South Dakota Lease or Rental of Computer Equipment

Description

How to fill out Lease Or Rental Of Computer Equipment?

If you require extensive access, download, or create authorized document templates, utilize US Legal Forms, the largest compilation of official forms available online.

Employ the site’s simple and user-friendly search to find the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button.

Choose the pricing plan you prefer and enter your information to sign up for an account.

- Utilize US Legal Forms to retrieve the South Dakota Lease or Rental of Computer Equipment in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to retrieve the South Dakota Lease or Rental of Computer Equipment.

- You can also access forms you previously obtained in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

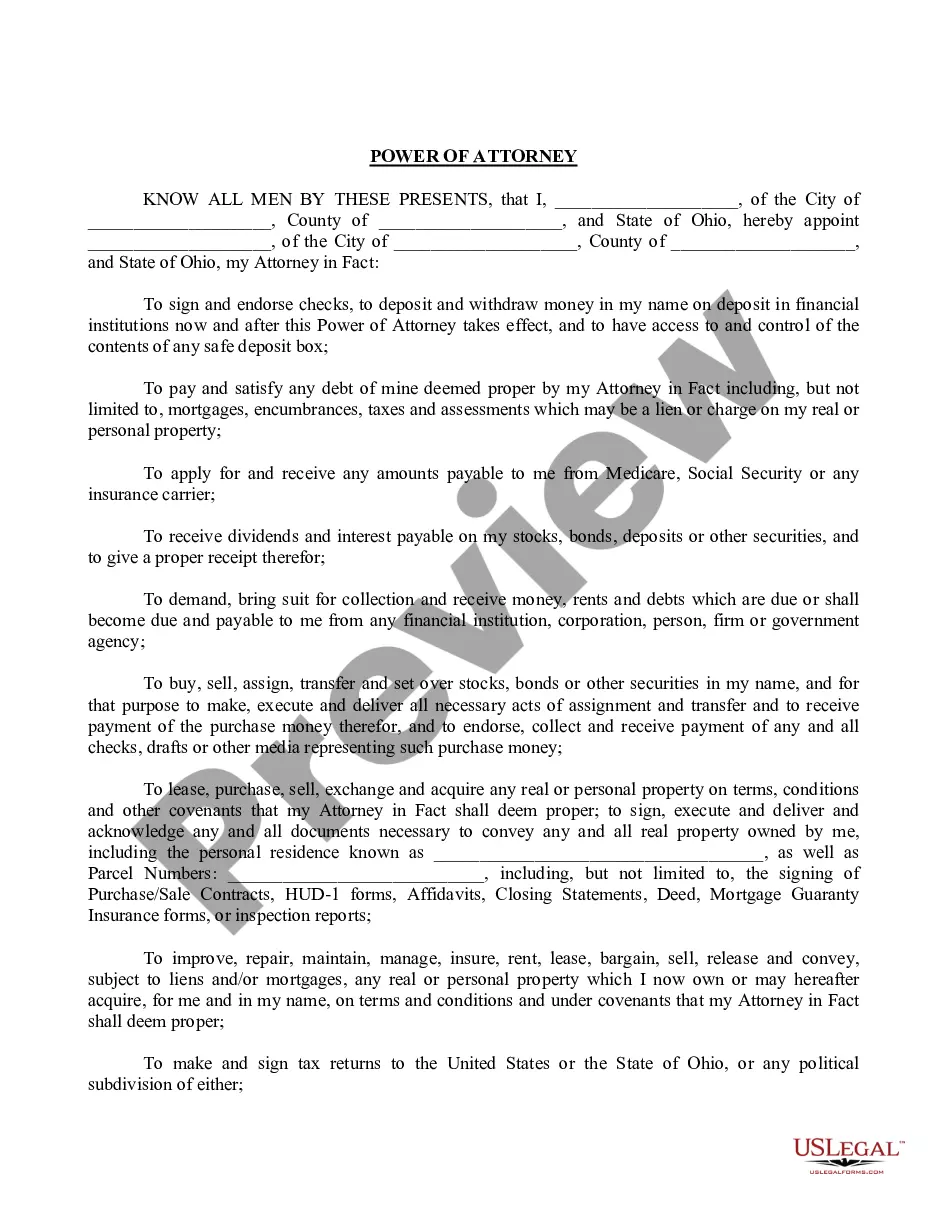

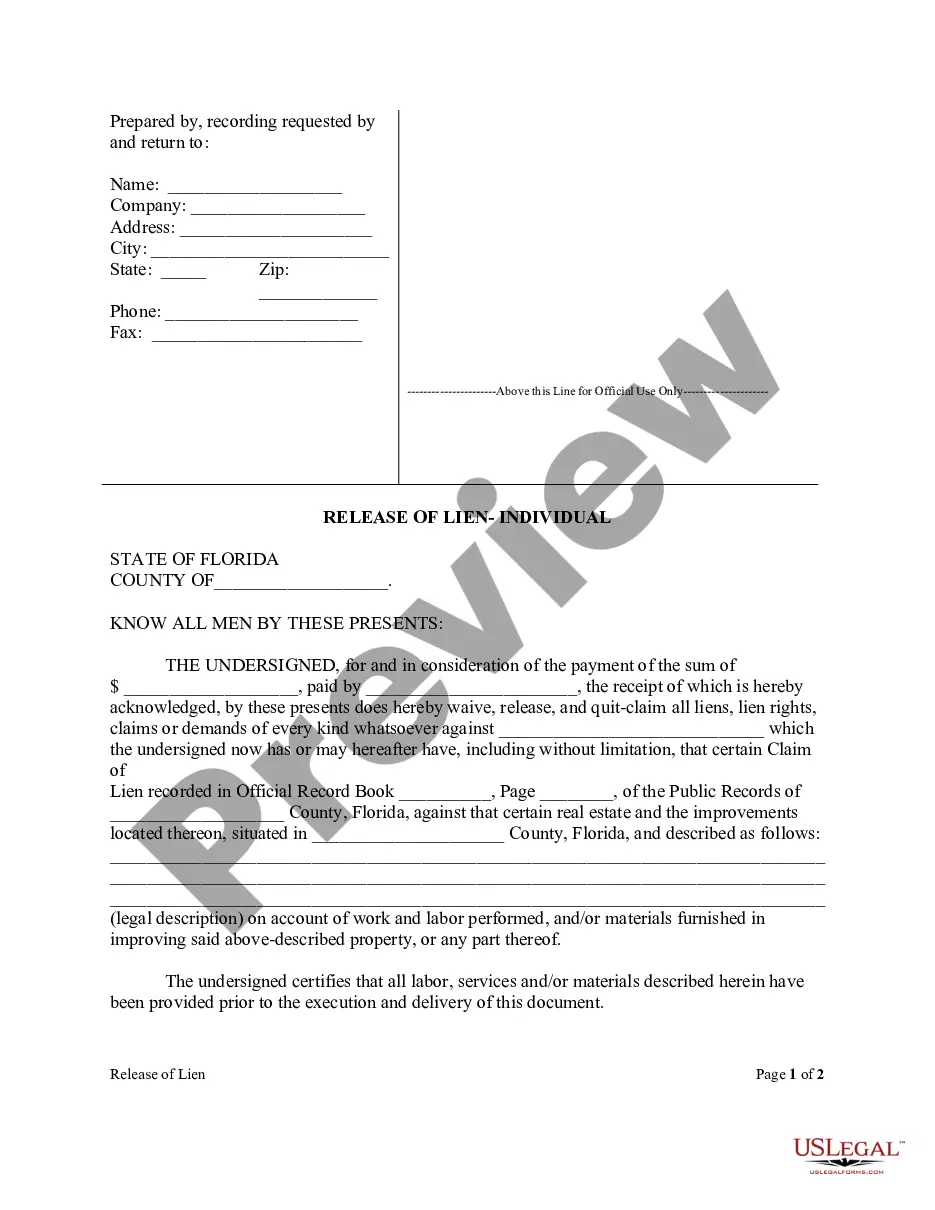

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternate versions of the legal document template.

Form popularity

FAQ

Yes, rental equipment can often be a tax write-off, depending on your business situation. When you rent computer equipment through South Dakota Lease or Rental of Computer Equipment, you may be able to deduct rental payments as a business expense. This can reduce your taxable income, making it an attractive option for many businesses. However, it's always wise to consult with a tax professional to fully understand your specific benefits.

Yes, you typically need a business license to rent out equipment in South Dakota, including computer equipment. This license ensures that your rental business adheres to state regulations and standards. If you consider starting a rental operation, look into the specific requirements for your location. With uslegalforms, you can find the necessary documentation to navigate the licensing process smoothly.

In South Dakota, certain items are exempt from sales tax, including most groceries and prescription medications. Additionally, some personal property, like certain agricultural equipment, may also be tax-exempt. It's important to be aware of these exemptions when considering a South Dakota Lease or Rental of Computer Equipment because it can affect your financial planning.

Yes, rent can be subject to sales tax in South Dakota, depending on the nature of the rental agreement. If you are renting equipment, such as computers, you should verify the tax rules that apply. Understanding these sales tax obligations is essential when entering into a South Dakota Lease or Rental of Computer Equipment.

Getting a tax ID number in South Dakota involves filling out the appropriate forms, either online or through the mail. You need to provide accurate information about your business and its structure. Once you submit your application, you can receive your tax ID, which is especially useful for any business participating in a South Dakota Lease or Rental of Computer Equipment.

To obtain a tax ID in South Dakota, you can apply online through the IRS website or complete a paper form. The online process is typically quicker and allows you to get your tax ID immediately. This ID is crucial for businesses, especially if you are engaging in a South Dakota Lease or Rental of Computer Equipment, as it helps manage your taxes efficiently.

Yes, an Employer Identification Number (EIN) is a specific type of tax ID number. The EIN is used primarily for tax purposes and is necessary for businesses that have employees. If you are involved in a South Dakota Lease or Rental of Computer Equipment, obtaining an EIN can help streamline your business operations and tax filings.

To obtain a tax ID number, you need to provide some basic information about your business. This includes your legal name, address, and the type of business structure you operate under. Additionally, you may need to supply information on the number of employees you plan to hire. If you engage in a South Dakota Lease or Rental of Computer Equipment, having a tax ID will help you manage your taxes effectively.

To report commercial rental income, including income from the South Dakota Lease or Rental of Computer Equipment, you must fill out the appropriate tax forms when filing your federal income tax return. This involves documenting all rental income received and any related expenses you can deduct. Keeping thorough records is essential for accuracy. Consider leveraging USLegalForms to find templates and guidelines for proper reporting.

Yes, your LLC can rent equipment from you, particularly under the framework of the South Dakota Lease or Rental of Computer Equipment. This arrangement can be structured as an asset transfer, allowing your LLC to benefit from equipment use. It is crucial to maintain proper documentation of the rental agreement and transactions. Utilizing tools like USLegalForms can streamline this process.