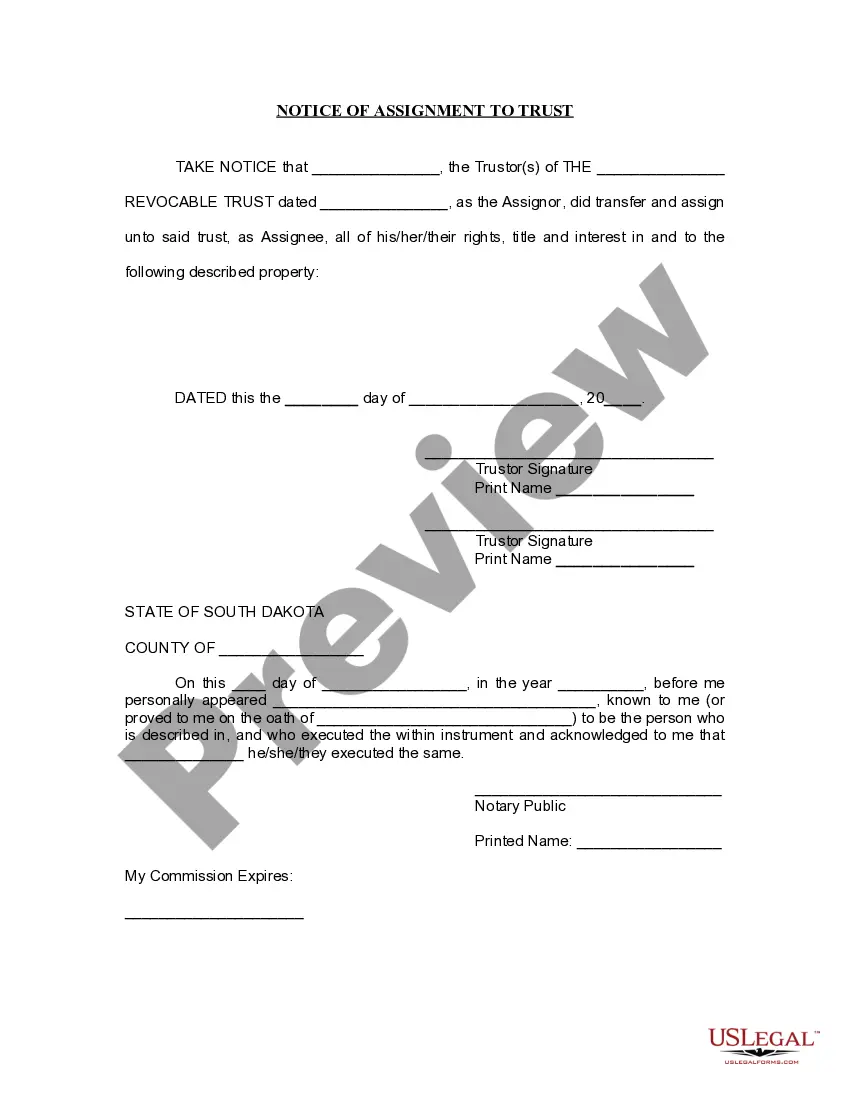

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

South Dakota Notice of Assignment to Living Trust

Description

How to fill out South Dakota Notice Of Assignment To Living Trust?

Access to quality South Dakota Notice of Assignment to Living Trust forms online with US Legal Forms. Avoid days of wasted time looking the internet and dropped money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find more than 85,000 state-specific legal and tax samples you can save and submit in clicks within the Forms library.

To get the example, log in to your account and click on Download button. The document is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Verify that the South Dakota Notice of Assignment to Living Trust you’re looking at is suitable for your state.

- See the form utilizing the Preview option and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to register.

- Pay by card or PayPal to complete creating an account.

- Select a preferred format to download the file (.pdf or .docx).

Now you can open the South Dakota Notice of Assignment to Living Trust sample and fill it out online or print it out and get it done by hand. Consider mailing the papers to your legal counsel to make certain everything is completed correctly. If you make a mistake, print and complete application again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

A living trust never needs to be filed with a court, either before or after your death. The probate court isn't involved in supervising your trustee, the person you name in the trust document to handle the distribution of the trust assets.

Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust. However, if real estate is involved, the trust may be recorded in the local office of the county clerk.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

If they request an EIN for the trust, they must file a separate income tax return for it using Form 1041. 6fefffeff This return would be due on the same date as your personal Form 1040. If you need an EIN for your revocable living trust, you can obtain one online by using the IRS EIN Assistant.

Living Trust Like a will, a trust will require you to transfer property after death to loved ones.Unlike a will, a living trust passes property outside of probate court. There are no court or attorney fees after the trust is established. Your property can be passed immediately and directly to your named beneficiaries.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

No. Trust does not need to be filed in California. Trusts are private documents and usually there are compelling reasons not to file the trust.