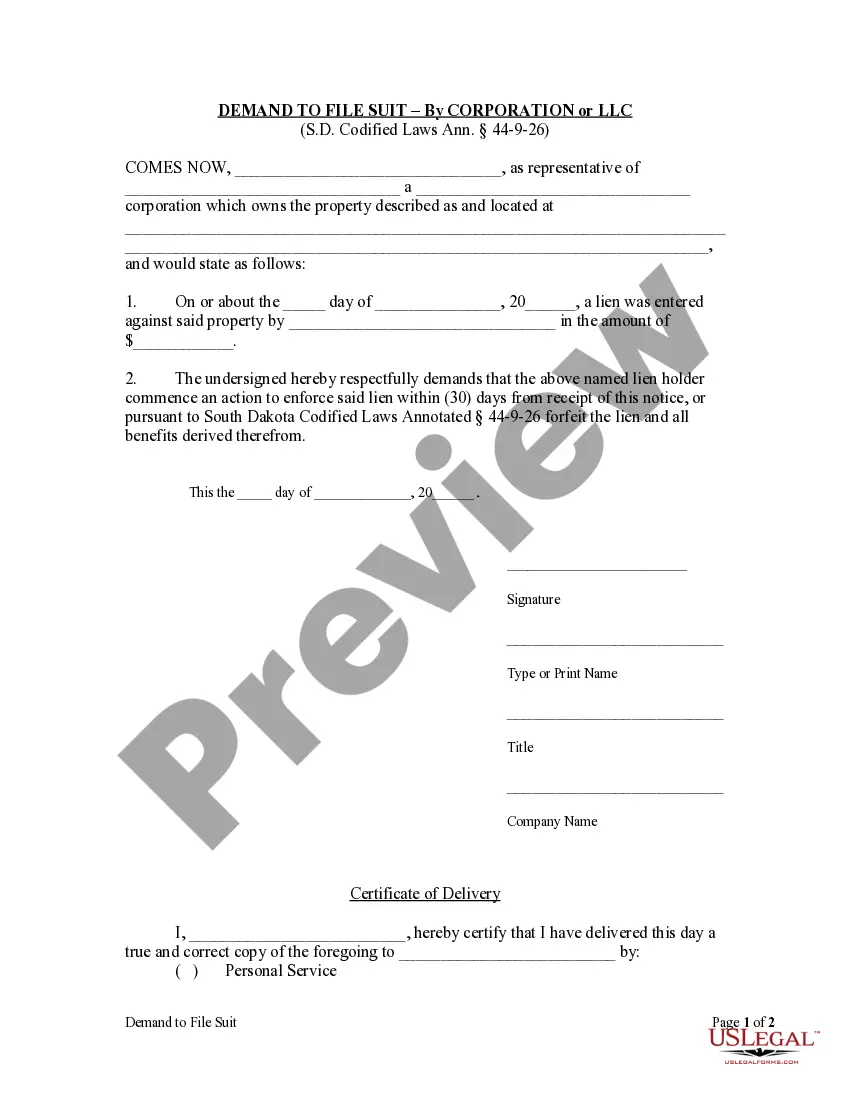

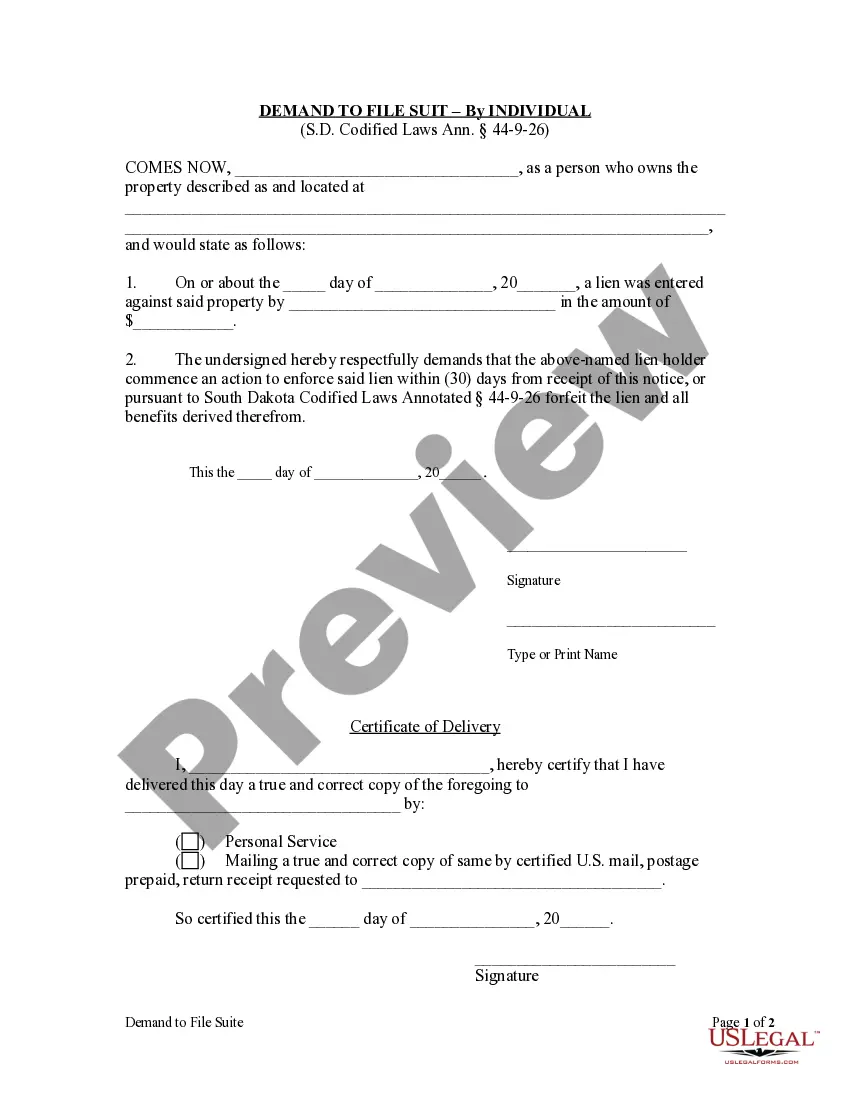

Upon written demand of the owner, his agent, or contractor, served on any person holding a lien, requiring him to commence suit to enforce such lien, such suit shall be commenced within thirty days after such service, or the lien shall be forfeited.

South Dakota Demand to Commence Suit by Corporation

Description

How to fill out South Dakota Demand To Commence Suit By Corporation?

The work with papers isn't the most easy task, especially for people who rarely work with legal paperwork. That's why we recommend utilizing correct South Dakota Demand to Commence Suit by Corporation or LLC templates made by professional attorneys. It allows you to avoid difficulties when in court or dealing with formal organizations. Find the documents you require on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the file webpage. After accessing the sample, it will be saved in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Look at this brief step-by-step guide to get the South Dakota Demand to Commence Suit by Corporation or LLC:

- Make sure that file you found is eligible for use in the state it is required in.

- Verify the document. Use the Preview option or read its description (if available).

- Buy Now if this file is the thing you need or return to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these simple steps, you are able to fill out the form in your favorite editor. Recheck completed information and consider asking a legal representative to review your South Dakota Demand to Commence Suit by Corporation or LLC for correctness. With US Legal Forms, everything becomes easier. Try it now!

Form popularity

FAQ

LLC operating agreements do not need to be filed with the state. Do not confuse the LLC operating agreement with the articles of organization. Articles of organization are public documents that are filed with the state to actually form the LLC.

How much does it cost to form an LLC in South Dakota? The South Dakota Secretary of State charges $165 to file the Articles of Organization. There is an additional $15 filing fee if submitted by mail. You can reserve your LLC name with the South Dakota Secretary of State for $25.

Step 1: Choose a Name for Your LLC. Step 2: Reserve a Name (optional) Step 3: Choose a Registered Agent. Step 4: Prepare an LLC Operating Agreement. Step 5: File Organizational Paperwork With the State. Step 6: Obtain a Certificate from the State. Step 7: Register to Do Business in Other States (optional)

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

You'll need your LLC's name, the name and address of its registered agent, and other basic information, like how it will be managed or the names of the LLC owners. You'll have to pay a filing fee when you submit the articles. In most states, the fees are modest - typically around $100.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Answer. A business is pretty much free to form a limited liability company (LLC) in any old state. But you may still need to qualify your LLC to do business in your home state -- and this means you'll have to file additional paperwork and pay additional fees.

Delaware is the most popular choice for forming an LLC outside of your home state. It has a reputation for being business-friendly, leading many people to decide to form an LLC in Delaware.