South Carolina Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

If you need to be thorough, download, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the website's straightforward and user-friendly search to locate the documents you require.

Different templates for commercial and personal purposes are sorted by categories and states, or keywords.

Every legal document template you obtain is yours indefinitely.

You have access to every document you downloaded within your account. Navigate to the My documents section and select a document to print or download again.

- Employ US Legal Forms to find the South Carolina Charitable Trust with Formation Based on Qualification for Tax Exempt Status in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and click the Get button to obtain the South Carolina Charitable Trust with Formation Based on Qualification for Tax Exempt Status.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the document for the correct state/region.

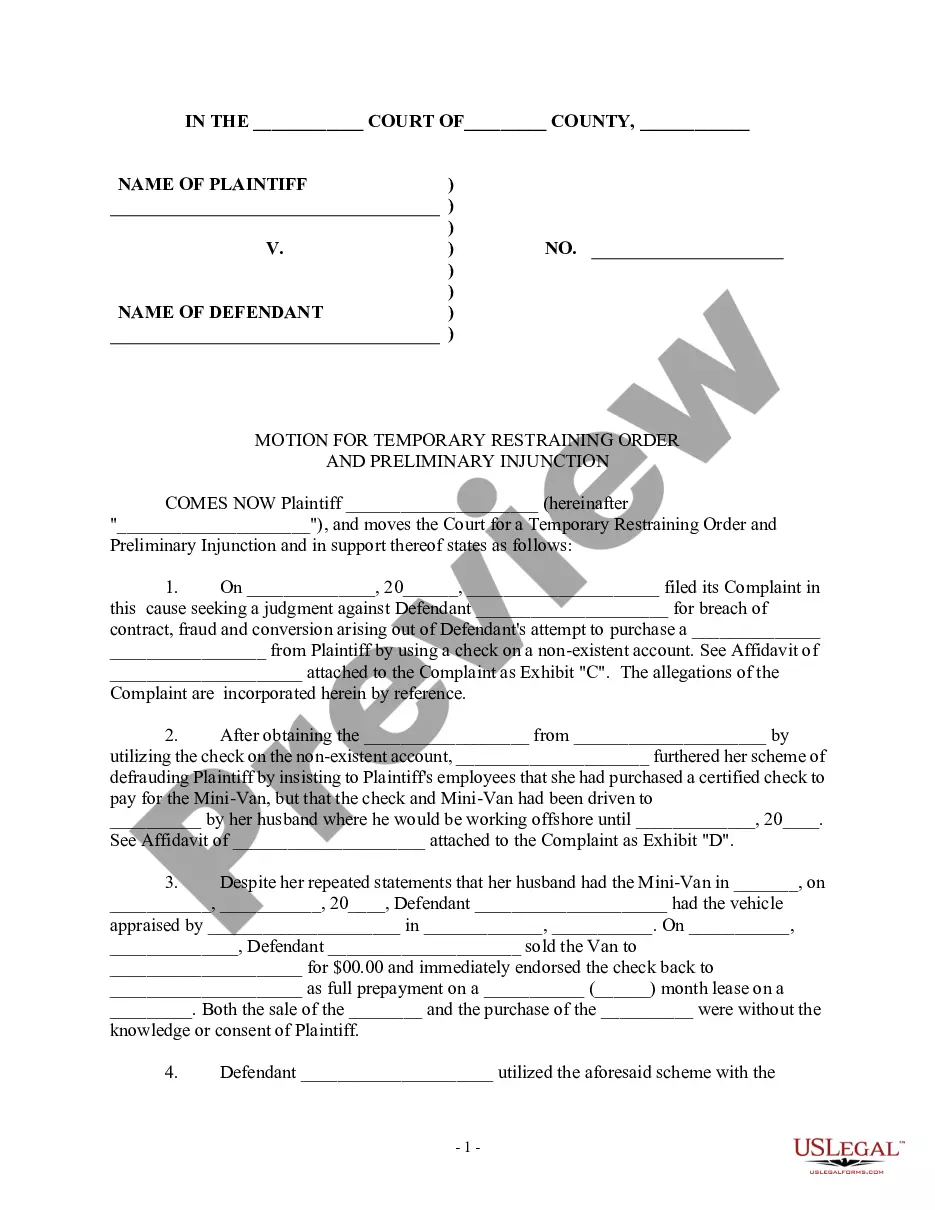

- Step 2. Utilize the Preview option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the template, use the Search feature at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the document you wish, click the Buy now button. Select the pricing plan that fits your needs and provide your information to create an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the South Carolina Charitable Trust with Formation Based on Qualification for Tax Exempt Status.

Form popularity

FAQ

Sales of tangible personal property (including accommodations) by a church or other nonprofit organization are exempt from the Sales and Use Tax.

You can only file as exempt for the tax year if both of the following are true: You owed no federal income taxes the previous year; and. You expect to owe no federal income taxes for the current year.

How to Start a Nonprofit in South CarolinaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

To start a nonprofit corporation in California, begin by filing nonprofit articles of incorporation with the California Secretary of State. California charges a $30 base filing fee, though fees may be higher depending on the filing options you choose, and you can file in person or by mail. California will incorporate

Goods that are subject to sales tax in South Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription medicines, groceries, and gasoline are all tax-exempt. Some services in South Carolina are subject to sales tax.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Visit the Secretary of State's website at to access the Business Entities Online filing application. You can also download the Articles of Incorporation form and submit it by mail. The fee to incorporate as a nonprofit corporation is $25.

How does a South Carolina nonprofit become exempt from state tax? No. You will need to apply for tax exempt status with the IRS. If you receive the official Letter of Determination, you include a copy of that letter with a letter requesting exemption from the South Carolina corporate tax to the Department of Revenue.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,

The nonprofit organization should complete and file Form ST-387 Application for Sales Tax Exemption under SC Code §12-36-2120(11)), "Exempt Organizations." The law does not require an organization to obtain an exemption certificate in order to purchase items exempt under this exemption.