South Carolina Landlord Tenant Commercial Package

Description

How to fill out Landlord Tenant Commercial Package?

Choosing the right legitimate document design can be quite a have a problem. Naturally, there are plenty of layouts available online, but how can you get the legitimate kind you want? Use the US Legal Forms site. The services delivers a large number of layouts, such as the South Carolina Landlord Tenant Commercial Package, that you can use for business and personal requires. All the types are examined by specialists and meet state and federal requirements.

When you are presently listed, log in to the profile and click the Down load button to have the South Carolina Landlord Tenant Commercial Package. Utilize your profile to search throughout the legitimate types you possess acquired earlier. Proceed to the My Forms tab of your profile and obtain another version in the document you want.

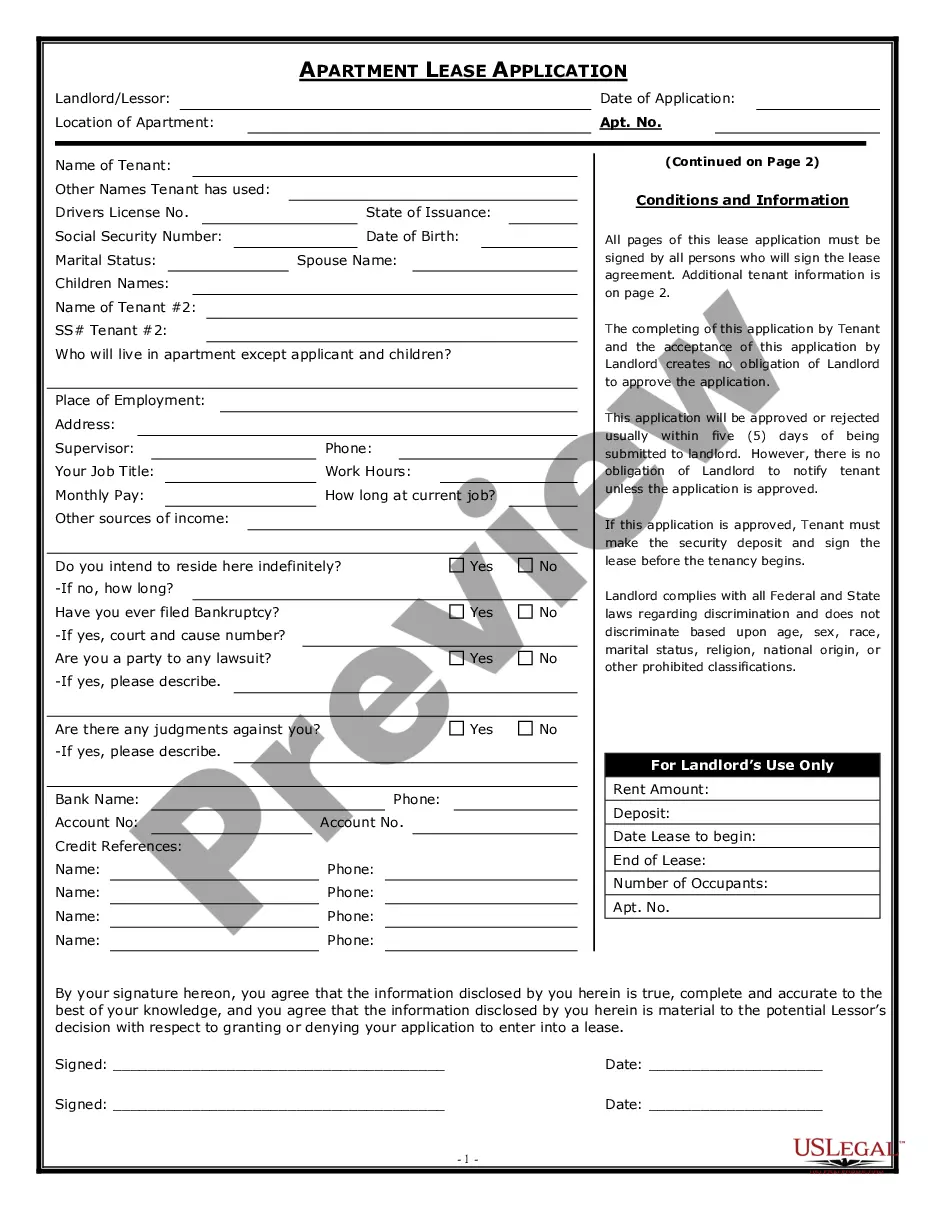

When you are a new consumer of US Legal Forms, here are simple directions that you can adhere to:

- Initial, be sure you have chosen the proper kind for your personal area/county. You may look over the shape using the Preview button and study the shape outline to guarantee this is the best for you.

- When the kind does not meet your expectations, use the Seach industry to find the proper kind.

- When you are certain that the shape is acceptable, go through the Get now button to have the kind.

- Select the rates strategy you want and enter the needed information and facts. Make your profile and pay for the transaction with your PayPal profile or credit card.

- Pick the data file format and obtain the legitimate document design to the device.

- Complete, revise and produce and signal the received South Carolina Landlord Tenant Commercial Package.

US Legal Forms is the biggest library of legitimate types that you can find different document layouts. Use the company to obtain skillfully-made documents that adhere to status requirements.

Form popularity

FAQ

A gross lease is a type of commercial real estate lease agreement where the landlord is responsible for paying all operating expenses, and the tenant pays a fixed rent.

In South Carolina and a number of other states, there is no cap on the amount rent can increase?although landlords can't raise the rent during the fixed term of a lease unless the lease specifically permits that.

Net Lease Structures: Triple Net (?NNN?) Lease: In a Triple Net lease, the tenant is responsible for their proportionate share of property taxes, property insurance, common operating expenses and common area utilities.

A triple net lease (NNN) assigns sole responsibility to the tenant for all costs relating to the asset being leased, in addition to rent. A double net lease makes the tenant responsible for both property taxes and insurance premiums due.

SECTION 27-37-30. Service of rule; posting and mailing requirements. (A) The copy of the rule provided for in Section 27-37-20 may be served in the same manner as is provided by law for the service of the summons in actions pending in the court of common pleas or magistrates courts of this State.

In commercial real estate, a net lease is a lease in which the tenant is required to pay a portion, or all, of the taxes, fees, and maintenance costs for a property.

Triple Net Lease/?NNN? Lease A triple net lease is essentially the opposite of a gross lease. The tenant (you) agrees to pay for not only the fees for rent and utilities but also all of the commercial property's operating expenses, such as maintenance fees, building insurance, and property taxes.

There are four different types of lease: gross lease, net lease, percentage lease, and variable lease.