South Carolina Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

Are you presently in a scenario where you need paperwork for either business or personal reasons frequently.

Many legal document templates are accessible online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of document templates, including the South Carolina Self-Employed Independent Contractor Consulting Agreement - Detailed, designed to comply with federal and state regulations.

Once you find the right document, click Buy now.

Select the payment plan you prefer, provide the required information to process your payment, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the South Carolina Self-Employed Independent Contractor Consulting Agreement - Detailed template.

- In case you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is appropriate for your specific city/state.

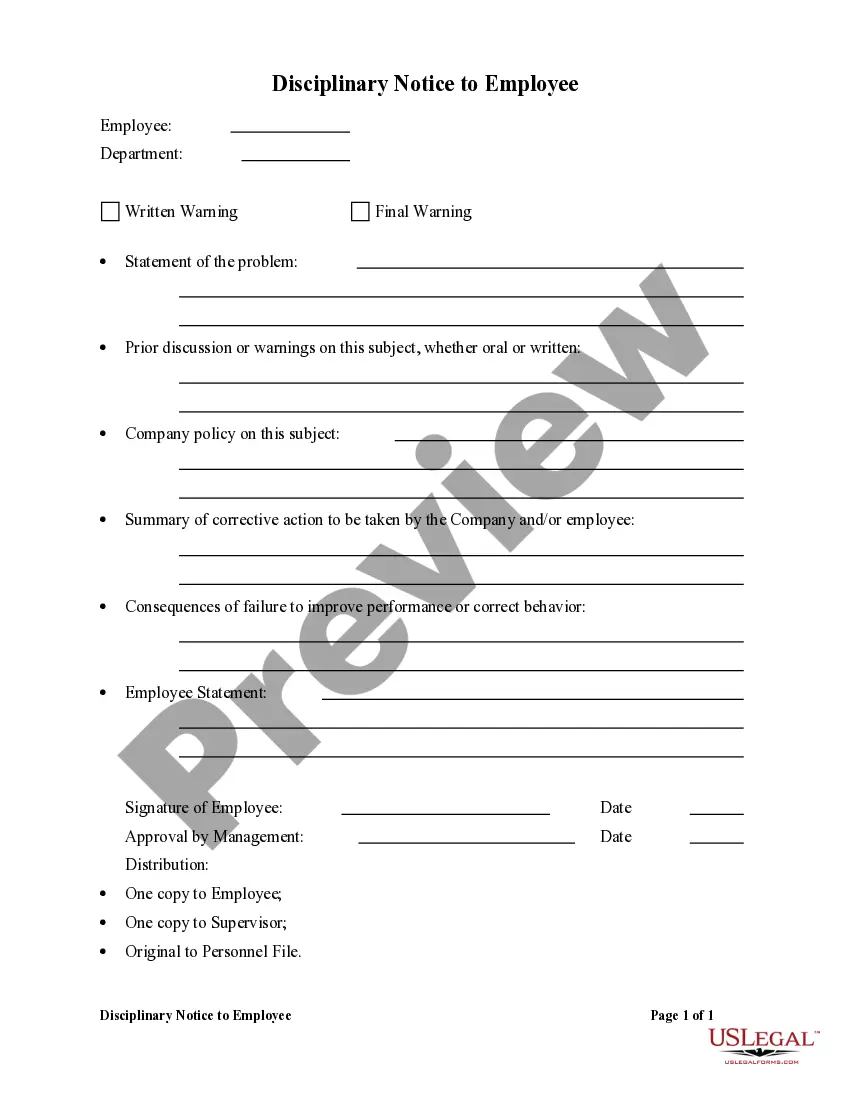

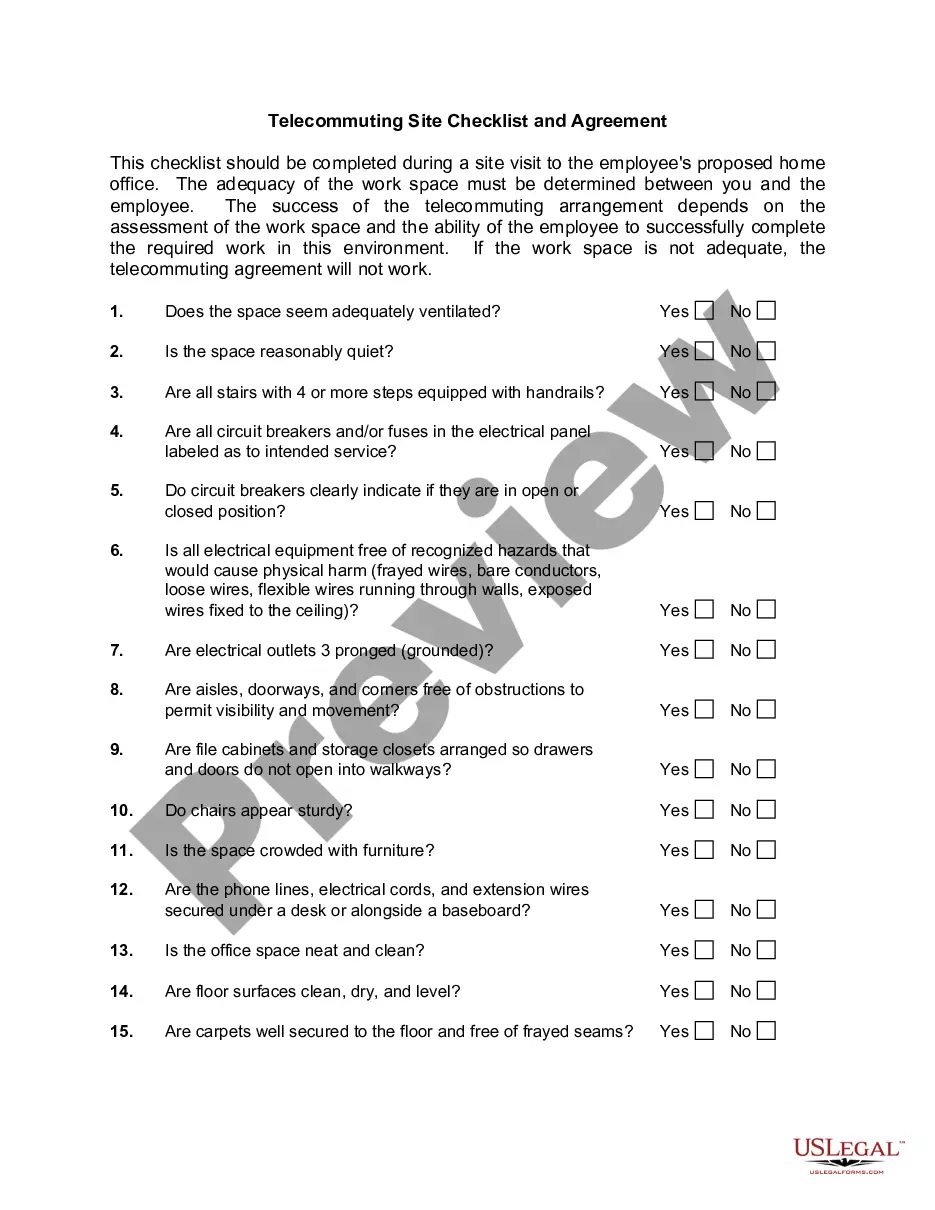

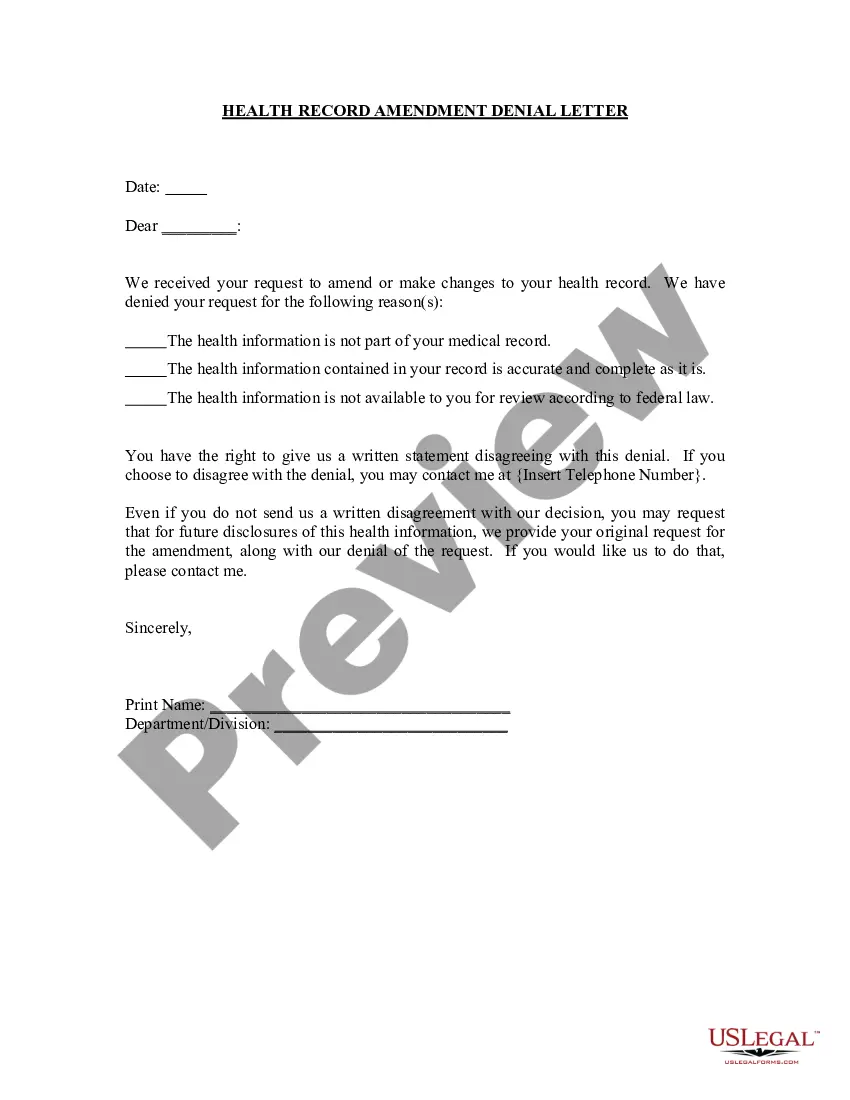

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the correct document.

- If the document does not match your needs, use the Search field to find the document that meets your requirements.

Form popularity

FAQ

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

Independent consultants improve operations, solve problems, and develop strategies. They can be employed in many industries and typically require specialized knowledge of the field they work in. Independent consultants rely on extensive skill and experience and are often retired experts in their field.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.