South Dakota Revocable Living Trust for Unmarried Couples

Description

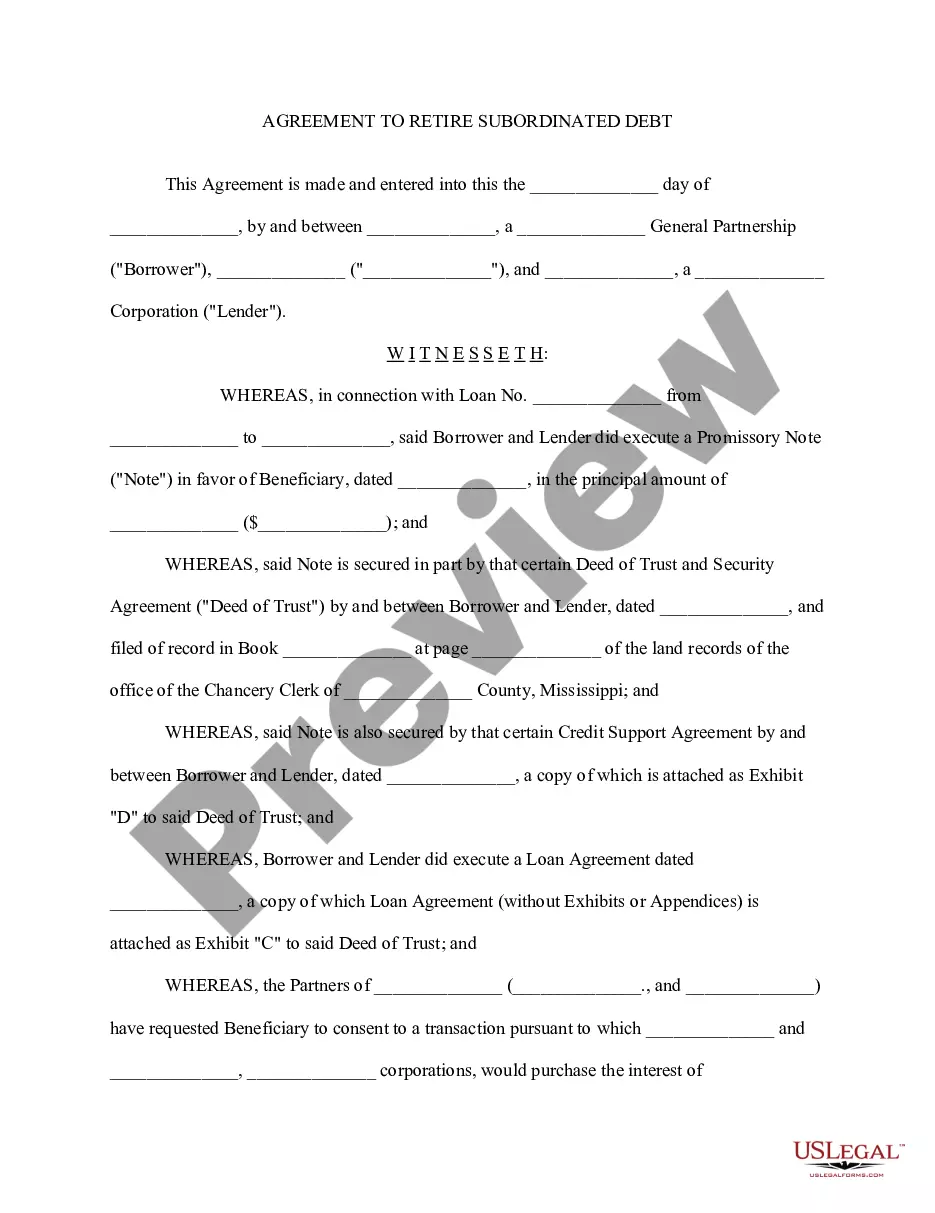

How to fill out Revocable Living Trust For Unmarried Couples?

If you need to finish, acquire, or print legal document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you want, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the South Dakota Revocable Living Trust for Unmarried Couples with just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to get the South Dakota Revocable Living Trust for Unmarried Couples.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the information.

- Step 3. If you are unhappy with the form, use the Search bar at the top of the screen to find other forms in the legal format.

Form popularity

FAQ

Filling out a revocable living trust involves entering specific details about your assets, beneficiaries, and trustees into a legal document. A South Dakota Revocable Living Trust for Unmarried Couples requires careful attention to ensure all information is accurate and complete. Using a straightforward template from USLegalForms helps streamline this process, guiding you through each section step by step. Once completed, remember to sign and notarize the document.

While a South Dakota Revocable Living Trust for Unmarried Couples offers many benefits, there are some disadvantages to consider. One downside is that the assets in the trust do not have protection from creditors. Additionally, because you can modify the trust, it does not provide the same level of asset protection as an irrevocable trust. Thus, it is essential to weigh these factors carefully when deciding if a revocable trust is appropriate for your situation.

Yes, anyone can set up a South Dakota Revocable Living Trust for Unmarried Couples. The process involves drafting the trust document and ensuring it complies with state laws. You don't need to be a resident of South Dakota to create this trust; however, it’s crucial to follow specific legal guidelines. Utilizing a service like US Legal Forms can help simplify the setup process and ensure that your trust meets all necessary requirements.

Setting up a living trust in South Dakota involves several key steps. Begin by identifying the assets you want to include and choose a trustee to manage the trust. Then, draft the trust document, ensuring it complies with state laws, possibly utilizing resources from uslegalforms to simplify this process. Finally, transfer your chosen assets into the trust to complete the setup.

While revocable living trusts offer flexibility and control, they also have some disadvantages. Firstly, these trusts do not provide asset protection from creditors or lawsuits. Additionally, the South Dakota Revocable Living Trust for Unmarried Couples may require more ongoing management compared to simpler options like wills. Understanding these nuances helps you make informed decisions.

Yes, married couples can create a joint revocable trust, which allows both partners to manage their assets together. However, this type of trust is different from the South Dakota Revocable Living Trust for Unmarried Couples. If you are unmarried, establishing a separate trust can help ensure your wishes are honored. It’s wise to consult a legal professional to design the right trust for your situation.

Yes, you can establish a living trust without your spouse. In fact, a South Dakota Revocable Living Trust for Unmarried Couples is specifically designed for partners in this situation. This type of trust enables you to have full control over your assets and determine how they will be managed and distributed, providing peace of mind for the future.

Choosing between one trust or two depends on your financial situation and relationship dynamics. For many unmarried couples, a joint trust simplifies management and decision-making. However, separate trusts may provide more personalized control over individual assets. A South Dakota Revocable Living Trust for Unmarried Couples balances these factors, allowing partners to align their wishes while providing necessary safeguards.

In South Dakota, creating a trust requires a declaration of trust, designated beneficiaries, and valid signatures from all involved parties. It's essential to ensure that the trust complies with state laws to avoid future complications. Leveraging a South Dakota Revocable Living Trust for Unmarried Couples can simplify the process, offering clear guidelines for asset management and distribution.

The best trust for an unmarried couple is often a revocable living trust that addresses their unique needs. A South Dakota Revocable Living Trust for Unmarried Couples offers flexibility in asset management, enabling partners to decide how to distribute their assets. This type of trust also helps avoid probate, simplifying the legal processes after one partner passes away.