South Carolina Self-Employed Technician Services Contract

Description

How to fill out Self-Employed Technician Services Contract?

If you need to finalize, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site’s simple and straightforward search to locate the documents you require. Various templates for business and personal purposes are categorized by groups and regions, or keywords. Use US Legal Forms to find the South Carolina Self-Employed Technician Services Contract in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the South Carolina Self-Employed Technician Services Contract. You can also access forms you previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Make sure you have chosen the form for your specific city/state. Step 2. Utilize the Review feature to examine the form’s details. Don’t forget to read the description. Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template. Step 4. After locating the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to create an account. Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the South Carolina Self-Employed Technician Services Contract.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you purchase is yours permanently.

- You will have access to every form you saved in your account.

- Click the My documents section and choose a form to print or download again.

- Acquire and download, and print the South Carolina Self-Employed Technician Services Contract with US Legal Forms.

- There are millions of professional and state-specific forms available for your personal business or individual needs.

- Use the comprehensive range of resources available to fulfill all your legal documentation requirements.

- US Legal Forms ensures you have all the necessary tools to manage your legal forms effortlessly.

Form popularity

FAQ

In South Carolina, anyone who engages in construction work that exceeds $1,000 must obtain a contractor's license. This requirement includes general contractors, specialty contractors, and those involved in significant renovations. If you are a self-employed technician, you may need a South Carolina Self-Employed Technician Services Contract to operate legally. Understanding these requirements can save you time and legal troubles.

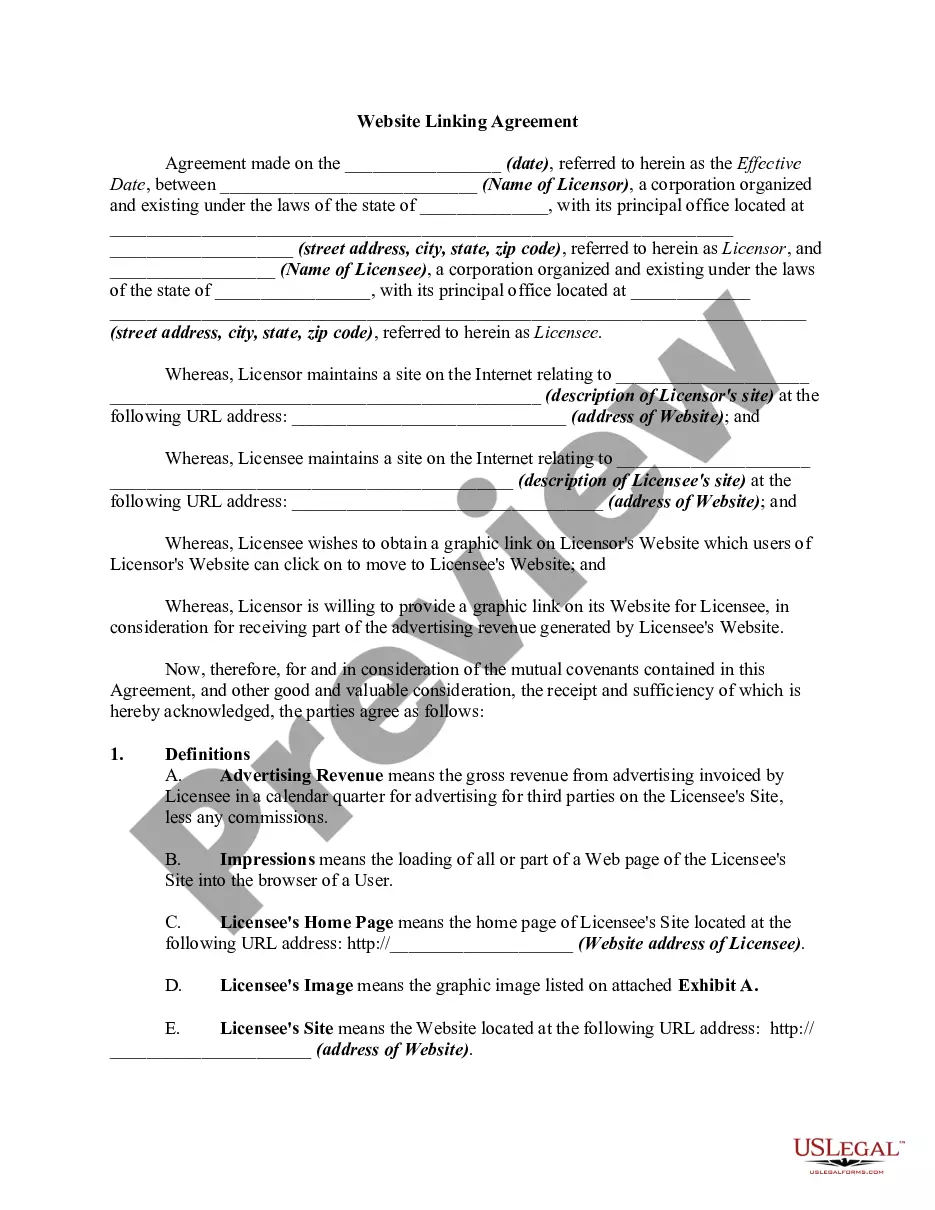

Writing a contract agreement for services involves defining the scope of work and the compensation structure. Include timelines and any specific requirements that need to be met. Using uslegalforms can assist you in creating an effective South Carolina Self-Employed Technician Services Contract that meets your needs.

To write a contract for a 1099 employee, outline the services to be performed, payment rates, and deadlines. Make sure to clarify the independent status of the worker and any expectations. A well-crafted South Carolina Self-Employed Technician Services Contract can help establish a strong professional relationship.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. Ensure that it clearly outlines the terms of the agreement, including services and payment. For additional support, uslegalforms provides templates to create valid South Carolina Self-Employed Technician Services Contracts.

Writing a self-employment contract requires you to detail your services, payment structure, and duration of work. Be sure to outline any legal responsibilities and rights for both you and the client. For a comprehensive South Carolina Self-Employed Technician Services Contract, consider using resources from uslegalforms.

To fill out a service contract, begin by entering your personal information and the client's details. Specify the services provided, add payment terms, and include any deadlines. Using uslegalforms can simplify this process and assist in creating a valid South Carolina Self-Employed Technician Services Contract.

Writing a simple employment contract involves outlining job responsibilities, compensation, and working conditions. Ensure you address the duration of the contract and any necessary legal obligations. A clear and straightforward approach will benefit both parties in a South Carolina Self-Employed Technician Services Contract.

To write a self-employed contract, start by clearly defining the services you will provide. Include payment terms, deadlines, and any specific requirements. Using platforms like uslegalforms can help streamline the process and ensure you include all necessary details for your South Carolina Self-Employed Technician Services Contract.

An independent contractor agreement in South Carolina outlines the terms between a client and a self-employed technician. This contract specifies services, payment details, and responsibilities. It ensures clarity and protects both parties involved in the South Carolina Self-Employed Technician Services Contract.

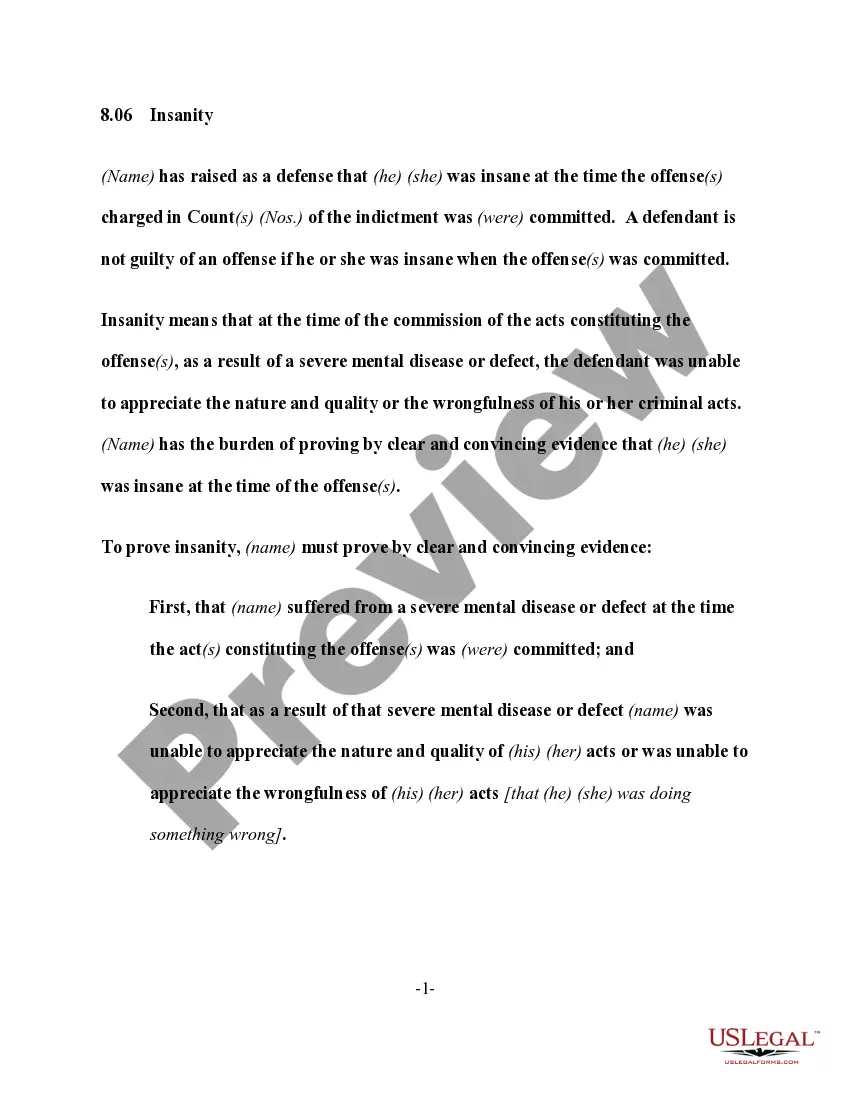

Independent contractor law in South Carolina focuses on the criteria used to determine if a worker qualifies as an independent contractor. This law affects benefits, taxes, and other legal obligations. To navigate this complex landscape, having a South Carolina Self-Employed Technician Services Contract is advisable, as it can help clarify the working relationship and ensure compliance with state laws.