South Dakota Promissory Note - Satisfaction and Release

Description

How to fill out Promissory Note - Satisfaction And Release?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

By utilizing the site, you will access thousands of forms for both business and personal uses, organized by categories, states, or keywords.

You can find the latest versions of documents like the South Dakota Promissory Note - Satisfaction and Release in just seconds.

- If you already have an account, Log In to download the South Dakota Promissory Note - Satisfaction and Release from the US Legal Forms library.

- The Download button will appear on every document you view.

- You can access all your previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/state.

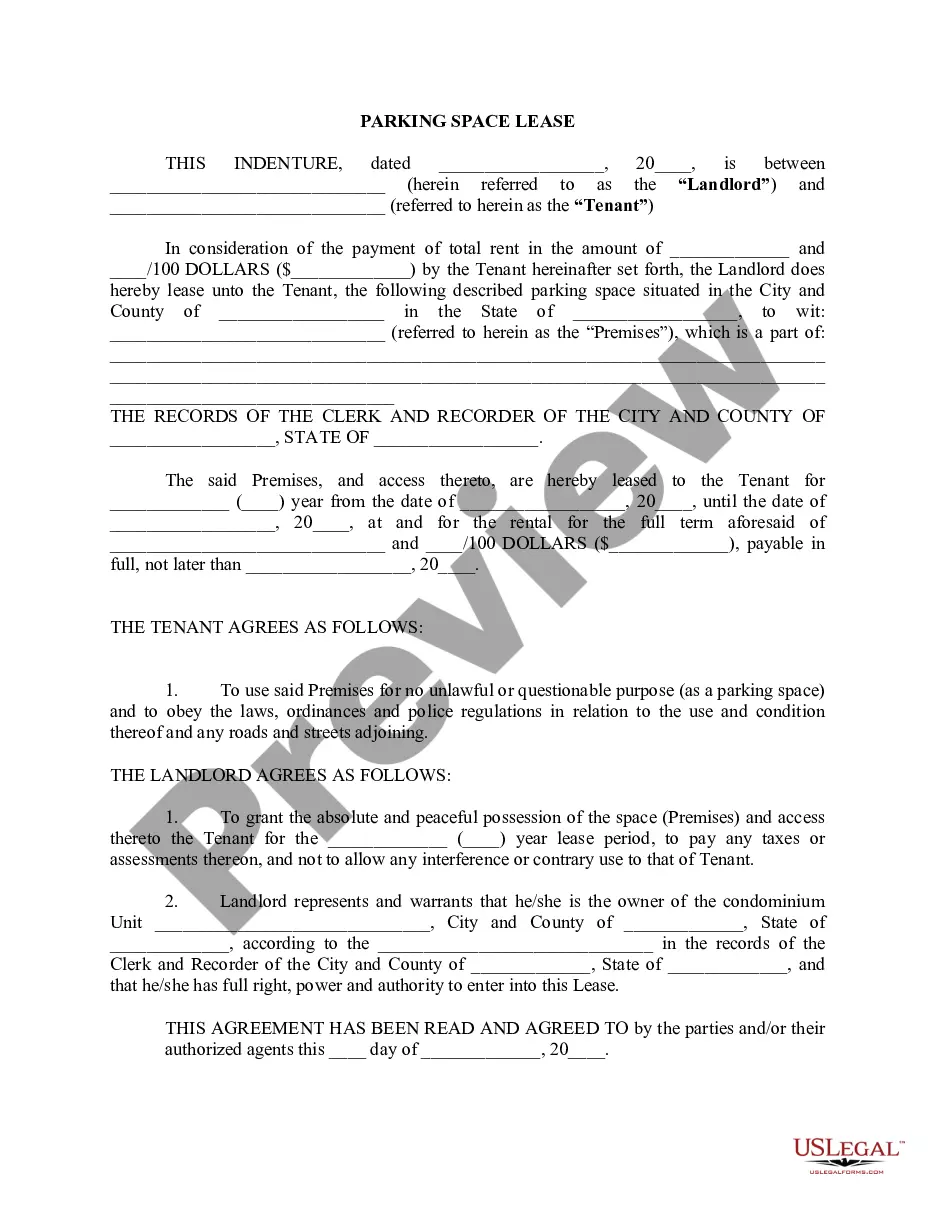

- Press the Preview button to review the form's details.

Form popularity

FAQ

Generally speaking, while discussions about national debt and defaults make headlines, the term 'default' holds specific legal meanings in financing agreements. To understand the implications related to a South Dakota Promissory Note - Satisfaction and Release, it's crucial to differentiate between personal obligations and broader fiscal policies. Awareness of these distinctions can lead to informed financial decisions.

In South Dakota, a judgment is generally enforceable for a period of 20 years. This length allows creditors ample time to collect on debts, including those arising from defaulted South Dakota Promissory Notes - Satisfaction and Release. Staying informed can help you manage your financial decisions effectively.

A default note refers to a document that confirms an individual has failed to meet the obligations specified in a promissory note. In South Dakota, such a note can lead to a formal process to collect the owed amount. Understanding the nature of default notes can guide borrowers and lenders on how to navigate the complex landscape of loans.

Defaulting on a payment indicates that an individual has failed to fulfill their payment obligations as outlined in the agreement. In the context of a South Dakota Promissory Note - Satisfaction and Release, this could lead to serious financial consequences, including late fees or legal action. Understanding the implications of defaulting can help you take necessary steps to avoid this situation.

The release and satisfaction of a promissory note indicates that the borrower has completed all payments, thus clearing any outstanding debt. This legal process involves drafting a separate document that both parties must sign. It's essential to provide comprehensive details about the original note to avoid confusion. US Legal Forms can assist you in preparing a proper South Dakota Promissory Note - Satisfaction and Release document.

Filling out a promissory demand note requires basic details such as the lender and borrower's names and addresses, along with the demanded amount. Additionally, specify that the payment is due upon demand, without set terms. Sign and date the note to validate the agreement. US Legal Forms provides suitable templates to help you create a compliant South Dakota Promissory Note - Satisfaction and Release.

To release a promissory note, you must create a satisfaction and release document. This document states that the borrower has fulfilled their payment obligations, effectively releasing the lender's claim. It's essential to include details about the original note along with both parties' signatures. Utilizing resources from US Legal Forms can ensure your release document complies with South Dakota laws.

To fill a demand promissory note, begin by entering the names and addresses of the borrower and lender. Clearly state the amount being borrowed, along with the interest rate, if applicable. Ensure that both parties sign and date the document, which reinforces the South Dakota Promissory Note - Satisfaction and Release. Using a reliable platform like US Legal Forms can simplify this process, providing accurate templates.