South Carolina Option to Purchase Common Stock

Description

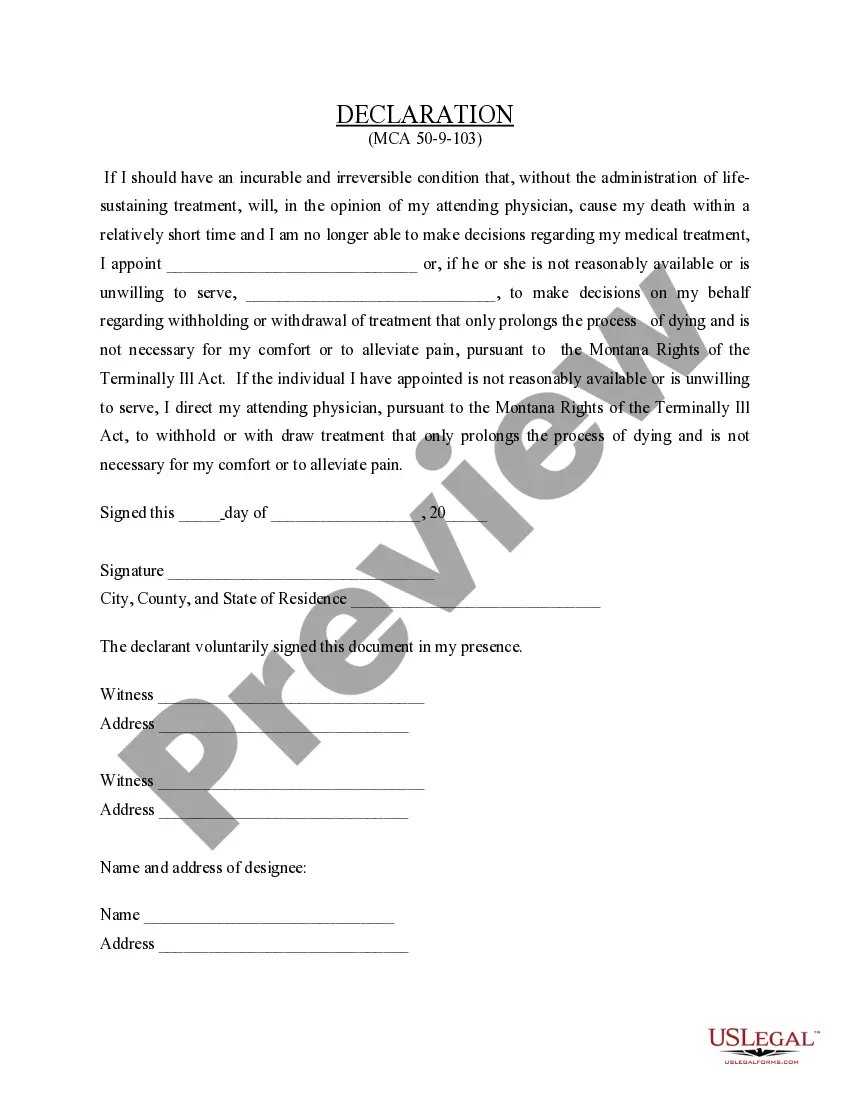

How to fill out Option To Purchase Common Stock?

If you want to complete, acquire, or printing legal file templates, use US Legal Forms, the biggest assortment of legal forms, which can be found online. Use the site`s simple and hassle-free search to find the papers you will need. Various templates for organization and person reasons are sorted by categories and says, or search phrases. Use US Legal Forms to find the South Carolina Option to Purchase Common Stock within a couple of clicks.

When you are presently a US Legal Forms client, log in to the account and then click the Download option to get the South Carolina Option to Purchase Common Stock. You can also gain access to forms you earlier downloaded from the My Forms tab of your own account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for the right area/nation.

- Step 2. Make use of the Review solution to look over the form`s content. Never forget to learn the explanation.

- Step 3. When you are unsatisfied using the kind, make use of the Research area near the top of the monitor to find other types of your legal kind web template.

- Step 4. Upon having discovered the form you will need, click the Buy now option. Opt for the costs strategy you favor and add your references to register on an account.

- Step 5. Process the transaction. You may use your bank card or PayPal account to perform the transaction.

- Step 6. Select the structure of your legal kind and acquire it on your own product.

- Step 7. Comprehensive, change and printing or sign the South Carolina Option to Purchase Common Stock.

Every single legal file web template you buy is the one you have permanently. You have acces to each kind you downloaded with your acccount. Go through the My Forms portion and pick a kind to printing or acquire yet again.

Contend and acquire, and printing the South Carolina Option to Purchase Common Stock with US Legal Forms. There are thousands of expert and condition-specific forms you may use for your personal organization or person demands.

Form popularity

FAQ

The best answer is C. Under the Uniform Securities Act, a "broker-dealer" is defined as a person that engages in the business of effecting securities transactions for the account of others; or a person that engages in the trading of securities for its own account.

A South Carolina professional corporation (PC) is a business formed by one or more licensed professionals to offer services related to their profession. The business is taxed as a single corporate entity and, in most cases, it shoulders the burden of liability instead of the individual owners (shareholders).

The most common exemptions from the registration requirements include: Private offerings to a limited number of persons or institutions; Offerings of limited size; Intrastate offerings; and.

Rule 701, adopted pursuant to Section 3(b) of the Securities Act of 1933, as amended (the ?Securities Act?),1 provides an exemption from the registration requirements of the Securities Act for certain offers and sales of securities made pursuant to the terms of compensatory benefit plans or written contracts relating ...

Causes listed in the Uniform Securities Act that could lead to the revocation of the registration of a broker/dealer would include: the conviction of a principal officer for a securities related crime. the firm had no employees.

South Carolina Business Corporation Act of 1988 defines a Corporation or Domestic Corporation as a corporation incorporated for profit and not a foreign corporation. Any person may act as the incorporator of a corporation by delivering articles of incorporation to the Secretary of State for filing.

The Attorney General protects investors, pension funds, and the general public through enforcement of California's Corporate Securities and Commodities laws.