South Carolina General Partnership for Business

Description

How to fill out General Partnership For Business?

You can spend countless hours online searching for the legal document format that complies with the federal and state standards you desire.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can conveniently download or print the South Carolina General Partnership for Business from this service.

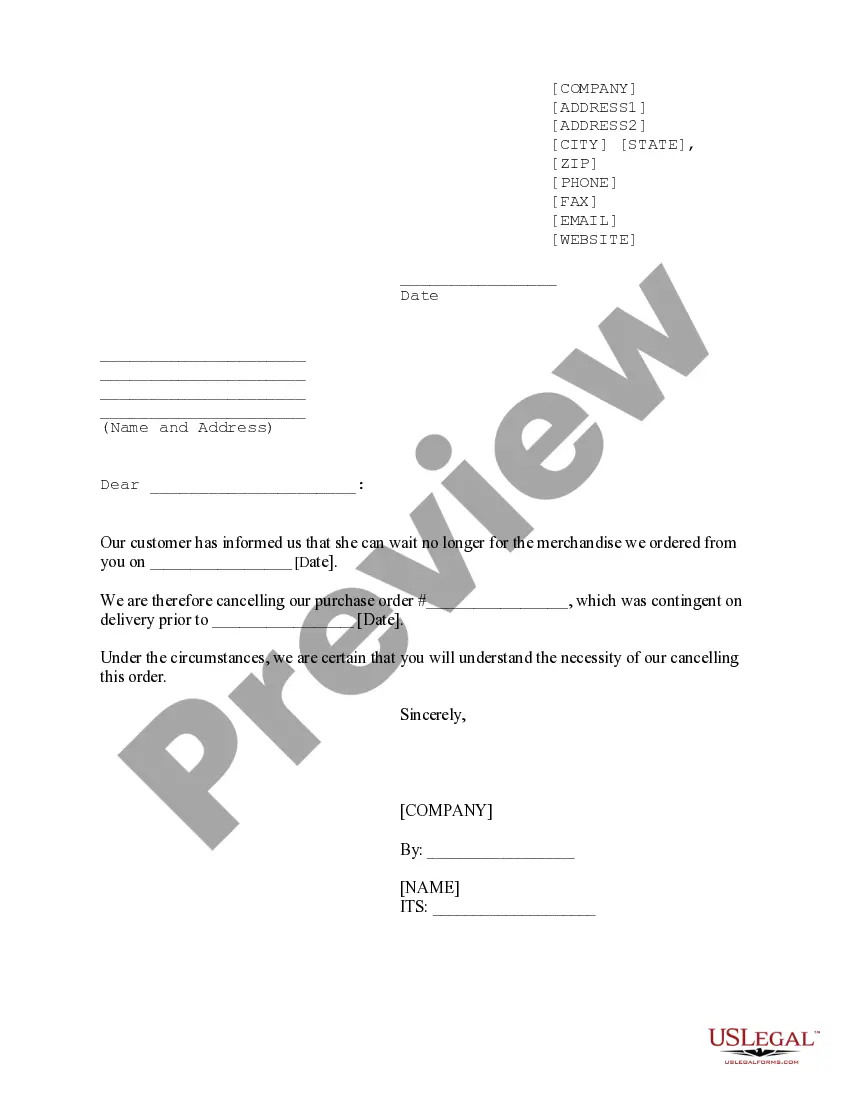

If available, utilize the Review button to preview the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Get button.

- Subsequently, you can fill out, modify, print, or sign the South Carolina General Partnership for Business.

- Every legal document you obtain is yours indefinitely.

- To retrieve another copy of the document you acquired, navigate to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow these simple instructions below.

- First, verify that you have chosen the correct document format for your area/region of interest.

- Read the document description to ensure you have selected the right form.

Form popularity

FAQ

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

There are a few important steps to go through once the decision has been made to start a partnership in South Carolina.Step 1: Select a business name.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...

There are a few important steps to go through once the decision has been made to start a partnership in South Carolina.Step 1: Select a business name.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

As per definition, a partnership business consists of at least two people that combine resources, and they agree to share losses and profits. Law firms, physician groups, real estate investment firms, and accounting companies are examples of partnership businesses.

For example, let's say that Dottie and Dave decide to open a clothing store. They decide to name the store D.D.'s Duds. Dottie and Dave don't need to do anything special in order to form a general partnership. Once Dottie and Dave agree to form the business, it's automatically considered to be a general partnership.

A general partnership must satisfy the following conditions: The partnership must minimally include two people. All partners must agree to any liability that their partnership may incur. The partnership should ideally be memorialized in a formal written partnership agreement, though oral agreements are valid.