South Carolina Jury Instruction - Failure To File Tax Return

Description

How to fill out Jury Instruction - Failure To File Tax Return?

Are you currently within a position in which you need to have documents for either company or specific reasons nearly every day time? There are tons of authorized papers templates available on the net, but finding types you can trust is not simple. US Legal Forms offers 1000s of type templates, much like the South Carolina Jury Instruction - Failure To File Tax Return, that are written to meet federal and state needs.

If you are already familiar with US Legal Forms web site and possess an account, basically log in. After that, you may obtain the South Carolina Jury Instruction - Failure To File Tax Return template.

Should you not provide an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the type you want and ensure it is to the right area/state.

- Utilize the Review button to review the shape.

- Look at the outline to ensure that you have chosen the appropriate type.

- In the event the type is not what you`re looking for, make use of the Research field to obtain the type that meets your needs and needs.

- Once you discover the right type, click Buy now.

- Opt for the pricing plan you want, fill out the required details to create your money, and pay for the transaction utilizing your PayPal or charge card.

- Decide on a handy file file format and obtain your duplicate.

Find all the papers templates you might have purchased in the My Forms food selection. You can get a more duplicate of South Carolina Jury Instruction - Failure To File Tax Return at any time, if needed. Just select the needed type to obtain or print the papers template.

Use US Legal Forms, one of the most comprehensive assortment of authorized types, to save lots of time as well as steer clear of errors. The service offers appropriately produced authorized papers templates that you can use for a range of reasons. Produce an account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

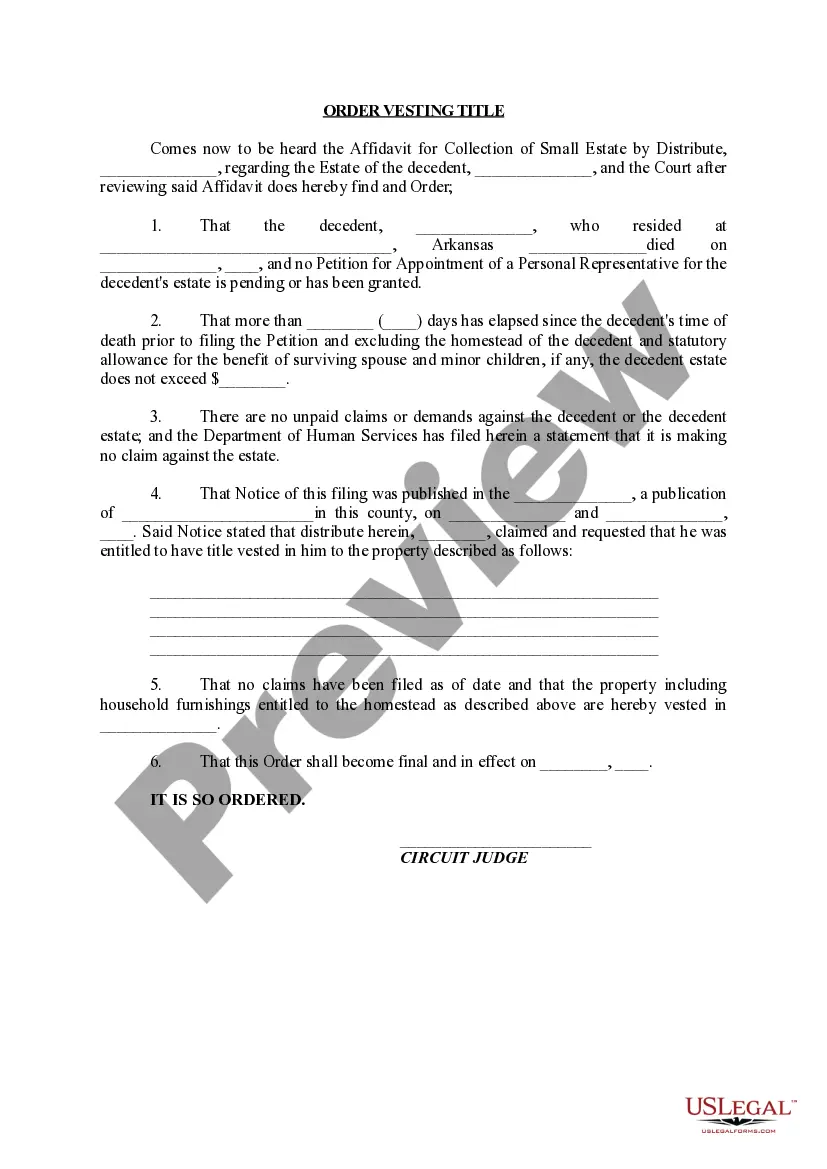

If you are a nonresident or part-year resident, you are generally required to file a South Carolina return if you work in South Carolina or are receiving income from rental property, businesses, or other investments in South Carolina. Individual Income Tax returns are due April 15 of each year.

The withholding amount is 7% of the gain recognized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the gain recognized on the sale by a nonresident corporation or other nonresident entity, if the seller provides the buyer with a Seller's Affidavit stating the amount of gain. SC Revenue Ruling #09-13 sc.gov ? resources-site ? lawandpolicy sc.gov ? resources-site ? lawandpolicy

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Taxation of Nonresident Aliens | Internal Revenue Service irs.gov ? individuals ? international-taxpayers irs.gov ? individuals ? international-taxpayers

Failure to appear may result in a citation for contempt of court, and a bench warrant may be issued for your arrest. Persons seeking to be excused must submit their request in writing when returning the jury summons.

Jurors who fail to show adequate cause for their absence from jury duty can be held in contempt of court under the Jury Selection Act, 28 U.S.C. § 1966(g). Penalties range from a fine of $100 to three days in jail or both.

If you elect to file as a nonresident, file SC1040 with Schedule NR. You will be taxed only on income earned while a resident in South Carolina and will prorate your deductions. All personal service income earned in South Carolina must be reported to this state. INDIVIDUAL INCOME TAX GENERAL INFORMATION SC Department of Revenue (.gov) ? Forms ? GenInfo_2018 SC Department of Revenue (.gov) ? Forms ? GenInfo_2018 PDF

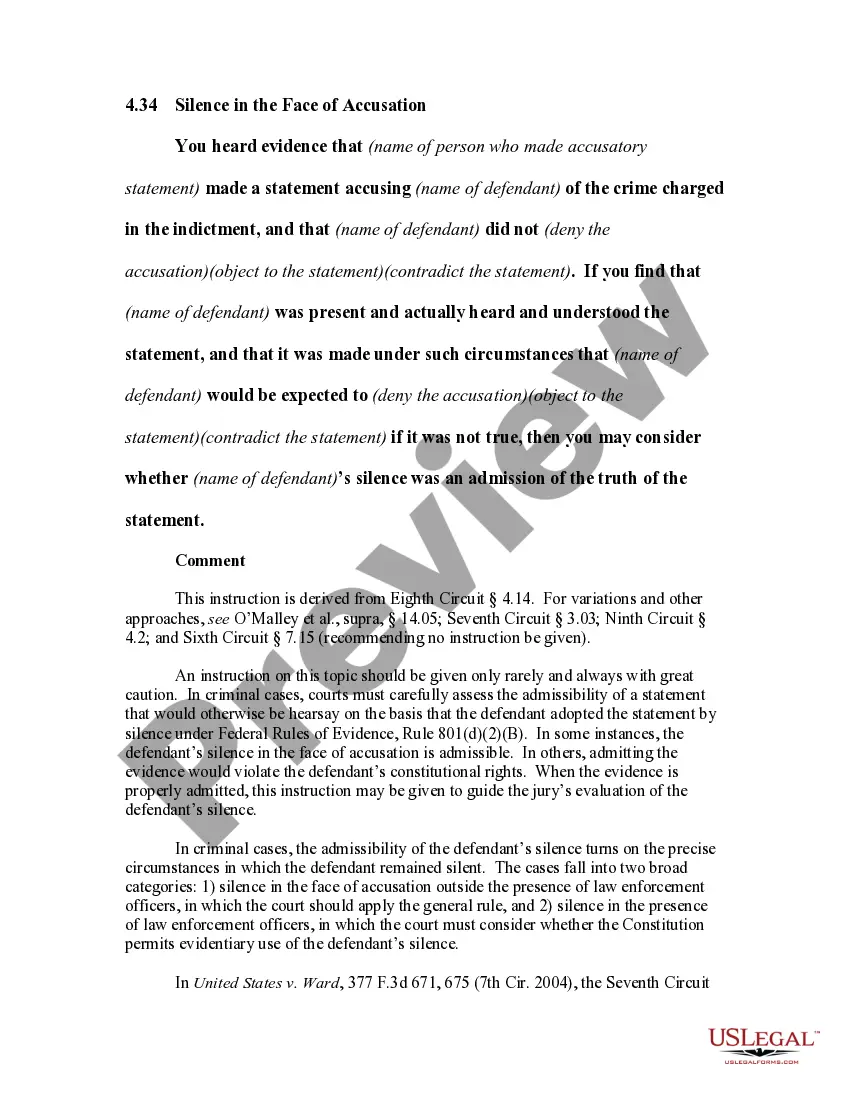

South Carolina's thirteenth juror doctrine is so named because it entitles the trial judge to sit, in essence, as the thirteenth juror when he finds "the evidence does not justify the verdict," and then to grant a new trial based solely "upon the facts." Id.

Excuse requests must be submitted online or in writing once a person is summoned. The following individuals may be excused from jury service: Persons over 70 years of age. Persons who have served as a grand or petit juror in Federal Court within the past two years.

When writing your or your employee's jury duty excuse letter, you must include basic information like the juror number, date, and your mailing address. You also need to include the clerk's information. Include detailed information about why you or your employee needs to be excused from serving jury duty.

Excuse requests must be submitted online or in writing once a person is summoned. The following individuals may be excused from jury service: Persons over 70 years of age. Persons who have served as a grand or petit juror in Federal Court within the past two years.