South Carolina Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

How to fill out Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

Have you been in a place where you need papers for possibly business or individual uses just about every day time? There are a variety of authorized document web templates available on the net, but getting versions you can rely is not straightforward. US Legal Forms offers a huge number of kind web templates, just like the South Carolina Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, that happen to be created to meet federal and state requirements.

Should you be currently familiar with US Legal Forms site and also have your account, basically log in. Following that, you may acquire the South Carolina Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage design.

Should you not provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the kind you require and ensure it is for the correct metropolis/state.

- Utilize the Review key to check the form.

- Browse the explanation to actually have selected the appropriate kind.

- When the kind is not what you are seeking, take advantage of the Look for field to discover the kind that fits your needs and requirements.

- When you discover the correct kind, simply click Buy now.

- Choose the prices program you desire, fill out the specified information to generate your account, and pay money for an order using your PayPal or bank card.

- Pick a hassle-free paper structure and acquire your backup.

Discover all of the document web templates you possess purchased in the My Forms food selection. You can obtain a extra backup of South Carolina Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage at any time, if necessary. Just click the necessary kind to acquire or printing the document design.

Use US Legal Forms, probably the most substantial selection of authorized forms, to save lots of time as well as stay away from mistakes. The support offers professionally manufactured authorized document web templates that can be used for an array of uses. Make your account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

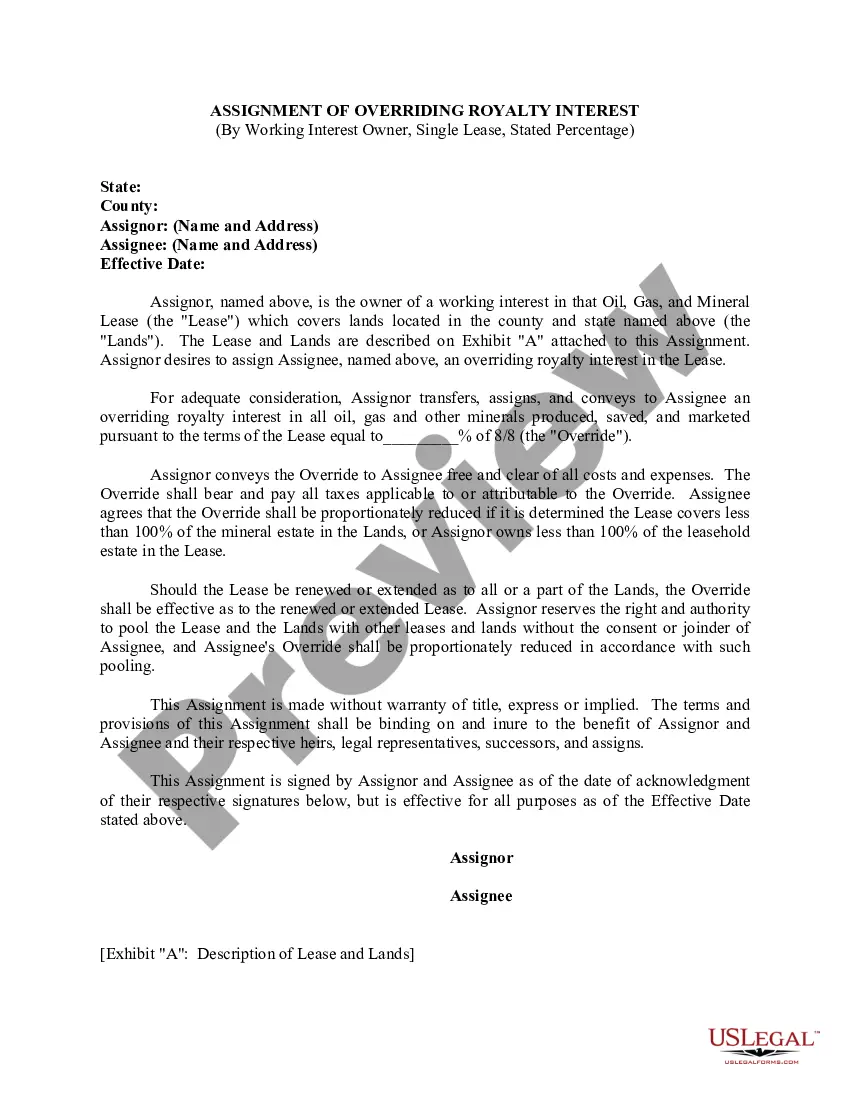

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.