South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Campaign Worker Agreement - Self-Employed Independent Contractor?

Have you ever found yourself in a situation where you need documents for both professional or personal purposes almost all the time.

There are numerous legitimate document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and prevent errors.

The service offers properly crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/state.

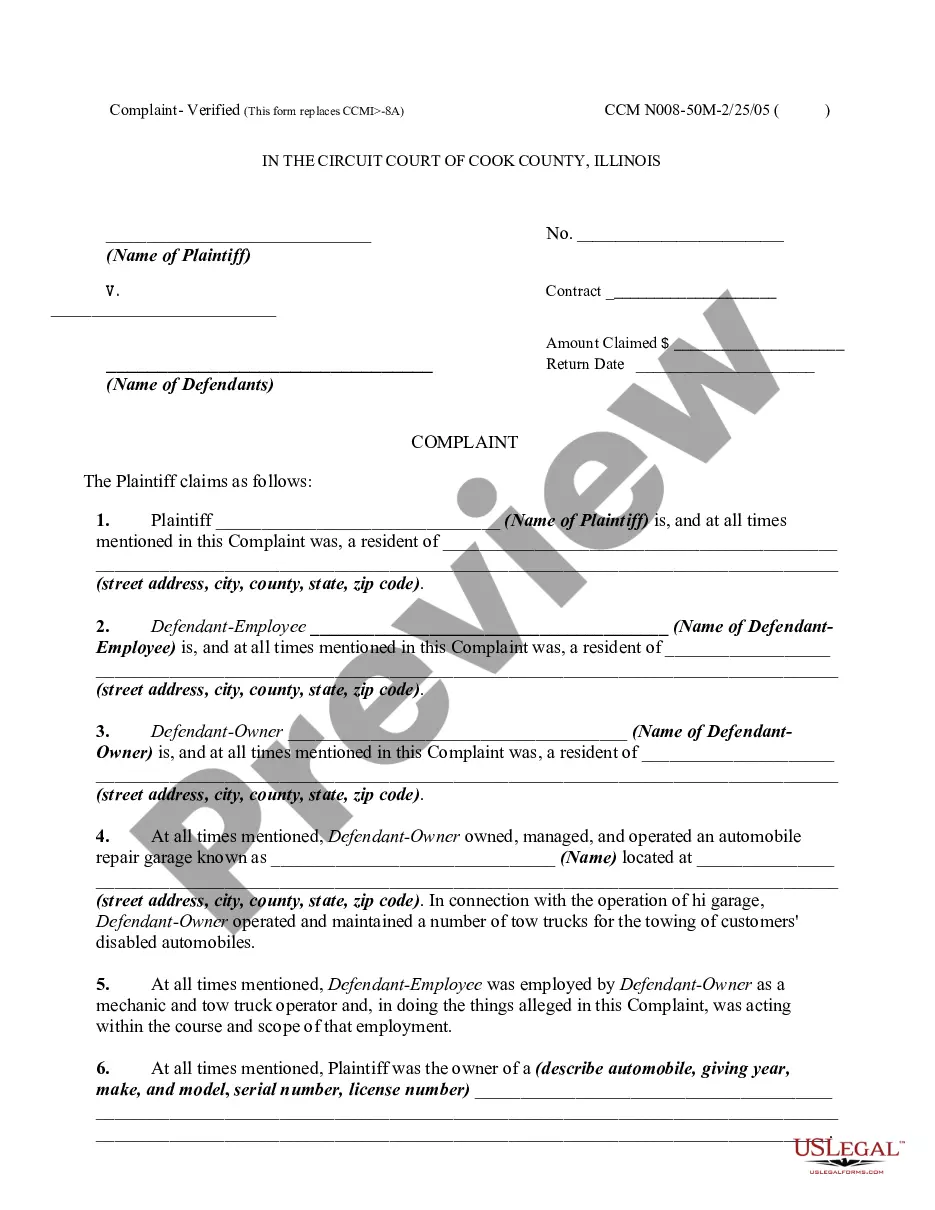

- Use the Preview button to review the form.

- Check the summary to ensure you have selected the correct document.

- If the form isn't what you're looking for, utilize the Search field to find the form that fits your needs and specifications.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor at any time, if needed. Just click on the desired form to download or print the document template.

Form popularity

FAQ

Filling out an independent contractor form requires you to provide your personal information and details about your work arrangement. Be specific about the services offered and how they align with the South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor. Ensure all sections are completed carefully to avoid any delays. For added support, consider using templates from USLegalForms, which can guide you through each step.

To fill out a declaration of independent contractor status form, begin by providing your basic information, such as name and contact details. Next, you should outline the nature of your work in relation to the South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor. It’s important to ensure that the information is accurate and corresponds with your agreement. USLegalForms offers resources and guidance to help you navigate this form efficiently.

Writing an independent contractor agreement involves clearly defining the roles and responsibilities of each party. Start by including the names of the parties, the scope of work, payment details, and timeline. To ensure clarity, mention the specific requirements related to the South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor. Utilizing platforms like USLegalForms can simplify this process by providing templates that cater to your specific needs.

Creating a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor involves several straightforward steps. First, define the scope of work and payment terms clearly. Next, include provisions for confidentiality, termination conditions, and any other relevant clauses. Utilizing resources from uslegalforms can simplify this process, providing templates and guidance to ensure your agreement is comprehensive and legally sound.

The basic independent contractor agreement is a simple yet comprehensive document that outlines the project's terms. It typically includes details about payment, deadlines, and the scope of work involved. Having a well-drafted agreement protects the interests of both parties and ensures clarity in the work relationship. When working with a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor, you can conveniently establish a solid foundation for your engagement.

Yes, independent contractors file their taxes as self-employed individuals. This means they report their earnings through Schedule C of their tax returns. It is important for contractors to keep meticulous records of their income and expenses. Using a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor can help organize important information relevant for tax filing.

Independent contractor law in South Carolina establishes the guidelines for classifying workers as independent contractors. This law ensures that both parties understand the implications of their relationship, such as tax responsibilities and liability protections. It is vital for contractors to be aware of these laws to safeguard their rights. Utilizing a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor helps in adhering to these guidelines.

Filling out an independent contractor agreement involves several important steps. Begin by detailing the scope of work, payment terms, and deadlines. It's crucial to include both the contractor's and the hiring entity's information clearly. For an effective approach, consider using a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor template, which can simplify the process.

Recently, new federal rules have emerged regarding the classification of independent contractors. These rules aim to provide clearer guidance on who qualifies as an independent contractor versus an employee. Understanding these regulations is essential for those utilizing a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor. Staying informed can help you ensure proper compliance and avoid potential legal issues.

The independent contractor agreement in South Carolina outlines the relationship between a business and a self-employed individual. This contract clearly defines the terms of work, compensation, and responsibilities. It is important for both parties to understand their rights and obligations. Utilizing a South Carolina Campaign Worker Agreement - Self-Employed Independent Contractor can streamline this process.