South Dakota Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

If you wish to compile, acquire, or produce authorized document templates, utilize US Legal Forms, the most extensive repository of legal documents, which is accessible online.

Employ the website's simple and user-friendly search feature to locate the documents you require. Various templates for commercial and personal purposes are categorized by types and requests, or keywords.

Utilize US Legal Forms to find the South Dakota Personal Guaranty - General with just a few clicks.

Every legal document template you procure is yours permanently. You can access every document you've downloaded within your account. Go to the My documents section and select a document to print or download again.

Be proactive and download and print the South Dakota Personal Guaranty - General with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms client, Log In to your account and then click the Download button to obtain the South Dakota Personal Guaranty - General.

- You can also access documents you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

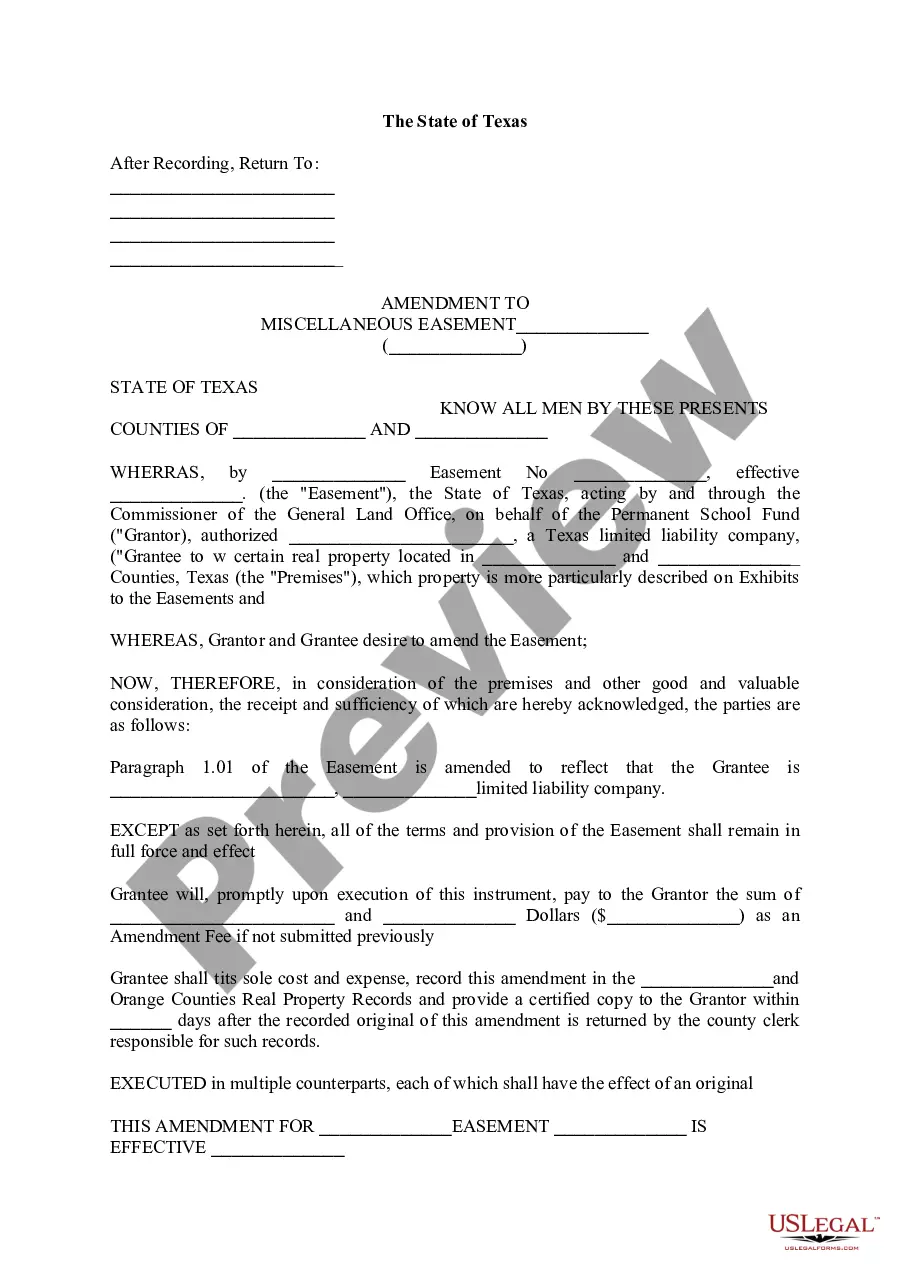

- Step 2. Use the Preview feature to review the form's content. Don't forget to check the summary.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have identified the form you desire, click the Buy now button. Select the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify and print or sign the South Dakota Personal Guaranty - General.

Form popularity

FAQ

A personal guarantee is typically binding, provided it is properly executed. In South Dakota Personal Guaranty - General cases, such guarantees often compel individuals to uphold their financial commitments. The binding nature emphasizes the importance of being conscious about entering such agreements. For peace of mind, consider utilizing resources like USLegalForms to draft and review your guarantees.

The enforceability of a personal guarantee largely depends on its clarity and the context in which it was signed. In South Dakota, if the agreement meets legal standards, it is generally enforceable. However, exceptions exist, such as cases involving fraud or undue influence. It is wise to review your personal guarantee with platforms like USLegalForms to ensure compliance and increase its enforceability.

Yes, a personal guarantee can hold up in court if it meets specific legal requirements. Courts typically look for clear intent and lawful consideration in the agreement. If you fulfill these criteria, the South Dakota Personal Guaranty - General should withstand legal scrutiny. Consult relevant legal resources or platforms like USLegalForms to navigate these nuances effectively.

A personal guarantee can be deemed invalid for several reasons. For instance, if the guarantee lacks proper signatures or if the terms are not clearly defined, courts may refuse to enforce it. Additionally, if the terms are misleading or ambiguous, the guarantee may not hold up. Understanding these nuances in South Dakota Personal Guaranty - General is crucial for ensuring enforceability.

To enforce a guaranty, first assess the terms outlined in the document and confirm the debtor's default. The enforcement process may involve legal action where you present your case, including documentation showing the guaranty and the defaulting behavior. Using a reliable platform like uslegalforms can ensure that your South Dakota Personal Guaranty - General contains all necessary elements for effective enforcement.

Fighting a personal guarantee in South Dakota can be challenging, but it's not impossible. You can contest the enforceability of the guaranty by arguing factors like lack of consideration or misrepresentation. Consulting with a legal professional familiar with South Dakota laws can greatly increase your chances of success. Consider using resources from uslegalforms to draft a compelling case against a South Dakota Personal Guaranty - General.

Yes, South Dakota requires a general contractor license to ensure that contractors meet specific standards and regulations. Having this license contributes to professionalism in the construction industry. If you plan to enter into contracts that may include personal guarantees, understanding the licensing requirements is crucial. A well-structured South Dakota Personal Guaranty - General can safeguard your investment in such contracts.

To enforce a guaranty in South Dakota, start by verifying the terms agreed upon in the document. If the principal debtor defaults, the creditor can take legal action based on the guaranty. Generally, it requires filing a lawsuit and providing evidence of the debt and default. Utilizing a service like uslegalforms can help you create a solid South Dakota Personal Guaranty - General that stands up in court.

Enforcing a guarantee in South Dakota typically involves presenting the guaranty to a court. This legal document outlines the obligations of the guarantor, making it easier to claim enforcement if the primary party defaults. It's important to ensure that all terms are clear, as ambiguity can complicate the enforcement process. Therefore, having a well-drafted South Dakota Personal Guaranty - General is essential.

A debt in South Dakota becomes uncollectible after six years from the date it was due. After this period, creditors lose the legal right to sue for collection. Understanding this rule can empower you when addressing issues surrounding South Dakota Personal Guaranty - General. It's always beneficial to seek guidance if you're uncertain about your obligations.