South Carolina Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

How to fill out Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

You can invest hrs online looking for the authorized document template that fits the state and federal needs you want. US Legal Forms offers a huge number of authorized kinds that happen to be analyzed by experts. You can actually obtain or produce the South Carolina Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 from our services.

If you already have a US Legal Forms profile, it is possible to log in and then click the Acquire key. After that, it is possible to full, edit, produce, or indicator the South Carolina Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005. Every single authorized document template you purchase is yours for a long time. To obtain one more backup of any purchased form, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms website the first time, stick to the basic instructions under:

- Very first, make certain you have chosen the correct document template for your region/city that you pick. Look at the form description to ensure you have chosen the correct form. If available, utilize the Review key to check throughout the document template as well.

- If you would like locate one more variation of your form, utilize the Search area to find the template that meets your requirements and needs.

- Once you have identified the template you desire, just click Get now to proceed.

- Select the pricing program you desire, type in your references, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal profile to pay for the authorized form.

- Select the structure of your document and obtain it in your device.

- Make changes in your document if needed. You can full, edit and indicator and produce South Carolina Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005.

Acquire and produce a huge number of document web templates utilizing the US Legal Forms site, that provides the greatest variety of authorized kinds. Use professional and state-distinct web templates to deal with your business or individual requires.

Form popularity

FAQ

The person must have acted with knowledge that the testimony was false. A declaration under penalty of perjury typically follows such language: ?I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct.?

Primary tabs. A declaration is an official statement, or proclamation, such as an affidavit. If the person making the declaration (called the declarant) lies in it, the declarant may be guilty of perjury. [Last updated in September of 2022 by the Wex Definitions Team]

The act of declaration means to provide a statement of fact or to make a formal announcement. Hence, a declaration form is one that allows an individual, business, or any other corporate entity to make a formal statement about a particular thing.

If executed within the United States, its territories, possessions, or commonwealths: "I declare (or certify, verify, or state) under penalty of perjury that the foregoing is true and correct. Executed on (date). (Signature)".

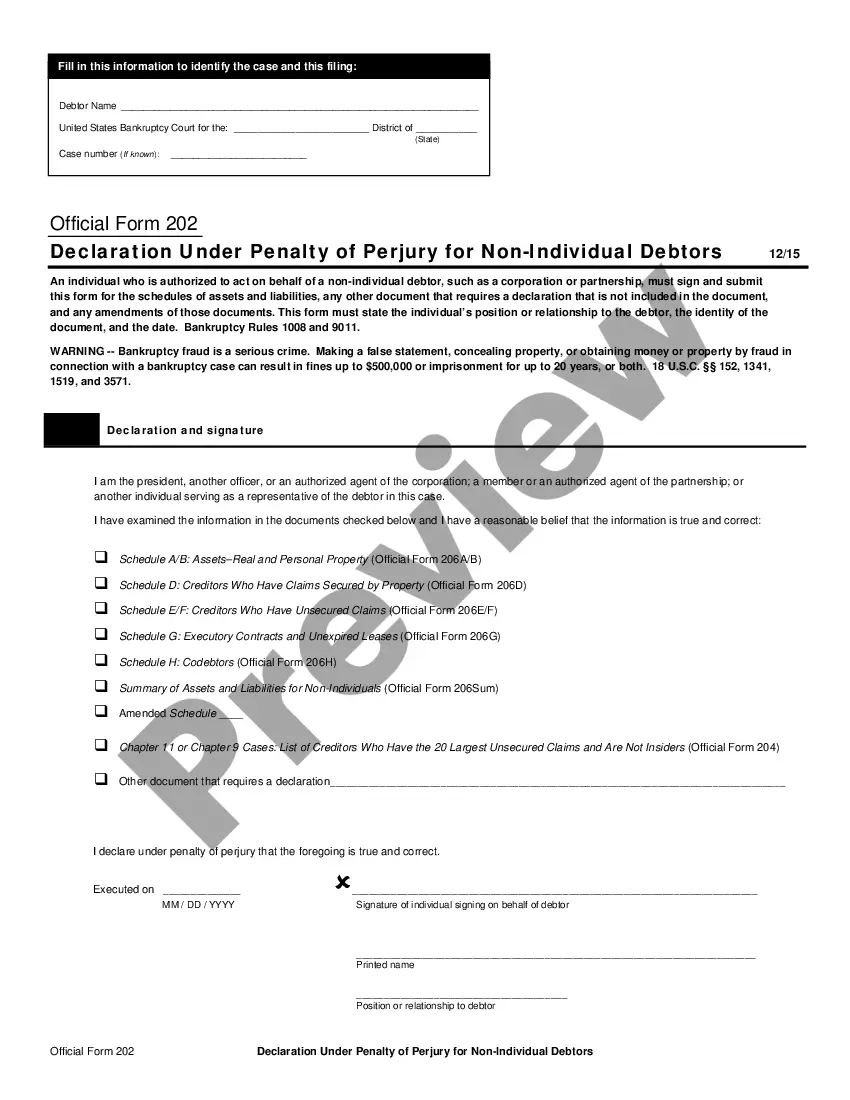

A written document in which the declarant (such as a party's attorney or a fact or expert witness) states, under penalty of perjury, that the contents of the document are true and correct.

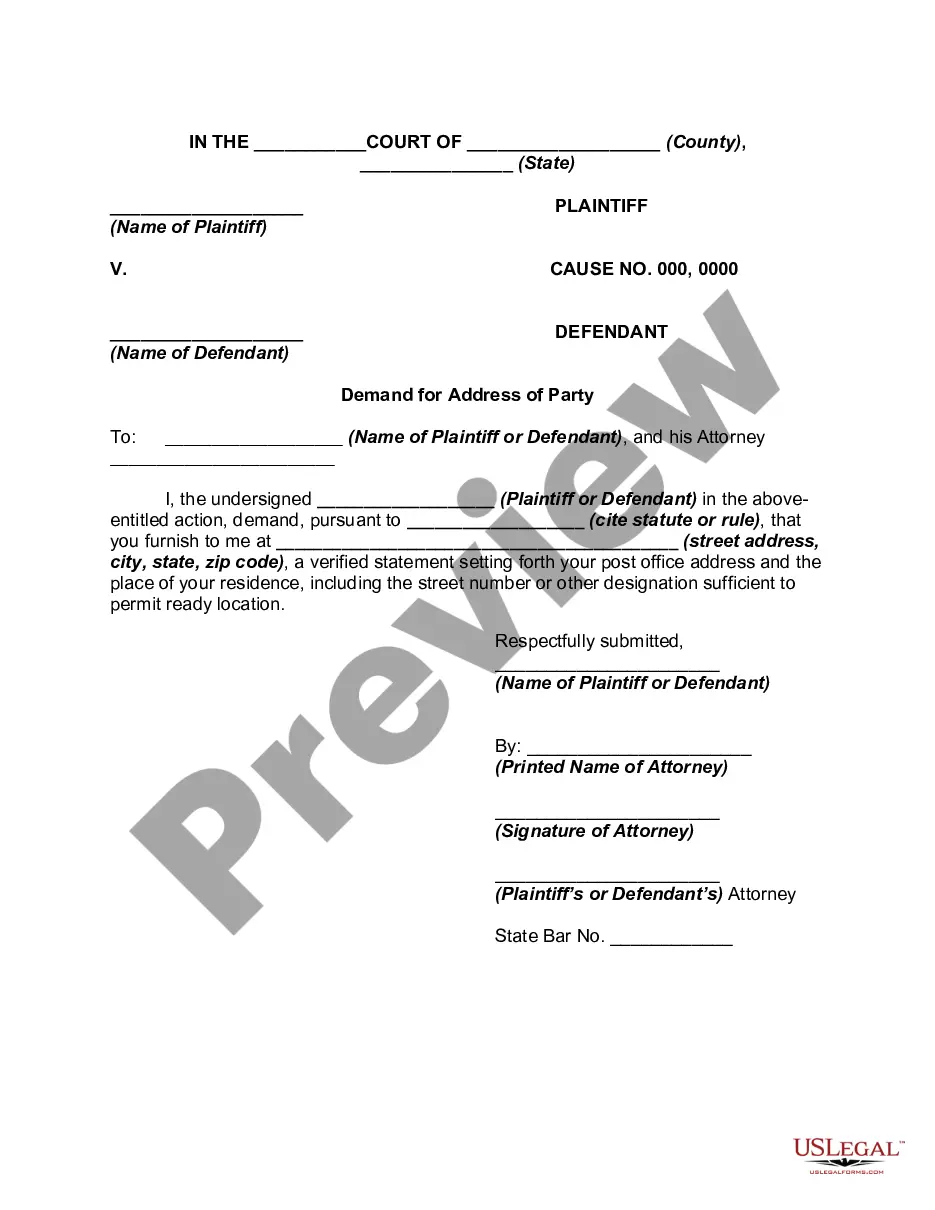

Your ?declaration? is your story to the judge. You will probably not be given the time to say much to the judge when you go to court. You must therefore write everything you want to say to the judge here in your declaration.

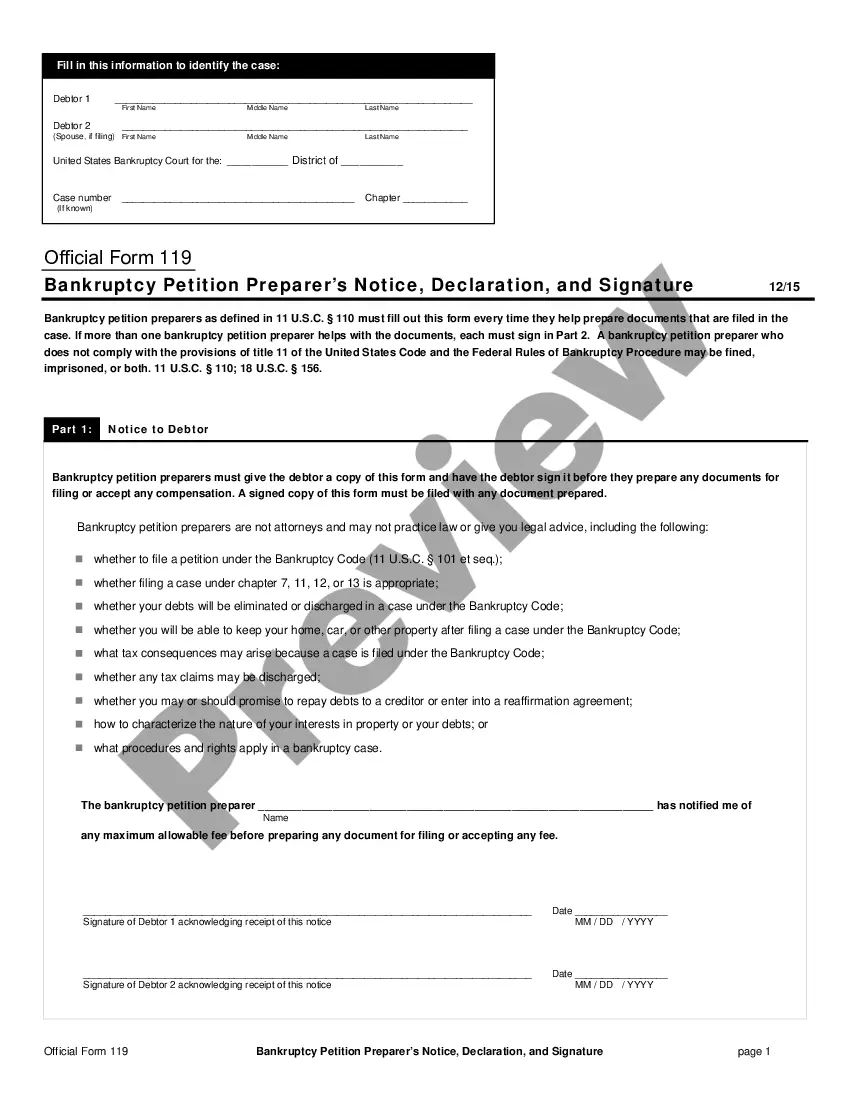

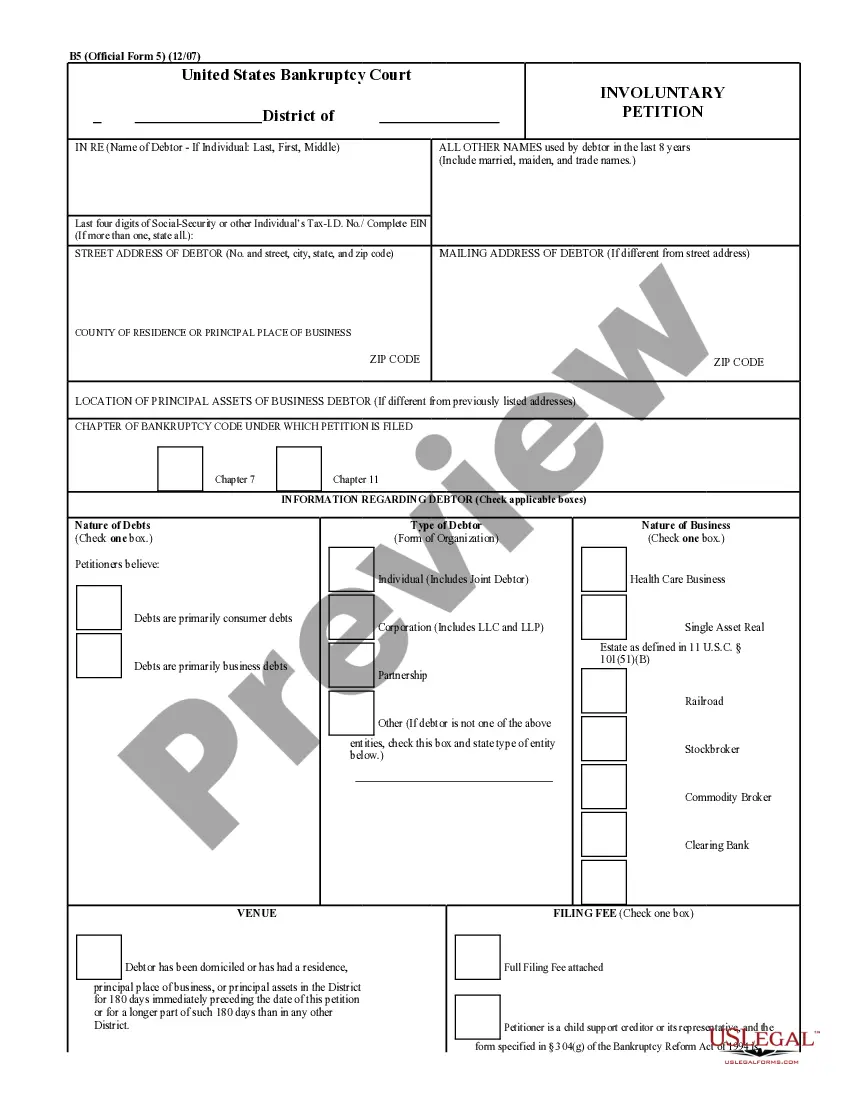

When you sign a document "under penalty of perjury" you swear that the contents of the document are truthful and acknowledge that you can get in trouble for lying. It's also called signing "under oath and penalty of perjury." The bankruptcy forms are all signed under penalty of perjury.

You may only write about facts or occurrences that you have personal knowledge of or that you personally witnessed. Explain how you know each fact. If you have documents that support your argument, you may attach them to this declaration. Using a separate paragraph and separate exhibit letter for each document.