South Carolina Model Notice of Blackout Periods under Individual Account Plans

Description

How to fill out Model Notice Of Blackout Periods Under Individual Account Plans?

Are you currently in a situation where you need documents for either professional or personal purposes almost all the time.

There are numerous legal form templates available online, but locating reliable ones isn't simple.

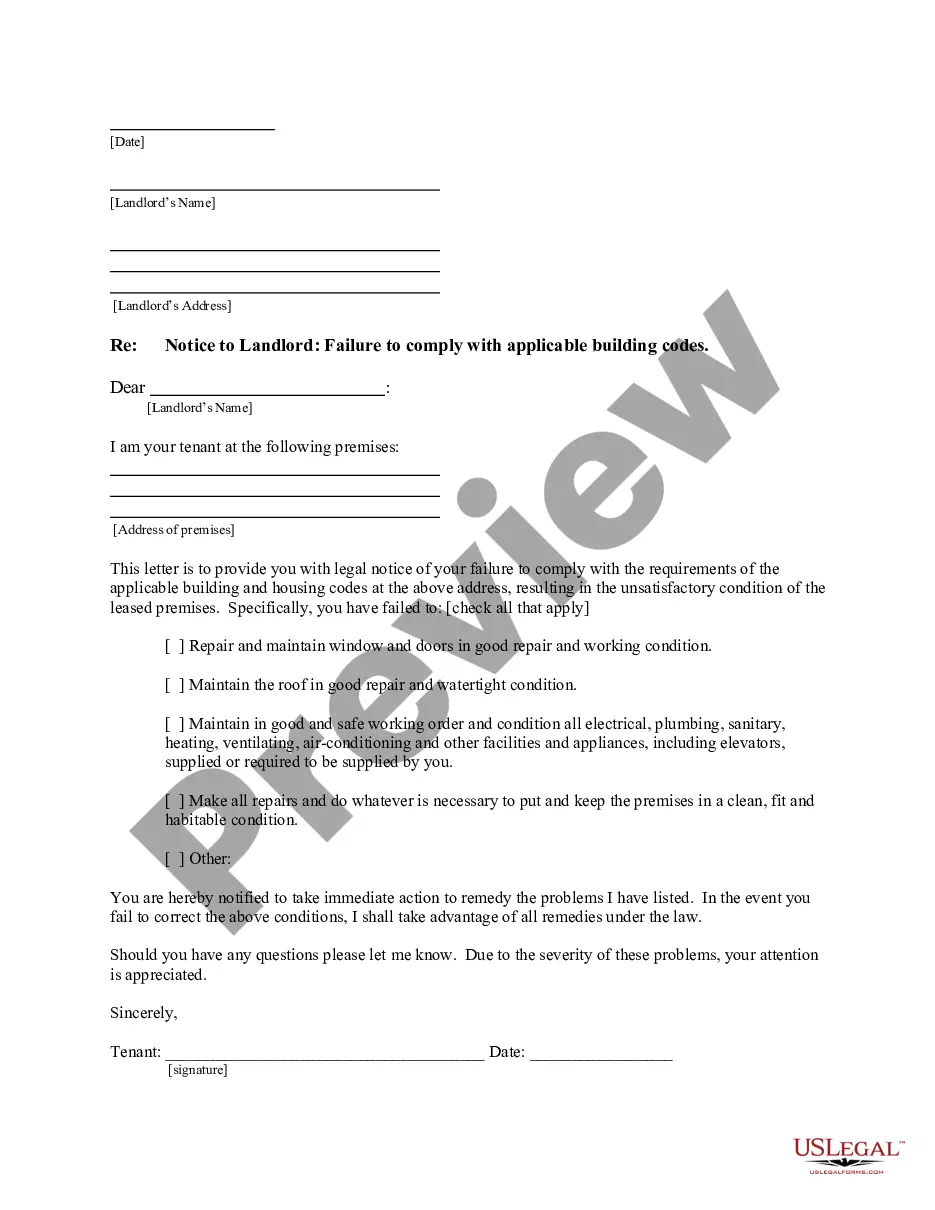

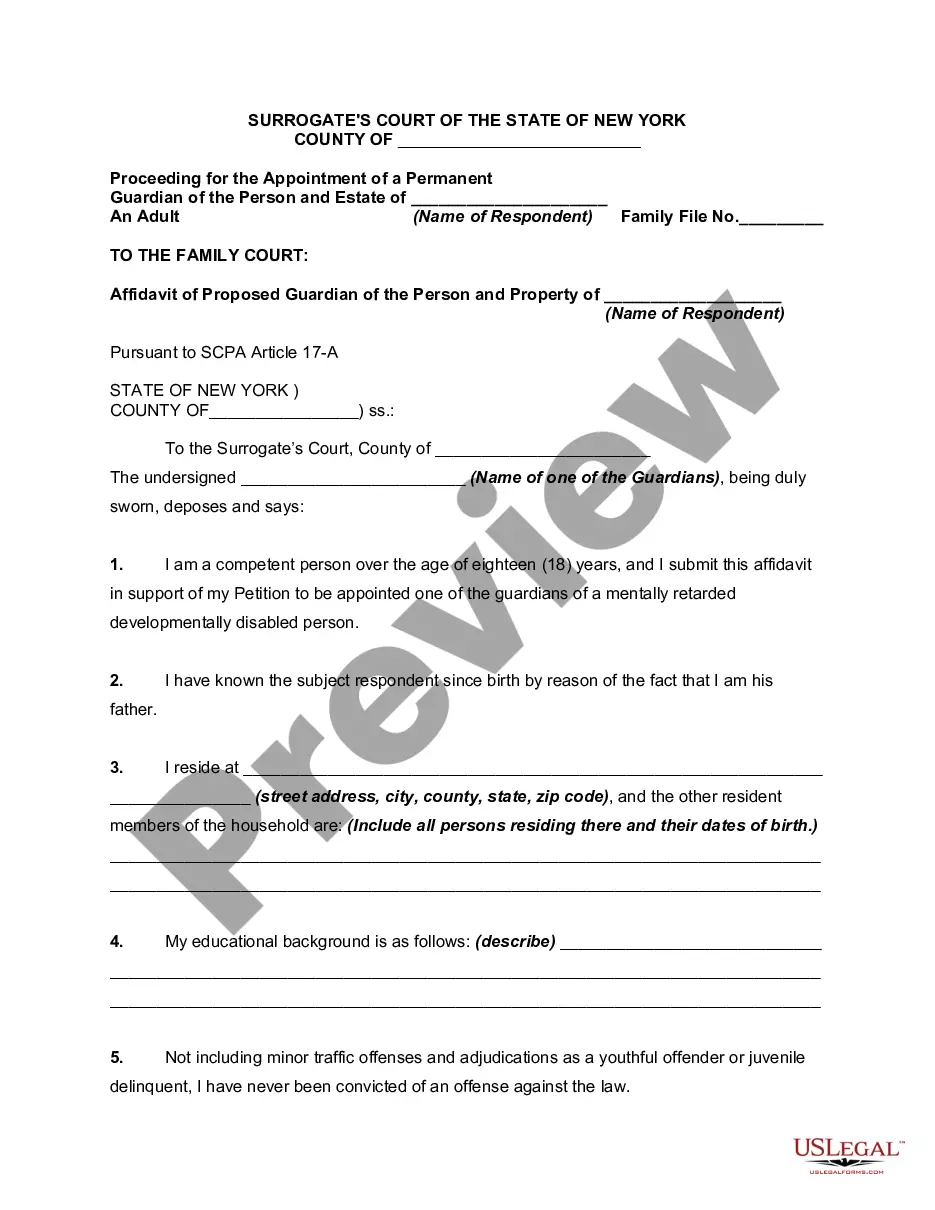

US Legal Forms offers thousands of form templates, such as the South Carolina Sample Notice of Blackout Periods under Individual Account Plans, designed to comply with both state and federal regulations.

Choose a suitable file format and download your copy.

Access all the form templates you have purchased in the My documents section. You can obtain an additional copy of the South Carolina Sample Notice of Blackout Periods under Individual Account Plans anytime, if needed. Just open the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service offers properly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms site and have your account, simply Log In.

- Then, you can download the South Carolina Sample Notice of Blackout Periods under Individual Account Plans template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct locality/county.

- Use the Review button to examine the form.

- Check the description to make sure you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

The new law says that written notice must be given to participants and beneficiaries at least 30 days before the blackout period begins and not more than 60 days before. Failure to issue notification of a blackout period may result in severe penalties.

A blackout period is a temporary interval during which access to certain actions is limited or denied. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. A blackout period for an employee retirement plan temporarily prevents participants from modifying their plans.

Black-out periods. occur when the ability of plan participants to take certain actions is temporarily. suspended. Sarbanes-Oxley requires that participants receive advance written. notice of certain black-out periods, and restricts the ability of insiders to trade in.

A blackout period is a time when participants are not able to access their 401(k) accounts because a major plan change is being made. During this time, they are not allowed to direct their investments, change their contribution rate or amount, make transfers, or take loans or distributions.

Employers must distribute the SAR to each plan participant covered under the plan during the applicable plan year, including COBRA participants and terminated employees who were covered under the plan. For instance, the Form 5500 (and the associated SAR) filed in 2020 pertain the to the plan that was offered in 2019.

Blackout List means a list of Securities in which personal trading is prohibited. Generally, the Securities included on the list are ETFs.

There is a mandatory 2 week blackout period for all employees of the Company prior to the release of quarterly and annual financial statements which shall continue until two trading days after the time such information has been released to the public.

A blackout notice should contain information on the expected beginning and end date of the blackout. The notice should also provide the reason for the blackout and what rights will be restricted as a result. The notice must specify a plan contact for answering any questions about the blackout period.

How long does a blackout period last? A blackout period usually lasts about 10 business days. However, it may need to be extended due to unforeseen circumstances, which are rare; but there is no legal maximum limit for a blackout period.