South Carolina New Client Questionnaire

Description

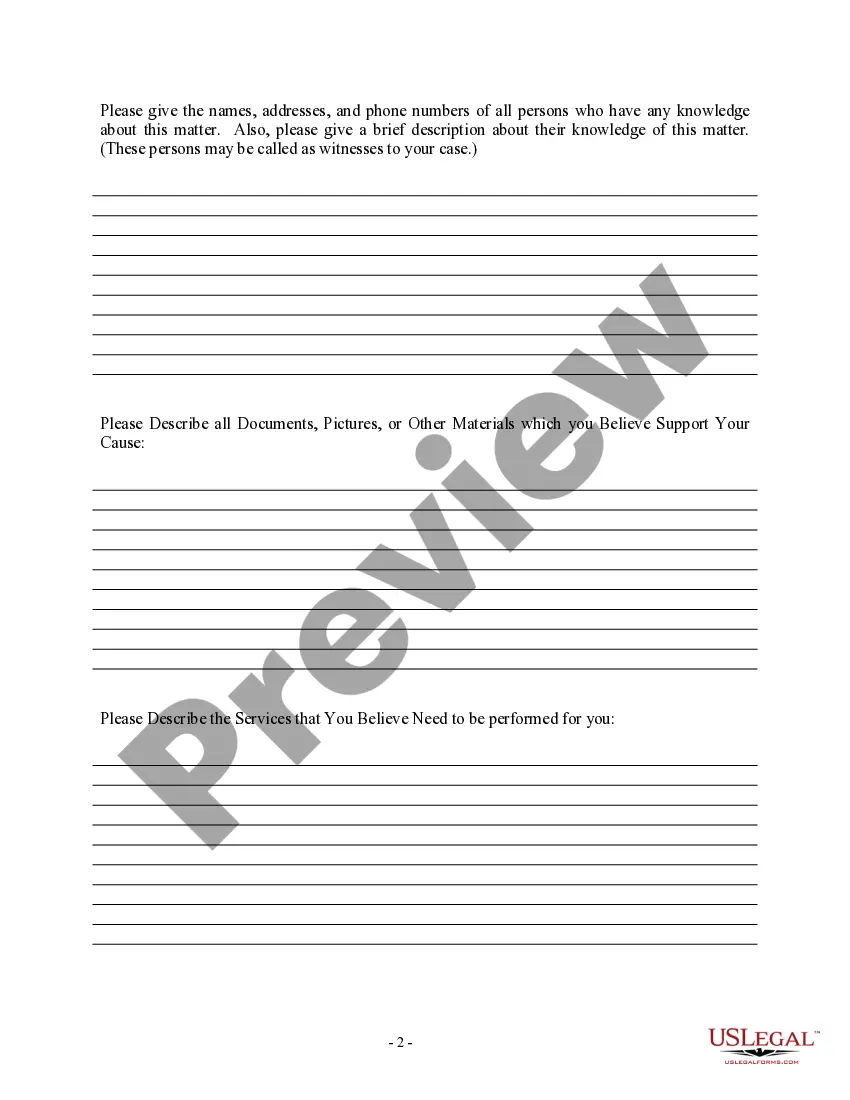

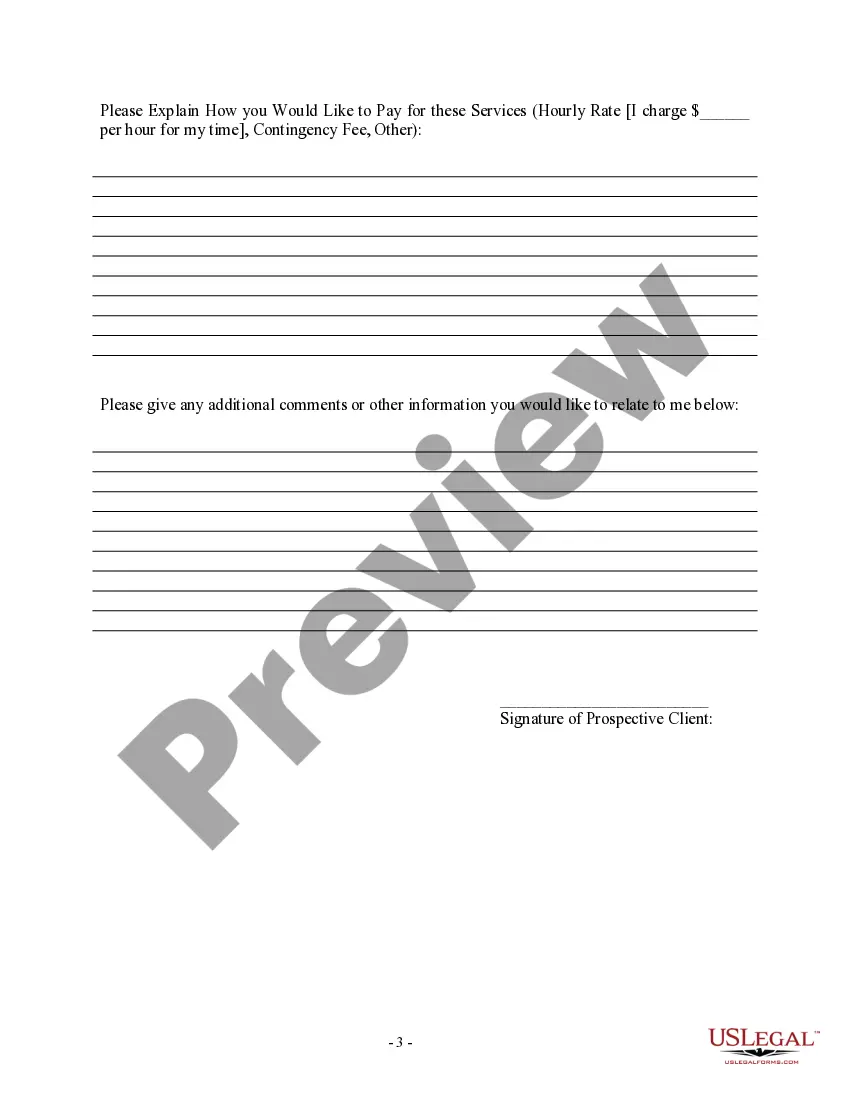

How to fill out New Client Questionnaire?

Are you in a place where you need to have papers for possibly enterprise or individual uses just about every time? There are tons of authorized file templates available on the Internet, but finding types you can trust is not simple. US Legal Forms offers a huge number of type templates, much like the South Carolina New Client Questionnaire, which are written in order to meet state and federal demands.

Should you be currently knowledgeable about US Legal Forms web site and also have a merchant account, just log in. Following that, you are able to down load the South Carolina New Client Questionnaire format.

Should you not have an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the type you need and make sure it is for the appropriate area/county.

- Make use of the Review key to analyze the form.

- See the information to actually have selected the right type.

- If the type is not what you`re seeking, take advantage of the Look for area to discover the type that meets your needs and demands.

- If you find the appropriate type, click Purchase now.

- Select the prices strategy you need, fill in the specified details to make your money, and pay for an order utilizing your PayPal or bank card.

- Select a convenient data file format and down load your version.

Discover every one of the file templates you may have purchased in the My Forms food selection. You can obtain a further version of South Carolina New Client Questionnaire whenever, if needed. Just click the required type to down load or print out the file format.

Use US Legal Forms, probably the most extensive selection of authorized varieties, to save time as well as avoid faults. The service offers professionally made authorized file templates that you can use for a range of uses. Create a merchant account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Emailing the request, with a physical signature, to RequestForCopies@dor.sc.gov ? faxing the request to 803-737-2934, or ? mailing the request to SCDOR, Request for Copies, PO Box 125, Columbia, SC 29214-0890. SC4506 - SC Department of Revenue sc.gov ? forms-site ? Forms sc.gov ? forms-site ? Forms

If you qualify for a paper copy of a tax form based on these criteria, you can email your paper form request to forms@dor.sc.gov or call 1-844-898-8542 to speak to a representative. You will need to provide your name, address, and the form you are requesting. Forms Assistance - SC Department of Revenue SC Department of Revenue (.gov) ? forms ? request SC Department of Revenue (.gov) ? forms ? request

RESIDENT You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages. You are married filing jointly, age 65 or older and your gross income is greater than federal gross income filing requirement amount plus $30,000. What are South Carolina's Filing Requirements? - TaxSlayer Support taxslayer.com ? en-us ? articles ? 360015... taxslayer.com ? en-us ? articles ? 360015...

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores. Forms and Publications -- How to Order - IRS irs.gov ? pub ? irs-news irs.gov ? pub ? irs-news

Forms are available at dor.sc.gov/forms.