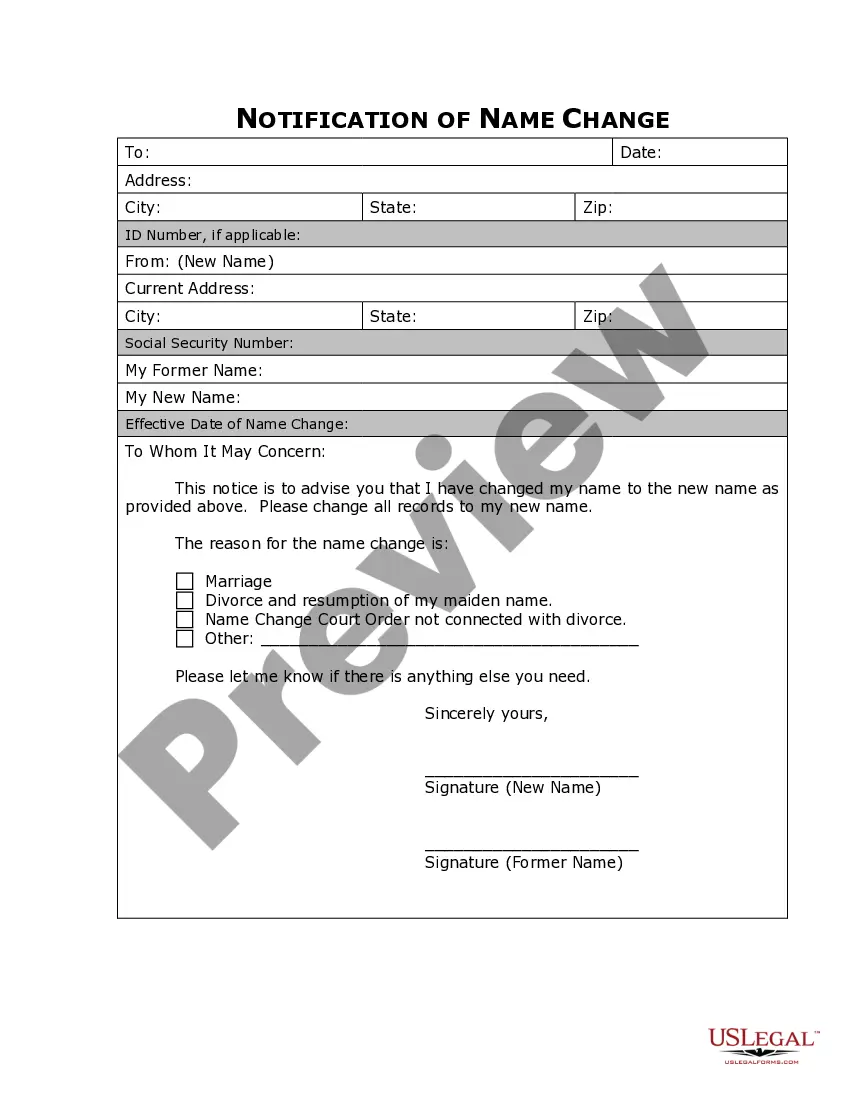

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

South Dakota Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Selecting the appropriate legal document template can be quite challenging. It goes without saying that there are numerous templates accessible online, but how can you locate the specific legal type you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the South Dakota Application for Certificate of Discharge of IRS Lien, suitable for both business and personal needs. All forms are reviewed by professionals and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the South Dakota Application for Certificate of Discharge of IRS Lien. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions you should follow: First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and examine the form outline to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are confident the form is correct, click the Buy now button to purchase the form. Choose the payment plan you prefer and input the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template for your records. Complete, modify, print, and sign the acquired South Dakota Application for Certificate of Discharge of IRS Lien.

In summary, US Legal Forms is a valuable resource for finding and managing legal document templates.

- US Legal Forms is the largest library of legal forms where you can discover various document templates.

- Utilize the service to download properly crafted documents that comply with state requirements.

- Explore the extensive range of legal forms available for different purposes.

- Access your previously purchased legal documents easily through your account.

- Ensure compliance with federal and state regulations when using legal templates.

- Follow the straightforward steps to acquire the forms you need efficiently.

Form popularity

FAQ

A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. Tax lien certificates are generally sold to investors through an auction process.

Under 6325(b)(2)(A) you will receive the certificate after IRS receives payment of the agreed upon amount in partial satisfaction of the tax liability, proof that the taxpayer has been divested of title, and receipt of a copy of the final settlement statement.

If the Internal Revenue Service (IRS) has placed a tax lien on your property, once you've satisfied the debt, the IRS should notify you that the lien has been removed. To do so, the IRS should send you a ?Certificate of Release of Federal Tax Lien,? also known as Form 668(Z).

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

Tax lien certificate is that certificate which is made available to an investor who shows his interest in a property by investing his funds in clearing the outstanding property tax of that property on behalf of the owner of such property.