South Carolina Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

You may devote several hours online searching for the suitable legal document format that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that have been evaluated by experts.

You can readily download or print the South Carolina Guaranty of Payment of Open Account from our service.

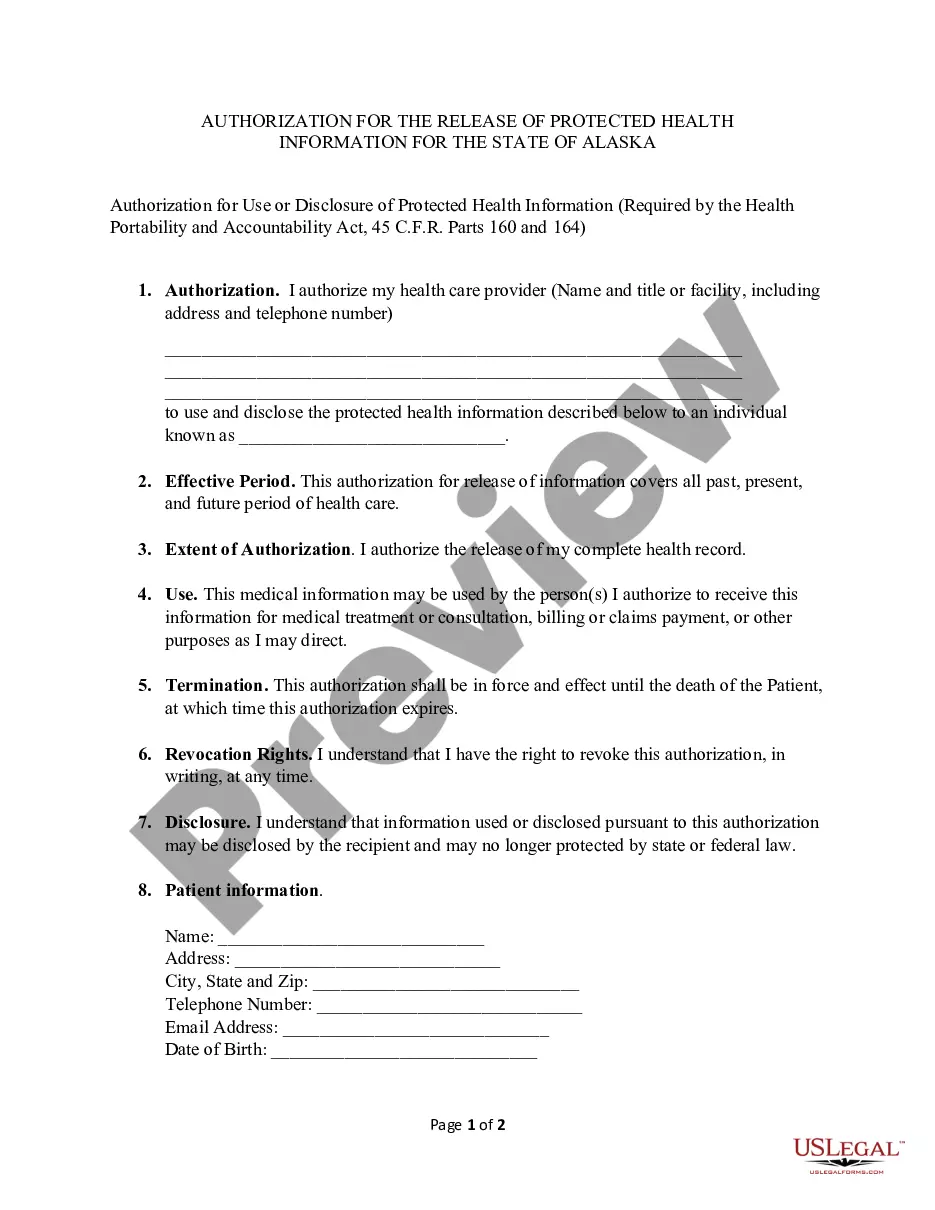

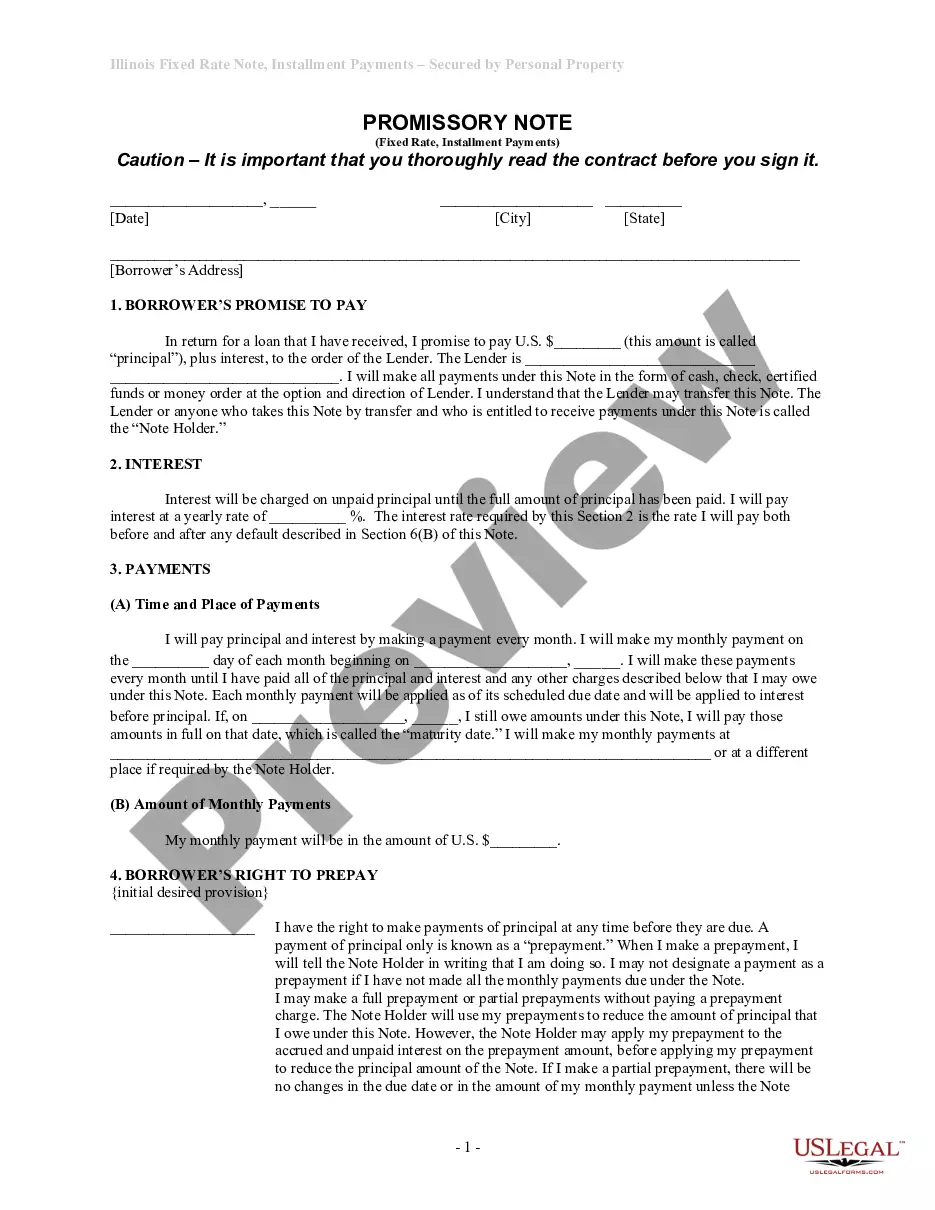

Use the Review button if available to check the document format as well.

- If you possess a US Legal Forms account, you can Log In and then hit the Acquire button.

- Following that, you can complete, modify, print, or sign the South Carolina Guaranty of Payment of Open Account.

- Every legal document format you acquire is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the region/city of your choice.

- Review the form details to confirm that you have chosen the correct type.

Form popularity

FAQ

A common example of a guarantor clause is a statement where one party agrees to be responsible for the payment obligations of another party in the event of non-payment. This clause is crucial in a South Carolina Guaranty of Payment of Open Account as it ensures that creditors have an additional layer of protection. The guarantor essentially pledges to cover the debt, which can reassure lenders when extending credit. By incorporating a guarantor clause, businesses can improve their chances of obtaining necessary financing while minimizing risk.

Yes, your bank account can be levied in South Carolina if a creditor obtains a court judgment against you. This process typically involves formal legal action and serves to recover unpaid debts as per the South Carolina Guaranty of Payment of Open Account. Understanding this risk allows you to manage your finances proactively. If you find yourself in this situation, seeking guidance from legal professionals or using services like US Legal Forms can provide you with necessary resources and support.

In South Carolina, for a contract to be legally binding, it must have an offer, acceptance, consideration, and mutual consent. Both parties should have the legal capacity to enter into the agreement, ensuring no coercion or misrepresentation. The South Carolina Guaranty of Payment of Open Account incorporates these principles, ensuring that all parties understand their rights and obligations. If you need help crafting a binding contract, resources like US Legal Forms can assist you with templates that meet state requirements.

To enforce a guaranty in South Carolina, you need to have a clear written agreement that outlines the obligations of the guarantor. Typically, you must demonstrate that the original debtor has defaulted on their obligation. Utilizing the South Carolina Guaranty of Payment of Open Account can streamline this process, as it provides a clear framework for claiming owed amounts. You may also consider contacting legal experts or using platforms like US Legal Forms to assist with the enforcement process.

A payment guaranty is a legal provision where one party agrees to take responsibility for the payment owed by another party in case of default. In the scope of a South Carolina Guaranty of Payment of Open Account, this ensures that creditors can rely on the guarantor to cover unpaid debts, enhancing trust and stability in business dealings. This tool is especially useful for companies looking to extend credit while minimizing risks. Utilizing platforms like uslegalforms can help you draft effective payment guaranty agreements tailored to your needs.

The term guarantee of payment refers to a commitment that payment will be made for goods or services provided, often supplementing a credit agreement. Within the framework of the South Carolina Guaranty of Payment of Open Account, it reinforces the seller's confidence in receiving compensation for products delivered. This guarantee mitigates the potential for disputes and fosters smoother transactions. It’s vital for businesses to grasp this meaning to protect their financial interests.

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

What are the documents that must be submitted for Bank Guarantee in case I have a current account?Application form.Bank Guarantee text (Word Format)Stamp paper (According to State Stamp Act)In the case of a Private/Public Limited Company, the Board Resolution must be provided.

Purpose of GuarantyThe guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.