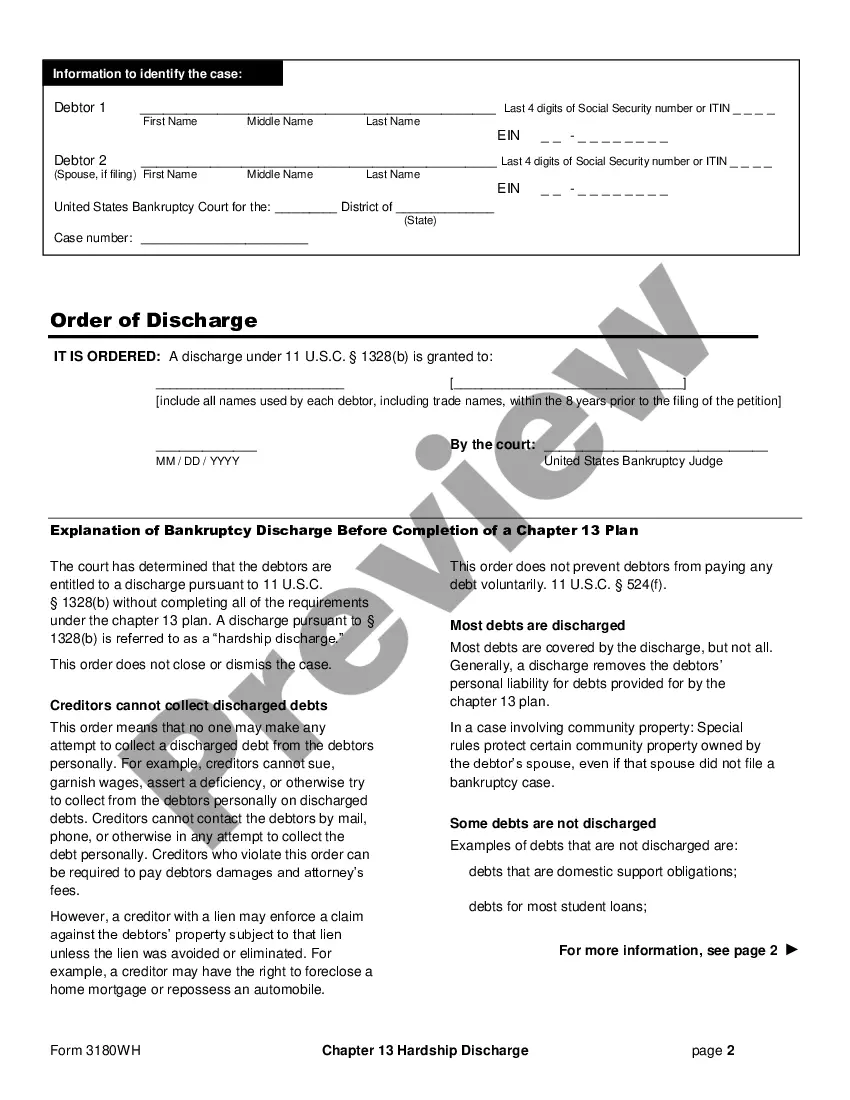

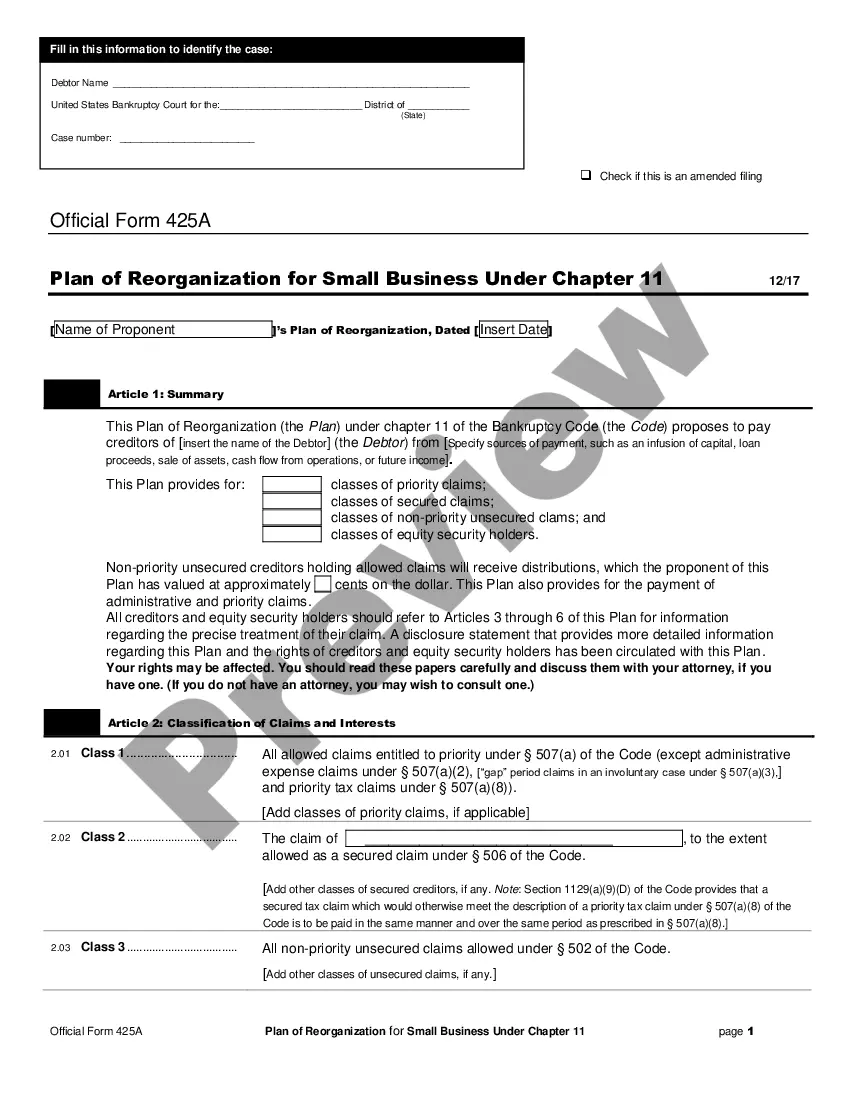

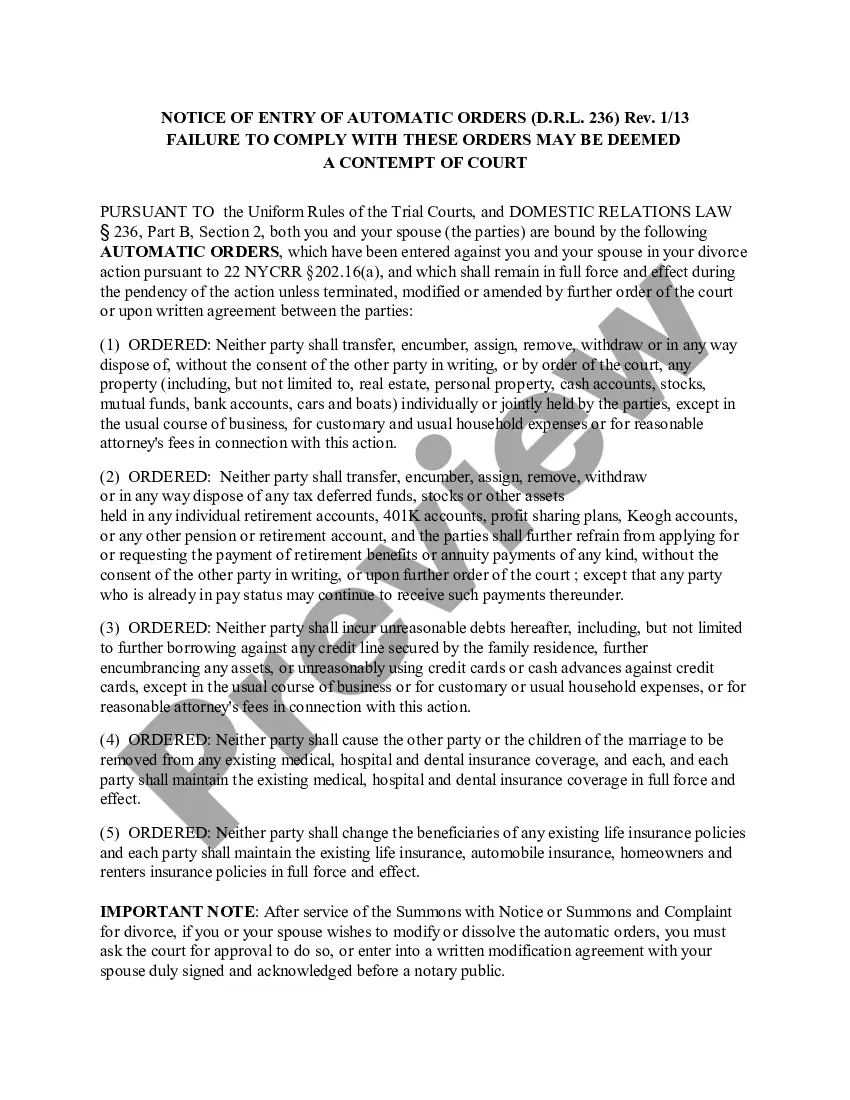

The chapter 13 plan provides that the debtor will pay the trustee a certain sum of money to be distributed among the creditors listed in the plan. The form must be signed by the creditor and the creditor's attorney.

South Dakota Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

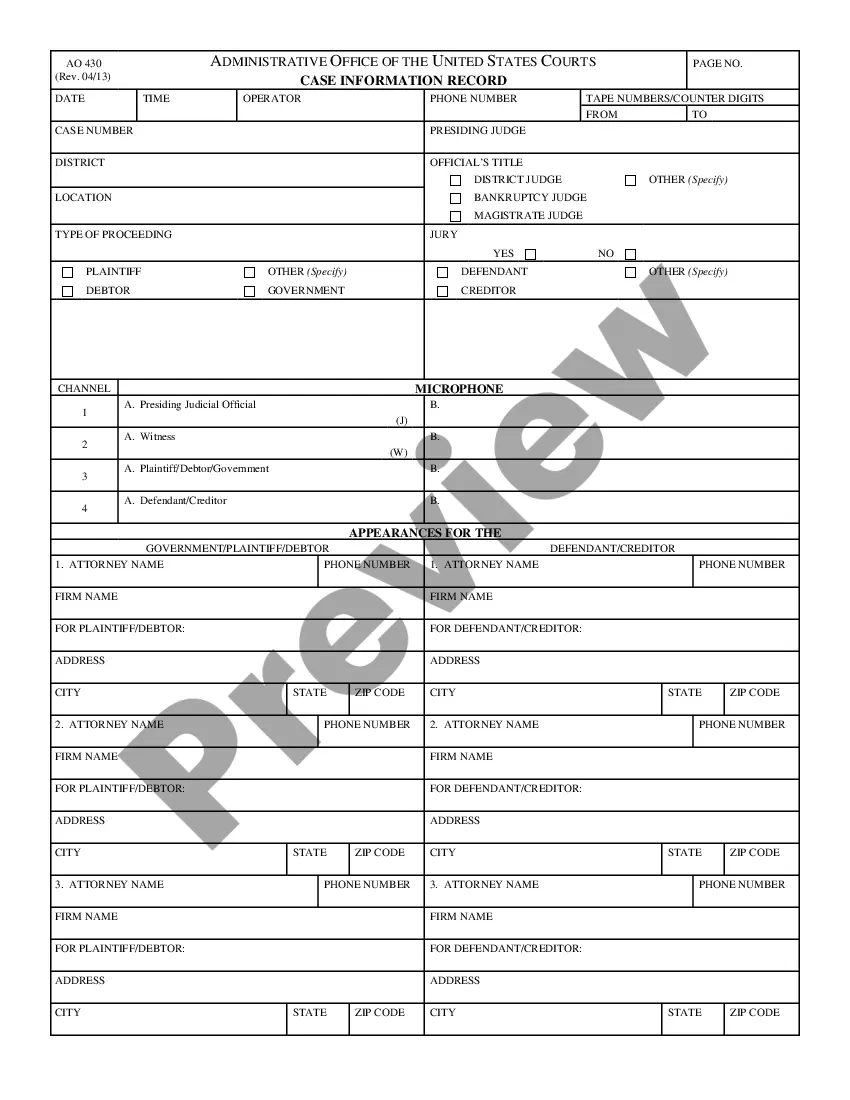

How to fill out South Dakota Chapter 13 Plan?

Get access to high quality South Dakota Chapter 13 Plan templates online with US Legal Forms. Avoid hours of lost time browsing the internet and lost money on files that aren’t updated. US Legal Forms gives you a solution to just that. Get around 85,000 state-specific authorized and tax samples that you can save and complete in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Check if the South Dakota Chapter 13 Plan you’re considering is suitable for your state.

- See the form using the Preview function and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Choose a preferred format to save the file (.pdf or .docx).

You can now open the South Dakota Chapter 13 Plan template and fill it out online or print it out and get it done by hand. Take into account mailing the document to your legal counsel to make certain things are filled in properly. If you make a mistake, print and complete application again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and get a lot more templates.

Form popularity

FAQ

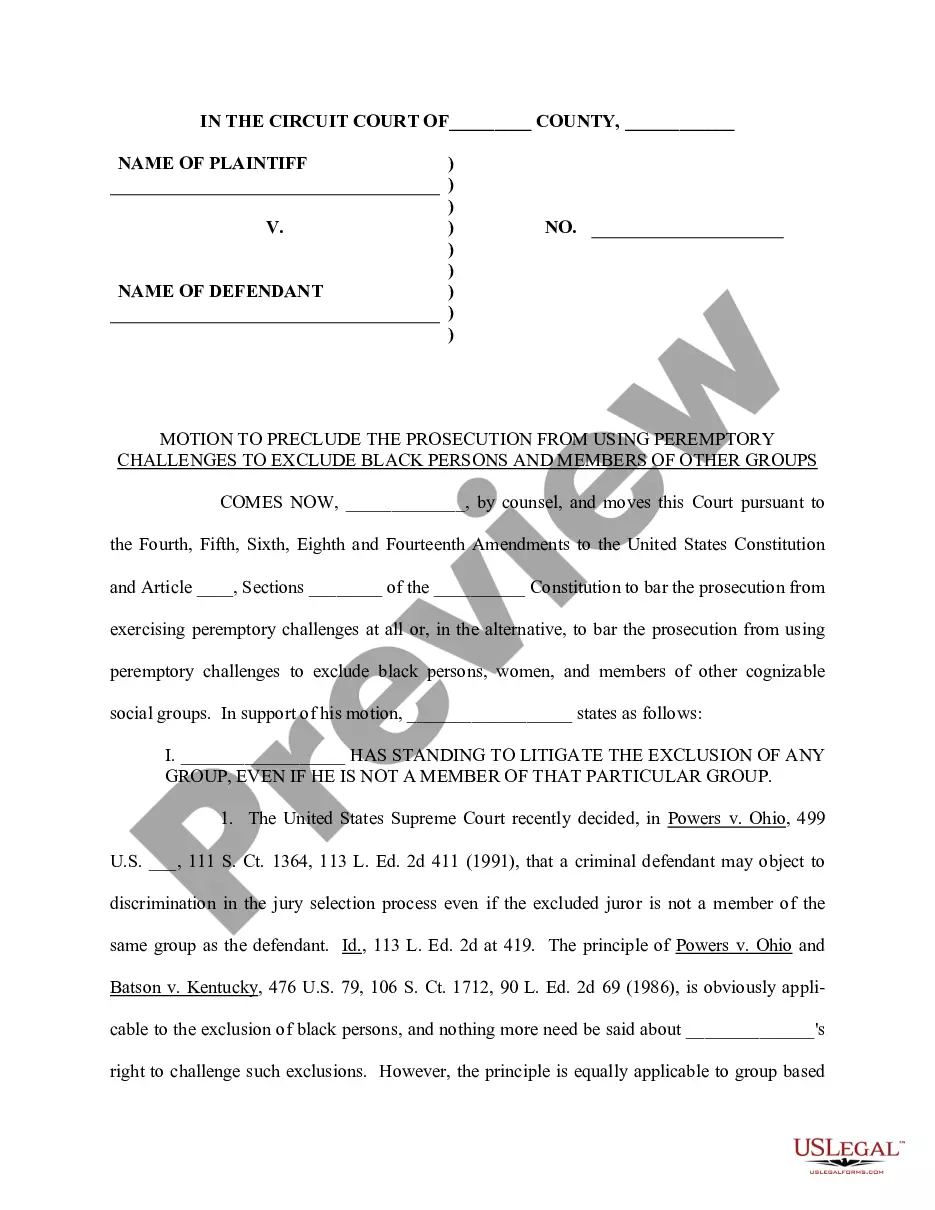

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.

Credit card debt. medical bills. personal loans. older nonpriority income tax obligations. utility bills, and. most lawsuit judgments.

The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation. It takes into account a large number of low payment amounts where low income debtors are paying very little back.

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.