South Carolina Release from Liability under Guaranty

Description

How to fill out Release From Liability Under Guaranty?

If you need to thorough, obtain, or create valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Utilize the site’s straightforward and convenient search to locate the documents you require. Various templates for business and personal purposes are categorized by type, state, or keywords.

Employ US Legal Forms to find the South Carolina Release from Liability under Guaranty with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Finish and download, and print the South Carolina Release from Liability under Guaranty with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log Into your account and select the Download button to retrieve the South Carolina Release from Liability under Guaranty.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

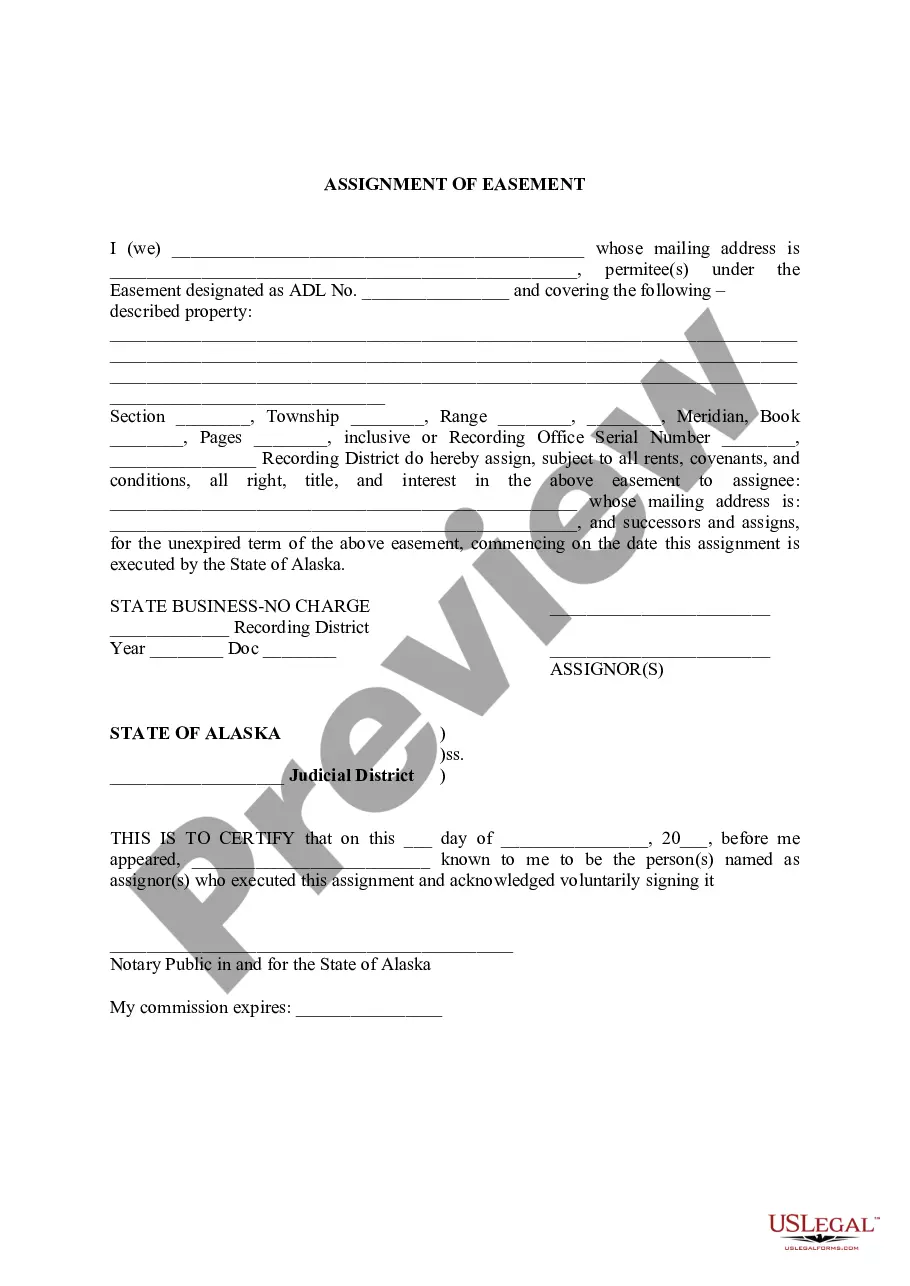

- Step 2. Use the Preview option to review the form’s content. Do not forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find additional forms from the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Download the format of the legal form and save it on your device.

- Step 7. Complete, edit, and print or sign the South Carolina Release from Liability under Guaranty.

Form popularity

FAQ

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

Although most guarantors are individual co-borrowers on an account, a company sometimes serves as the guarantor of certain debts -- for example, work-related medical evaluations. Irrespective of the nature of the relationship, a creditor usually has the right to sue a guarantor to satisfy an outstanding debt.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

Most commercial guaranties provide the lender with considerable discretion in structuring a collection strategy. The guaranty will typically permit the lender to sue one or more of the guarantors without necessarily being obligated to bring suit against the borrower or any other guarantor.

A guarantor is a person or business that promises to be responsible for repaying a loan that someone else is taking out. Guarantors share legal liability for the debt, and their financial information is considered when determining loan approval.

Principal debtor or obligor -The person whose performance to an obligation or undertaking has been secured by a surety or guarantor. The creditor or obligee-The person or institution whom the guarantor promises to fulfill the performance or requirement of the principal debtor in case of default.

The creditor generally cannot be compelled to sue another guarantor who he does not wish to sue, though that person may be joined by the guarantor who has been sued for a contribution. In most cases, the creditor goes after the guarantor with the deeper pockets.

With an unlimited personal guarantee, guarantors are liable for any part of the loan balance that is unpaid after the lender auctions off other collateral securing the loan.

An extension granted to the debtor by the creditor without the consent of the guarantor extinguishes the guaranty.

Guaranty is related to guarantee, but it is a narrower, more specific term. Guaranty is only used as a noun, where it means a promise to pay money if another party does not. It is mostly used in banking and finance, but is rarely used outside of legal context.