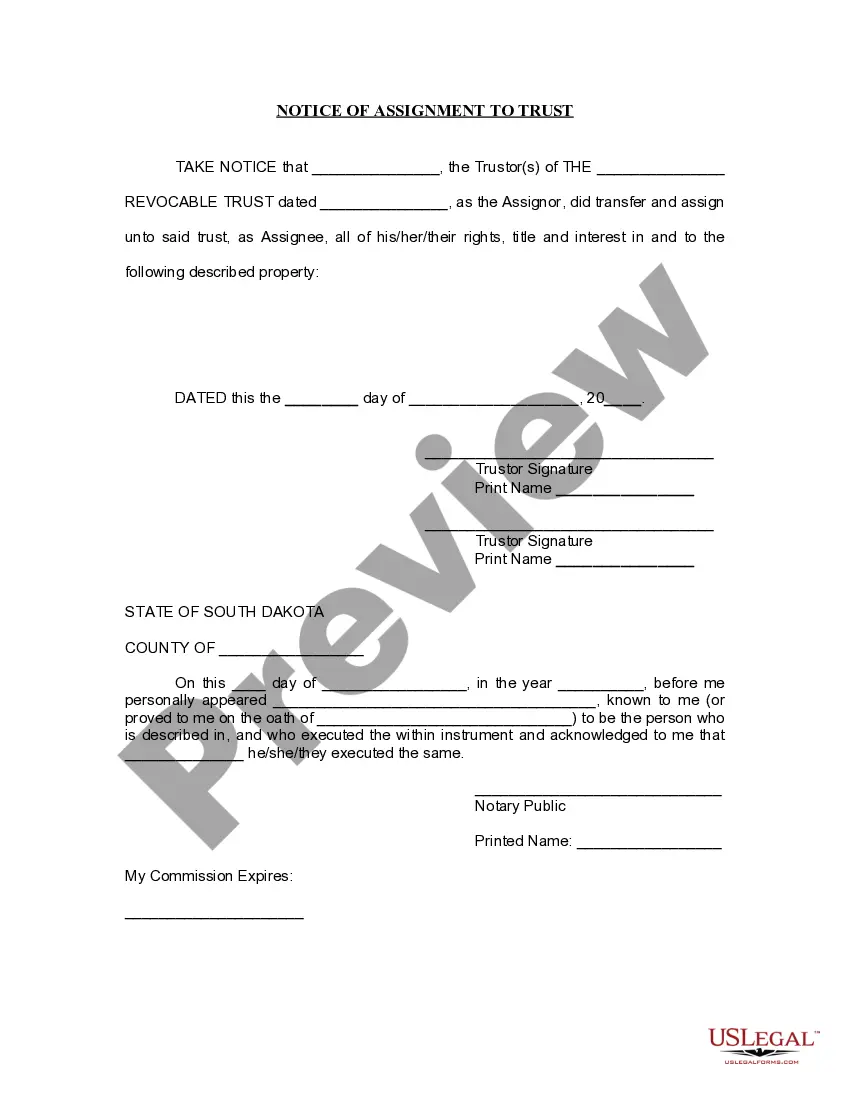

The format for a resolution to open a bank account typically includes the date, the name of the corporation, and the specific resolutions passed. It also outlines the authority given to certain individuals to act on behalf of the company to open the account. By utilizing South Dakota Open a Bank Account - Corporate Resolutions Forms, you can follow a clear and professional template.

A foreign corporation can indeed open a bank account in the US. The corporation must provide relevant documentation, including business registration and identification for authorized signers. By using South Dakota Open a Bank Account - Corporate Resolutions Forms for proper documentation, this process can be simplified and made more efficient.

Yes, a non-US citizen can open a bank account in the USA, but they generally need to provide certain documents, such as a passport and proof of address. Each bank may have different policies, so it is important to check in advance. Additionally, the use of South Dakota Open a Bank Account - Corporate Resolutions Forms can help facilitate necessary authorizations.

To open a business bank account in the USA as a non-resident, you must typically provide valid identification and documentation related to your business. Many banks require a federal tax ID along with proof of business registration. Consider using South Dakota Open a Bank Account - Corporate Resolutions Forms to ensure that your paperwork is in order.

A corporate resolution form is a written record that captures decisions made by a company's board of directors. This form typically contains the specific resolutions passed, including the appointment of individuals authorized to act on behalf of the company. You can access South Dakota Open a Bank Account - Corporate Resolutions Forms from uslegalforms to meet this need.

A corporate resolution is a document that formally approves a specific action, such as opening a bank account in the company’s name. This document shows that the bank account decision has been authorized by the company’s board of directors. Utilizing South Dakota Open a Bank Account - Corporate Resolutions Forms can be an effective way to simplify this process.

Yes, a foreign company can open a bank account in the US. However, they must comply with specific requirements, including providing legal documentation and identification. You will find that the process may differ depending on the bank and state regulations, including using South Dakota Open a Bank Account - Corporate Resolutions Forms to streamline establishment.

Corporate account opening refers to the process of establishing a bank account for a corporation. This includes filing necessary paperwork, providing required documentation, and ensuring the resolution is in place. Utilizing South Dakota Open a Bank Account - Corporate Resolutions Forms simplifies gathering all needed documentation and ensures proper compliance.

A corporate resolution to open an account is a specific type of document that officially records a corporate decision to open a bank account. This resolution designates who has the authority to manage and access the account. With South Dakota Open a Bank Account - Corporate Resolutions Forms, you can create a compliant resolution quickly and efficiently.