South Dakota Agreement with an Individual Sales Representative for Referral of Business

Description

How to fill out Agreement With An Individual Sales Representative For Referral Of Business?

If you need to gather, acquire, or print authorized document templates, use US Legal Forms, the top selection of legal forms available online.

Utilize the website's straightforward and convenient search to locate the documents you require.

A selection of templates for business and personal needs are categorized by types and regions, or keywords.

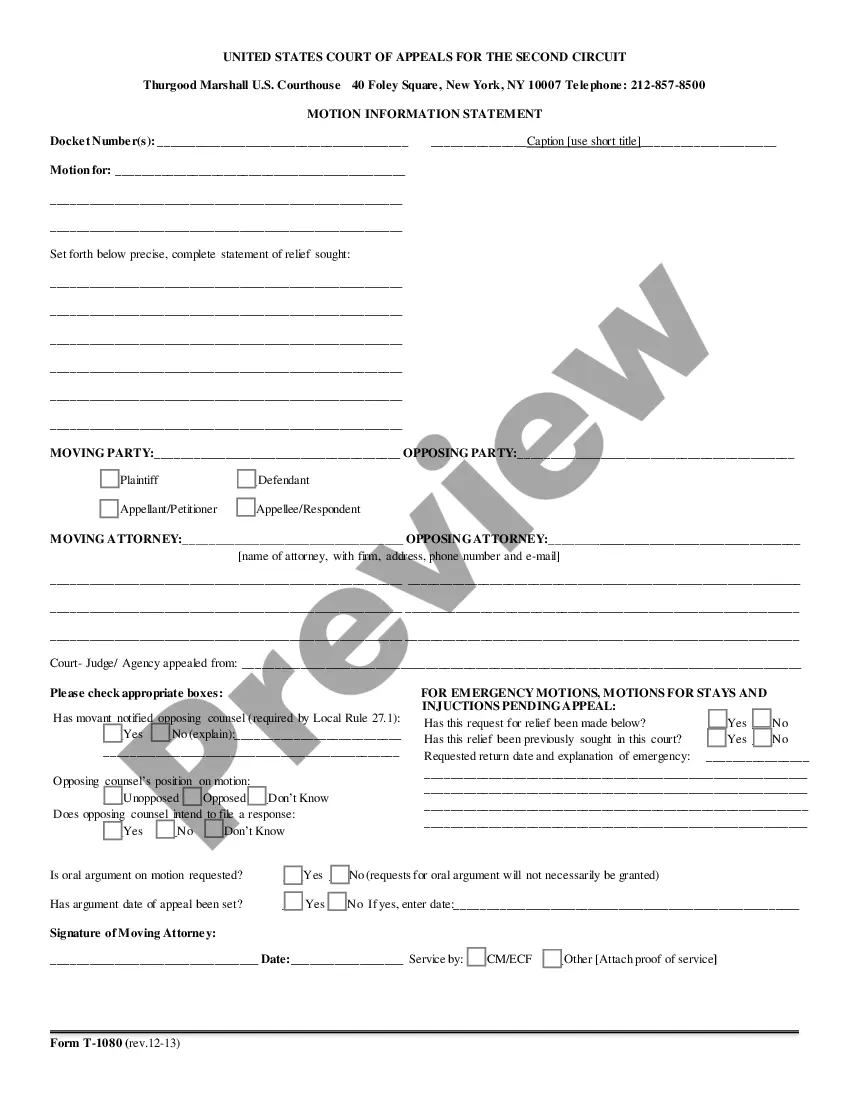

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions in the legal form template.

Step 4. After identifying the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Use US Legal Forms to find the South Dakota Agreement with an Individual Sales Representative for Referral of Business in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to access the South Dakota Agreement with an Individual Sales Representative for Referral of Business.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Confirm you have selected the form for the correct city/state.

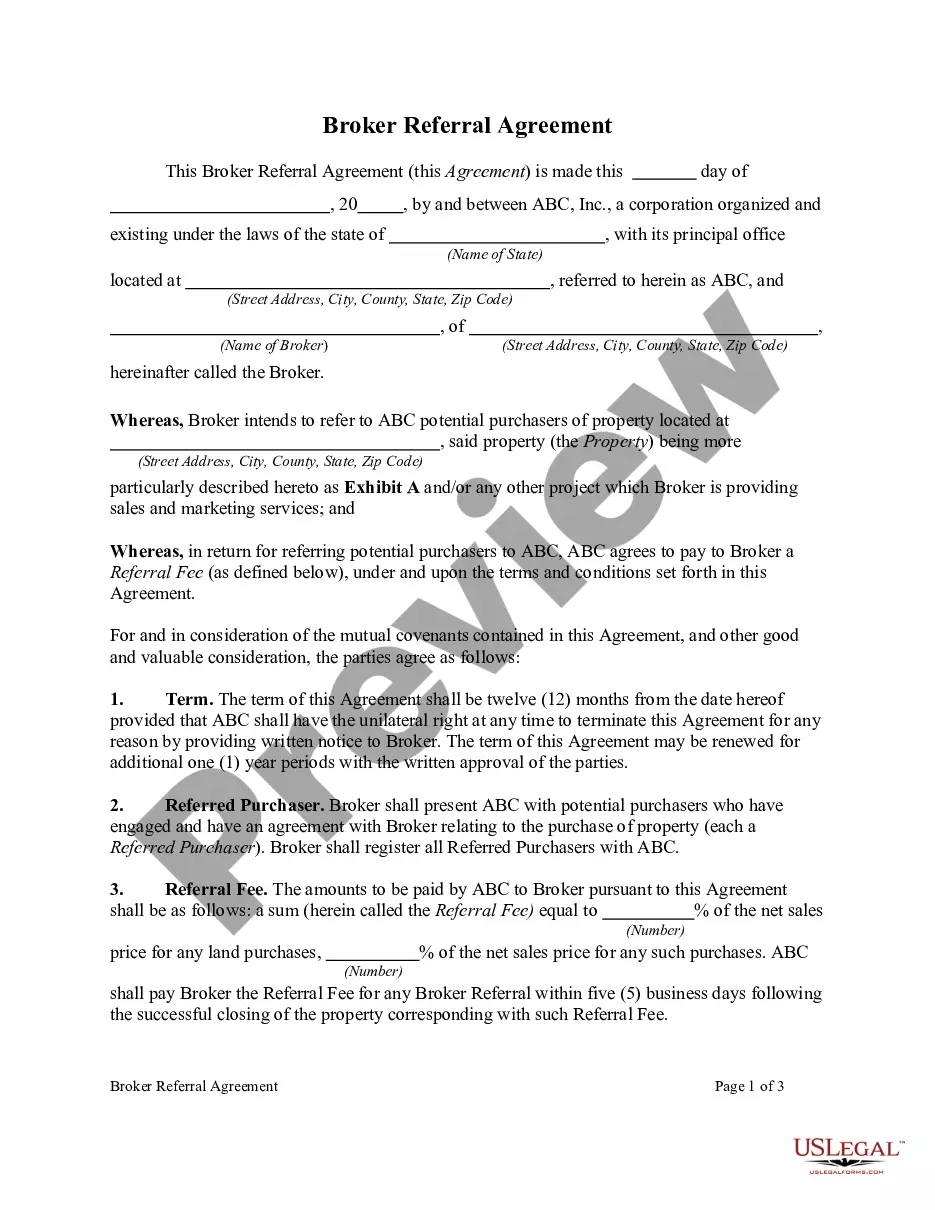

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

Form popularity

FAQ

Taxability of professional services varies from state to state. Several states impose sales tax on specific professional services, while others do not. If you are working with various states and entering a South Dakota Agreement with an Individual Sales Representative for Referral of Business, be sure to investigate the tax laws for each state to ensure compliance and avoid any issues.

Generally, professional services in South Dakota are not subject to sales tax. However, it’s always wise to verify specific services as regulations can change. If you are considering entering a South Dakota Agreement with an Individual Sales Representative for Referral of Business, understanding the tax status of your services will help you plan effectively.

South Dakota does not impose sales tax on many essential items and services, such as groceries and prescription medications. Additionally, services provided by certain professionals may also be exempt from sales tax. If your business involves entering a South Dakota Agreement with an Individual Sales Representative for Referral of Business, having clarity on what is not taxed can help streamline your financial planning.

In South Dakota, legal services are generally exempt from sales tax. This exemption applies broadly to most personal and business legal services. However, it’s beneficial to consult with a tax professional for specific circumstances or if you are entering a South Dakota Agreement with an Individual Sales Representative for Referral of Business, as understanding your tax obligations is crucial.

Yes, South Dakota does require sales tax on certain services. However, not all services are taxable. It’s essential to understand which services fall under taxable categories to avoid surprises. If you’re involved in a South Dakota Agreement with an Individual Sales Representative for Referral of Business, ensure you clarify your responsibilities regarding sales tax on services.

To apply for a South Dakota sales tax license, visit the Department of Revenue’s website. Follow the online application process, where you will provide details about your business. You will also need to supply your federal employer identification number and any other necessary documents. This is crucial for those entering a South Dakota Agreement with an Individual Sales Representative for Referral of Business, as it ensures compliance with state tax regulations.

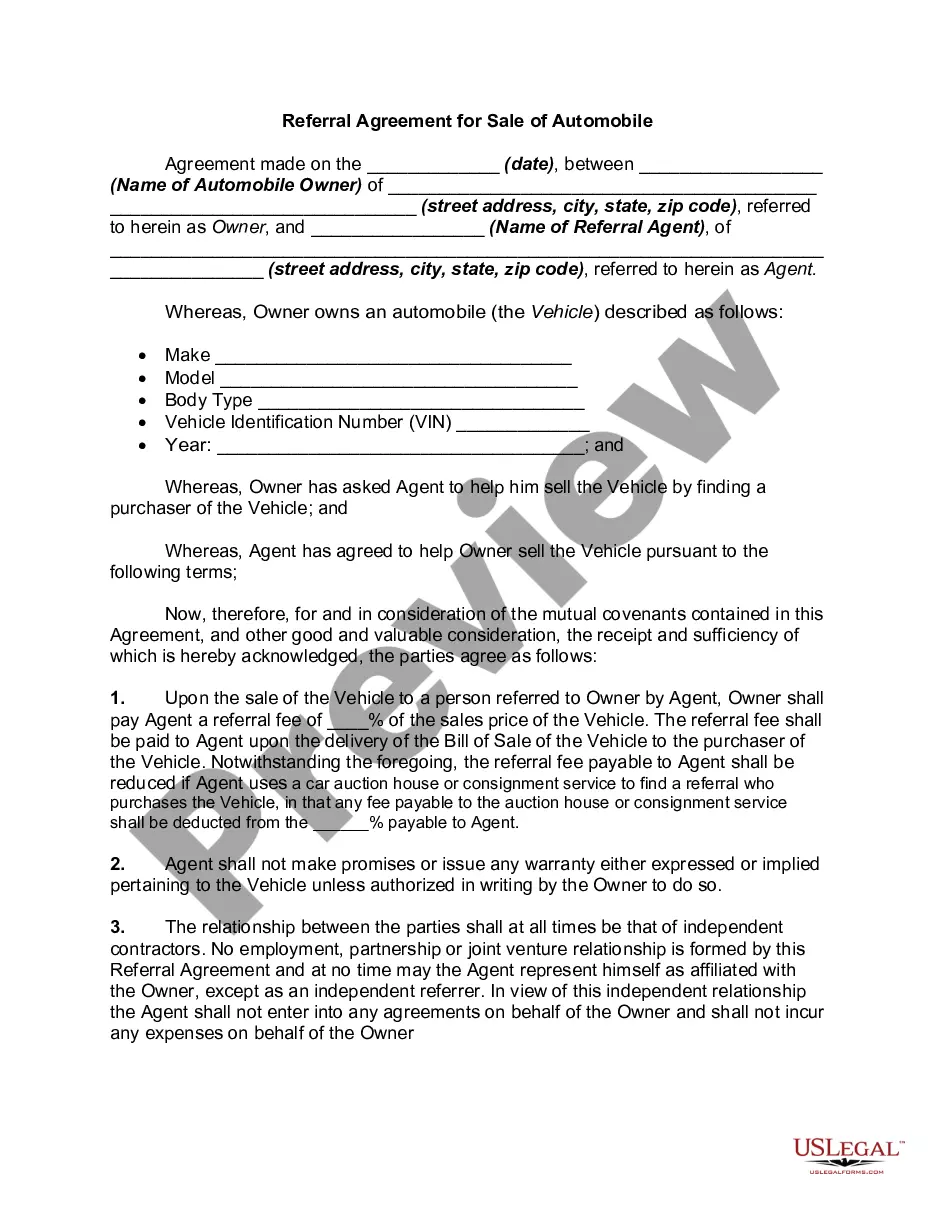

A sales representative agreement outlines the terms of engagement between a business and an individual sales representative. In the context of a South Dakota Agreement with an Individual Sales Representative for Referral of Business, this document specifies the role of the representative in generating referrals and the compensation structure for successful leads. It serves as a vital agreement to protect the interests of both parties.

To effectively structure a referral agreement in a South Dakota Agreement with an Individual Sales Representative for Referral of Business, include essential elements such as the identification of parties, compensation terms, referral process, and confidentiality provisions. Each clause should clearly articulate expectations and responsibilities. Utilizing templates from uslegalforms can aid in crafting a comprehensive agreement.

A referral structure refers to the framework or system in place that governs how referrals are made and rewarded. In a South Dakota Agreement with an Individual Sales Representative for Referral of Business, this structure dictates the commission rates, the process for tracking referrals, and how payments are processed. A well-defined referral structure ensures clarity and consistency for all parties.

To write a referral agreement in the context of a South Dakota Agreement with an Individual Sales Representative for Referral of Business, start by outlining the terms of the agreement, including the scope, compensation, and duration. Clearly define the roles and responsibilities of each party involved. Consider using templates from uslegalforms to ensure that the agreement adheres to local laws and regulations.