South Carolina Letter for Account Paid in Full

Description

How to fill out Letter For Account Paid In Full?

Selecting the finest authentic document template can be a challenge. Obviously, there are numerous designs accessible online, but how can you find the genuine form you require? Utilize the US Legal Forms website. The platform offers a multitude of templates, such as the South Carolina Letter for Account Settled in Full, which can be utilized for both business and personal purposes. All the documents are verified by professionals and meet state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the South Carolina Letter for Account Settled in Full. Use your account to browse through the legal forms you have previously ordered. Navigate to the My documents section of your account and download another copy of the documents you require.

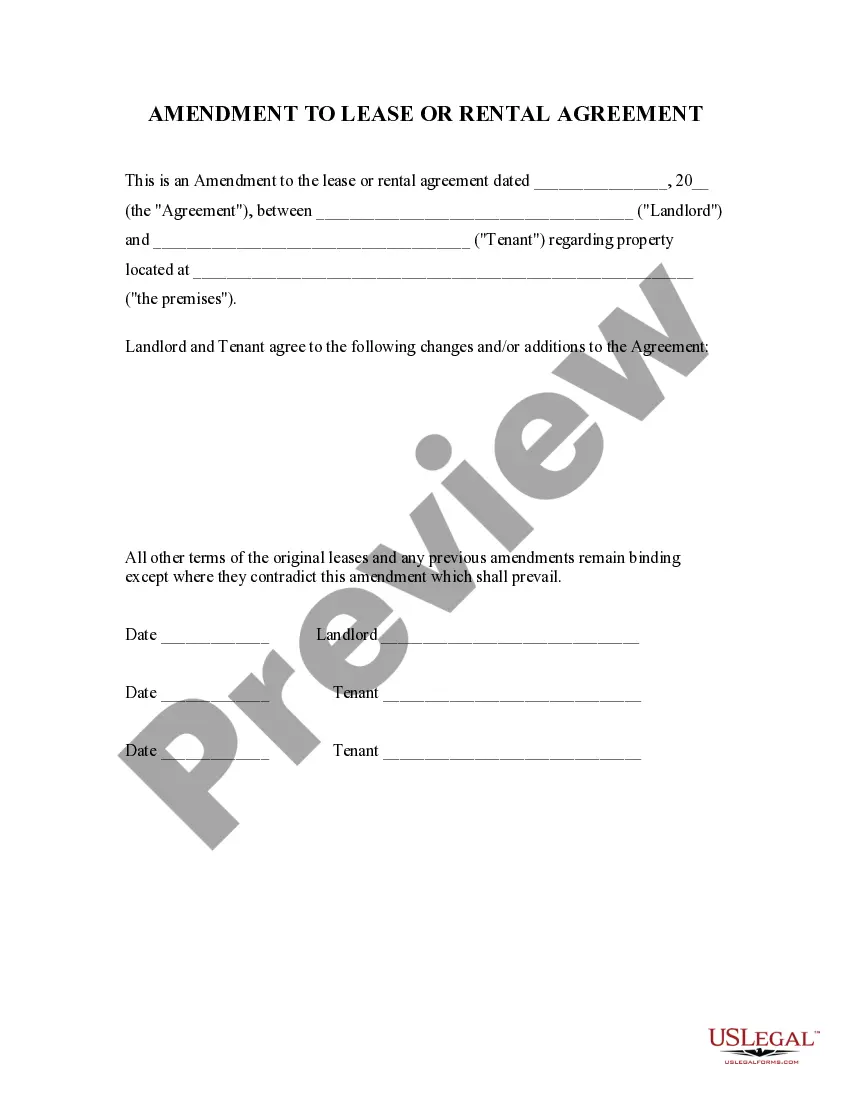

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have selected the correct form for your city/region. You can preview the document using the Review option and examine the form summary to confirm this is suitable for your needs. If the form does not meet your criteria, use the Search field to find the correct document. Once you are confident that the form is appropriate, proceed with the Purchase now option to acquire the document. Choose the pricing plan you prefer and input the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received South Carolina Letter for Account Settled in Full.

Take advantage of this service to secure the necessary legal documentation tailored to your requirements.

- US Legal Forms is the largest collection of legal documents.

- You can find various document templates.

- Utilize the service to obtain professionally crafted documents.

- All documents comply with state regulations.

- The platform is user-friendly for both new and returning users.

- Easily manage your purchases and downloads.

Form popularity

FAQ

To request a paid-in-full letter, you typically need to contact the creditor or company that holds your account. You can either call their customer service number or send a written request. Using a South Carolina Letter for Account Paid in Full template from uslegalforms can simplify this process, ensuring you provide all necessary details. This way, you can efficiently receive the confirmation you need.

When we say an account is paid in full, it indicates that you have settled your debt completely. This means you have made all payments required, and there are no outstanding balances. A South Carolina Letter for Account Paid in Full serves as proof of this settlement. It confirms that the account has been closed with no further obligations.

An example of a paid-in full letter would include your personal information, the creditor's details, and a statement confirming that the debt has been paid in full. It should also include the date of payment and your request for the South Carolina Letter for Account Paid in Full. Using a service like uslegalforms can help you draft this letter accurately.

To get a paid-in full letter, contact your creditor or collection agency and request the South Carolina Letter for Account Paid in Full. Provide them with your account details and any additional information they require. This letter is an essential part of your financial documentation.

When writing paid in full, you should clearly indicate that all outstanding amounts have been settled. Include the date and the amount paid, along with a request for the South Carolina Letter for Account Paid in Full for your records. This documentation can help you maintain a clean credit history.

Writing a paid-in full letter involves stating that you have settled your debt and requesting confirmation. Include your name, account number, and a request for the South Carolina Letter for Account Paid in Full. Be polite and clear in your communication to ensure a smooth process.

You can obtain a paid-in full letter by reaching out to the creditor or collection agency that you paid. Be clear in your request for the South Carolina Letter for Account Paid in Full, and provide them with relevant details to verify your payment. This letter serves as proof that your debt has been cleared.

To obtain your paid-up letter, you should contact the collection agency that handled your debt. Request the South Carolina Letter for Account Paid in Full directly from them. Make sure to provide any necessary information, such as your account number, to expedite the process.

A letter from a collection agency that states your account is paid in full serves as official documentation confirming that you have settled your debt. This South Carolina Letter for Account Paid in Full can be crucial for your financial records, as it proves that you have fulfilled your obligations. Keeping this letter can protect you from potential disputes in the future.

To obtain a South Carolina Letter for Account Paid in Full, you should contact the creditor or service provider directly. Request the letter and provide any necessary details, such as your account number and payment confirmation. If you need assistance, consider using a platform like US Legal Forms, where you can find templates and guidance to streamline the process.