South Carolina Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares

Description

How to fill out Acquisition Agreement Between GO Online Networks Corp And Westlake Capital Corp Regarding Purchase And Sale Of Company Shares?

Finding the right authorized document template can be quite a struggle. Of course, there are plenty of templates accessible on the Internet, but how will you discover the authorized form you require? Use the US Legal Forms website. The assistance provides a huge number of templates, including the South Carolina Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares, that can be used for enterprise and private needs. All the varieties are checked out by experts and fulfill federal and state demands.

Should you be already signed up, log in in your account and click on the Download option to get the South Carolina Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares. Make use of your account to search with the authorized varieties you have purchased formerly. Proceed to the My Forms tab of your own account and get another duplicate in the document you require.

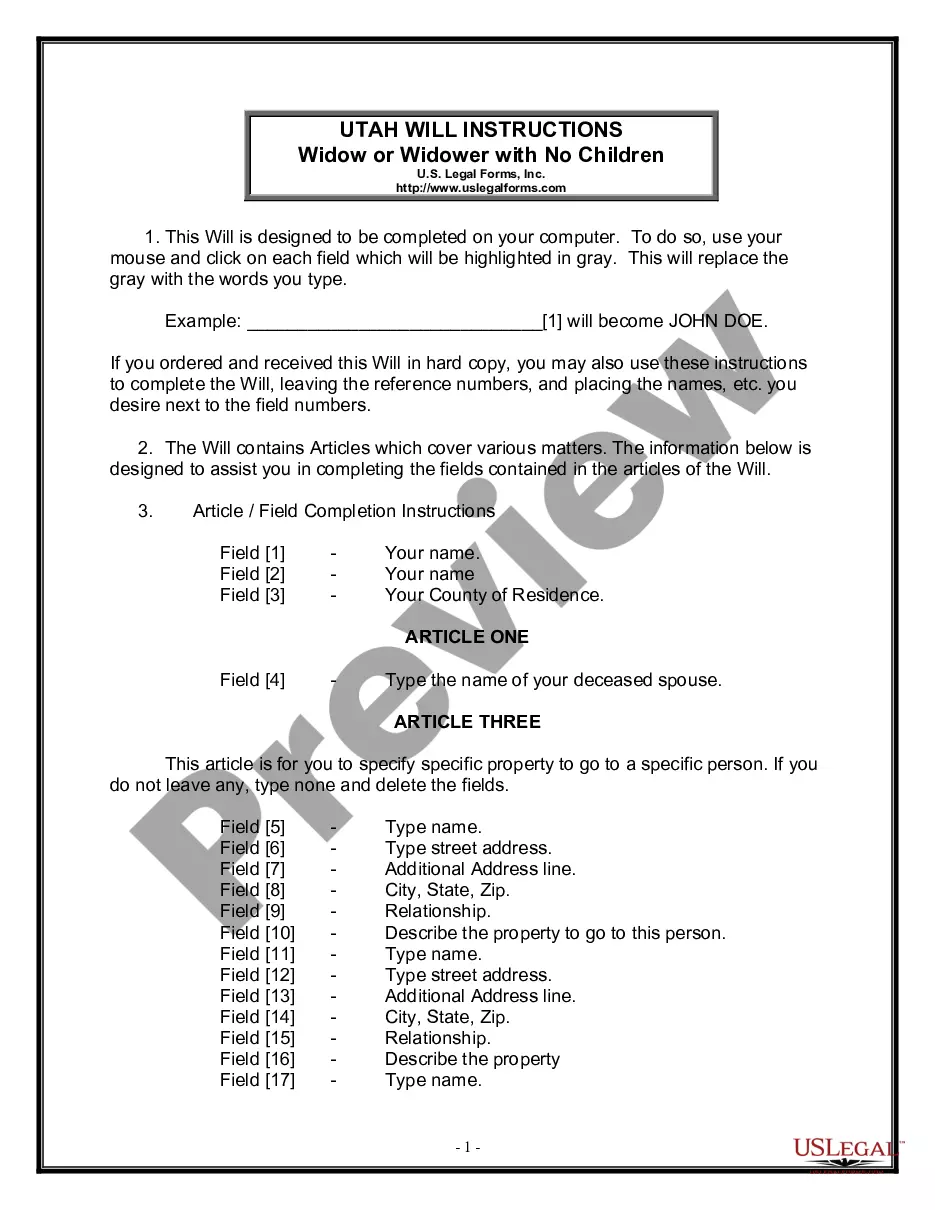

Should you be a fresh customer of US Legal Forms, listed here are easy directions for you to follow:

- First, be sure you have selected the proper form for your personal metropolis/county. You are able to look through the shape making use of the Review option and read the shape information to guarantee it is the right one for you.

- In the event the form fails to fulfill your preferences, utilize the Seach industry to discover the correct form.

- When you are positive that the shape is suitable, go through the Get now option to get the form.

- Opt for the costs plan you need and enter in the needed information. Create your account and purchase the order utilizing your PayPal account or bank card.

- Choose the document structure and down load the authorized document template in your gadget.

- Full, edit and produce and indication the obtained South Carolina Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares.

US Legal Forms will be the biggest library of authorized varieties that you will find different document templates. Use the company to down load expertly-manufactured files that follow condition demands.

Form popularity

FAQ

These journal entries will involve debiting and crediting various accounts such as cash, accounts payable/receivable, inventory, goodwill (if applicable), and retained earnings. It is essential that these entries accurately reflect the financial impact of the acquisition on both companies involved.

When the acquirer uses the acquisition accounting method, the target is treated as an investment. The target's assets and liabilities are netted using current fair market value and if the amount paid for the target is greater than that netted value, the difference is considered as goodwill.

This is done by calculating the net assets of the subsidiary at acquisition and multiplying this by the percentage owned by the non-controlling interest. Under the fair value method, the non-controlling interest at acquisition will be higher, meaning that the goodwill figure is higher.

As part of acquisition accounting, you must report the acquired company's fair market value between the net tangible and intangible assets recorded on your balance sheet. If there's any difference between the two types of assets, this is recorded as goodwill.

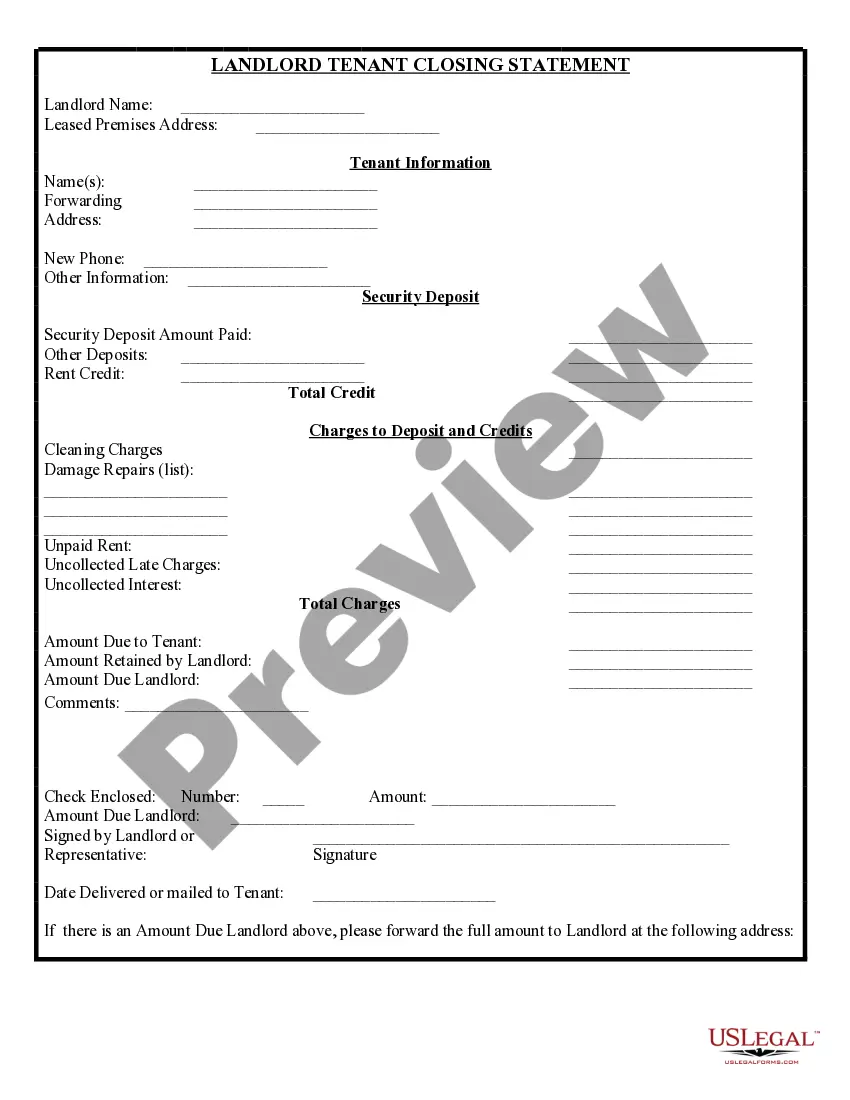

The following are listed in a share purchase agreement: Name of the company. Par value of shares. Name of purchaser. Warranties and representations made by seller and purchaser. Employee benefits and bonuses. Number of shares being sold. Details of the transaction. Indemnification agreement for unforeseen costs.

If you are planning to buy or sell shares, a correctly drafted share purchase agreement (SPA) is essential. An SPA is a legal document and it must therefore comply with legislation by providing either party in the transaction with accurate information.

Share purchase agreements typically include detailed terms and conditions, including warranties and indemnities, whereas share transfer agreements are more limited in scope. Choosing the correct agreement type is crucial for ensuring a smooth transaction and mitigating legal and financial risks.

You record acquisition costs on a company's balance sheet under the fixed assets section. The total cost included on the balance sheet includes all costs incurred to use the asset, including costs associated with getting the asset working and producing.