South Carolina Special Military Power of Attorney for Automobile Use and Registration

Description

How to fill out Special Military Power Of Attorney For Automobile Use And Registration?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can find the latest versions of forms such as the South Carolina Special Military Power of Attorney for Automobile Use and Registration in just a few minutes.

If you already have a monthly subscription, Log In and download the South Carolina Special Military Power of Attorney for Automobile Use and Registration from the US Legal Forms catalog. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded South Carolina Special Military Power of Attorney for Automobile Use and Registration. Each template you add to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the South Carolina Special Military Power of Attorney for Automobile Use and Registration with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the contents of the form.

- Check the form's summary to ensure you have chosen the right form.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

In the military, power of attorney allows service members to delegate authority to someone they trust to handle their affairs when they are away. The South Carolina Special Military Power of Attorney for Automobile Use and Registration is a specific type that enables individuals to manage automobile registration and related tasks. This ensures that important responsibilities are maintained even when the service member is deployed or stationed elsewhere.

Yes, you can use power of attorney to register a car. The South Carolina Special Military Power of Attorney for Automobile Use and Registration specifically allows your agent to complete the registration process on your behalf. This feature is beneficial for service members or anyone who may not be able to attend the registration in person.

To give someone power of attorney for a car, you need to create a South Carolina Special Military Power of Attorney for Automobile Use and Registration. This document should clearly specify the powers you are granting and must be signed in accordance with South Carolina laws. You can use platforms like USLegalForms to obtain the necessary templates and ensure compliance with legal requirements.

Yes, you can register a car using a power of attorney. By granting a South Carolina Special Military Power of Attorney for Automobile Use and Registration, you enable another person to handle the registration process on your behalf. This is particularly useful if you are unable to be present due to military duties or other commitments.

Yes, someone can register a car on your behalf by using a South Carolina Special Military Power of Attorney for Automobile Use and Registration. This legal document allows your designated person to complete the registration process for you. It is essential to ensure that the power of attorney is properly executed to avoid any complications during registration.

In South Carolina, a power of attorney does not need to be filed with the court to be valid. However, if you are using the South Carolina Special Military Power of Attorney for Automobile Use and Registration, it is advisable to keep a copy for your records and provide it to the relevant parties involved in the automobile transactions. This ensures that all parties recognize your authority to act on behalf of the principal. For your convenience, US Legal Forms provides templates and guidance to help you create and manage your power of attorney documents effectively.

You do not necessarily need a lawyer to obtain a power of attorney in South Carolina, including the South Carolina Special Military Power of Attorney for Automobile Use and Registration. However, having legal assistance can help ensure that the document meets all legal requirements and is tailored to your specific needs. If you feel uncertain about the process or want to avoid mistakes, consider using resources like US Legal Forms, which provide templates and guidance for creating your power of attorney.

To obtain a power of attorney for a car, you should first determine the type of power of attorney you need, such as the South Carolina Special Military Power of Attorney for Automobile Use and Registration. You will need to fill out the appropriate forms, which can often be found online or through legal service providers. Once completed, ensure that the document is signed and notarized, if necessary. Platforms like US Legal Forms offer easy access to the correct forms and guidance to streamline this process.

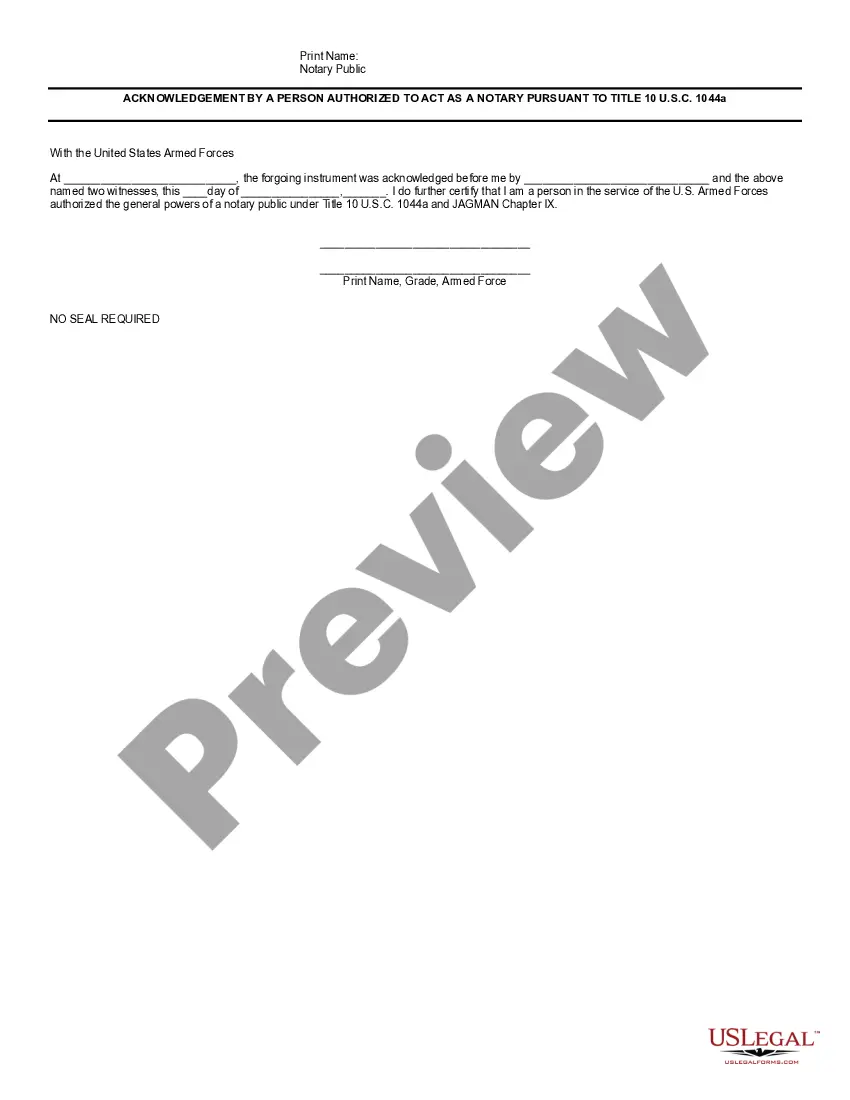

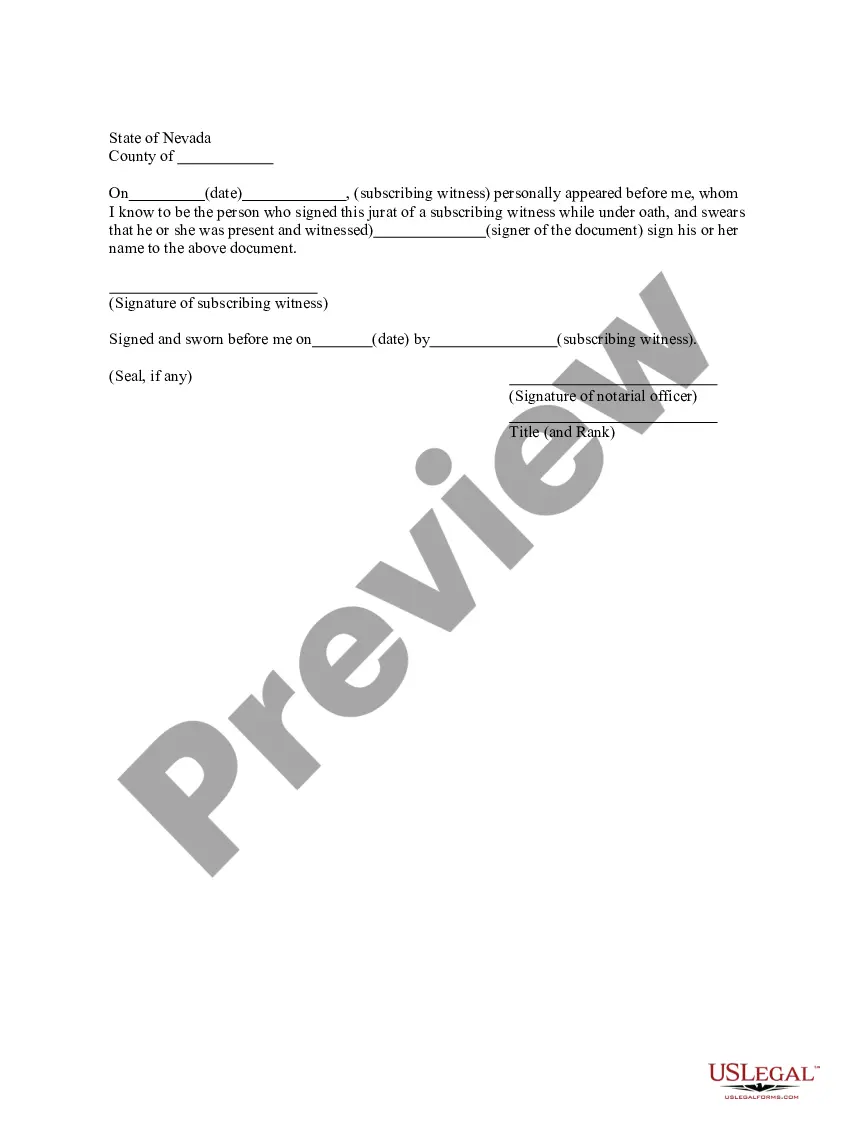

Yes, a military power of attorney, including the South Carolina Special Military Power of Attorney for Automobile Use and Registration, typically needs to be notarized to ensure its validity. Notarization helps verify the identity of the person granting the power and confirms that they are doing so voluntarily. It's essential to follow the specific requirements for notarization to avoid complications in the future. If you are unsure about the process, consider using a platform like US Legal Forms to help you navigate the necessary steps.