South Dakota Chattel Mortgage on Mobile Home

Description

How to fill out Chattel Mortgage On Mobile Home?

If you desire to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and individual purposes are organized by categories and states, or keywords.

Once you have located the form you need, select the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Complete the payment. You may use your credit card or PayPal account to finalize the transaction. Step 6. Download the legal form format and save it to your device. Step 7. Fill out, edit, and print or sign the South Dakota Chattel Mortgage on Mobile Home. Every legal document template you purchase is yours indefinitely. You will have access to every form you saved in your account. Choose the My documents section and select a form to print or download again. Be proactive and acquire, and print the South Dakota Chattel Mortgage on Mobile Home with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to locate the South Dakota Chattel Mortgage on Mobile Home with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Obtain button to download the South Dakota Chattel Mortgage on Mobile Home.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Confirm you have selected the form for the correct town/region.

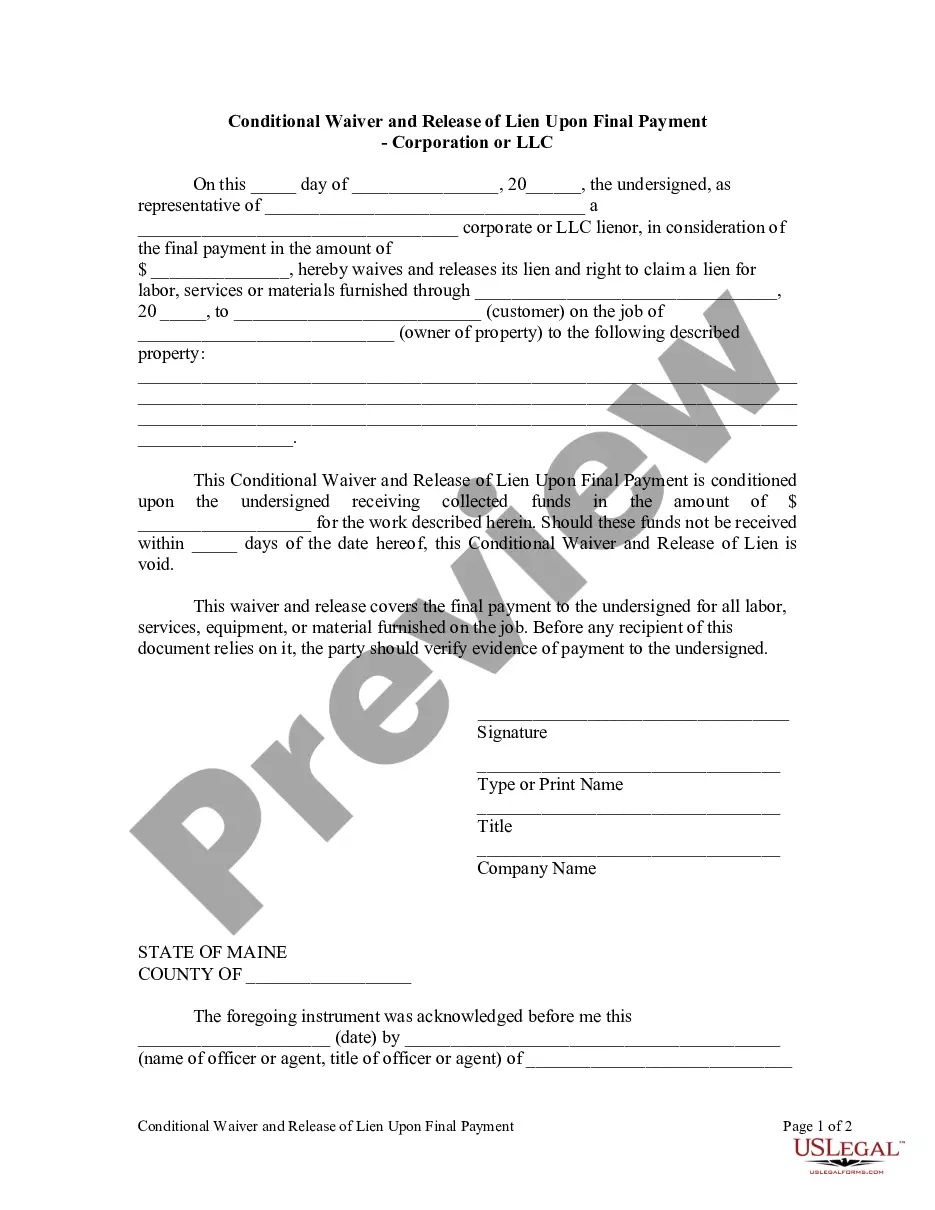

- Use the Preview feature to review the form's content. Be sure to read the details.

- If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, you can secure a mortgage on a mobile home in South Dakota using a chattel mortgage. This type of financing specifically caters to mobile homes, allowing you to treat it like personal property rather than real estate. By utilizing a South Dakota Chattel Mortgage on Mobile Home, you can access favorable terms and conditions tailored to your needs. With the right guidance from platforms like US Legal Forms, you can navigate the process smoothly and find the best options available.

Compare the Best Mobile Home Loans CompanyStarting Interest RateLoan Terms (range)Manufactured Nationwide Best OverallVaries15, 20, or 30 yearsManufacturedHome.Loan Best for Good CreditVariesVaries21st Mortgage Corporation Best for Bad CreditVariesVarieseLend Best for Low Down PaymentVariesVaries1 more row

Conventional Mortgages Conventional mortgages are the most common type of mortgage. That said, conventional loans may have different requirements for a borrower's minimum credit score and debt-to-income (DTI) ratio than other loan options.

Typically, a mobile home has to be built after 1976 to qualify for a mortgage, as we'll explain below. In this case your loan would work almost exactly the same as financing for traditional ?stick-built? houses.

Most lenders will not give you a conventional loan for a mobile or manufactured home because these structures are not considered real property. If you have a manufactured home that meets some very specific criteria, however, conventional mortgage sources Freddie Mac and Fannie Mae do actually offer specialized loans.

Best Mobile Home Loans Reviews Best for Rural Areas: USDA. ... Best for a Variety of Loan Options: Vanderbilt Mortgage and Finance. ... Best for Low Credit Scores: Manufactured Nationwide. ... Best for Good Credit Scores: ManufacturedHome. ... Best for Mobile Homes Within a Community or Park: 21st Mortgage Corporation.

Vanderbilt Mortgage can finance mobile, modular or manufactured homes, both new and pre-owned. While the application itself is similar, there are some differences between both. Terms and conditions for the loans may differ, and the way you apply can also vary.