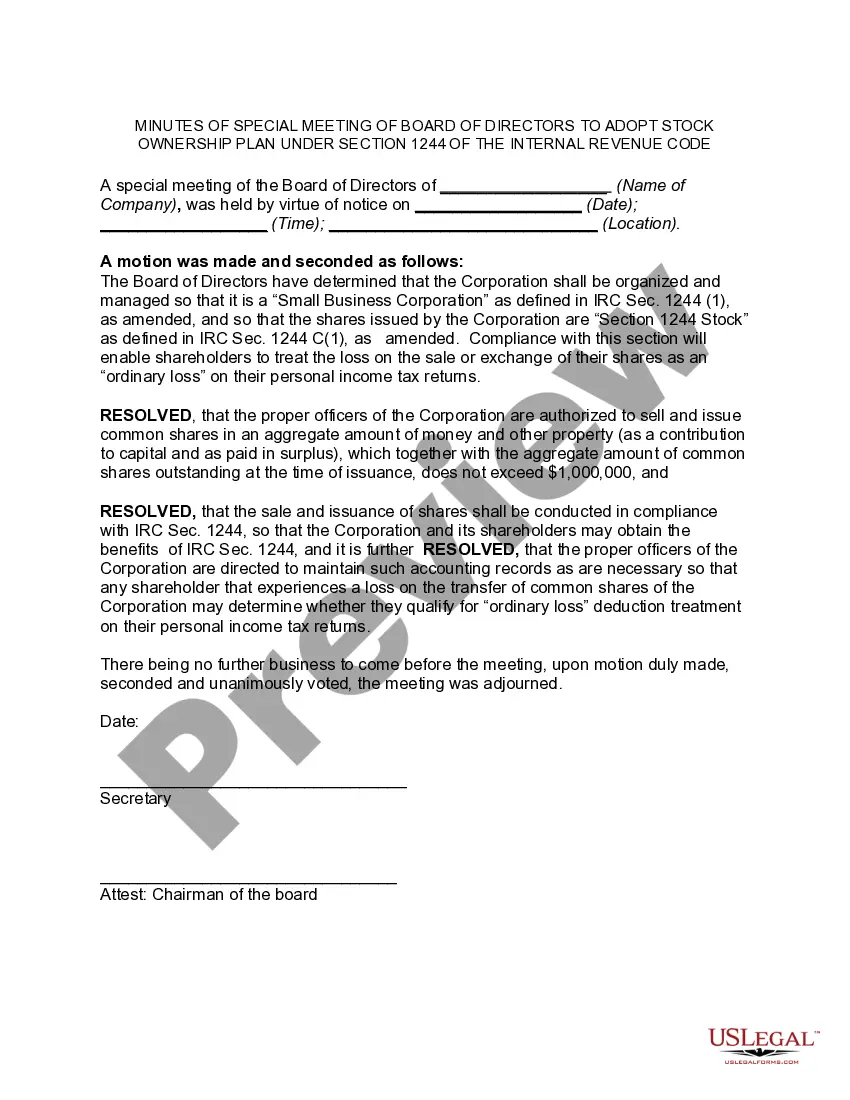

South Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

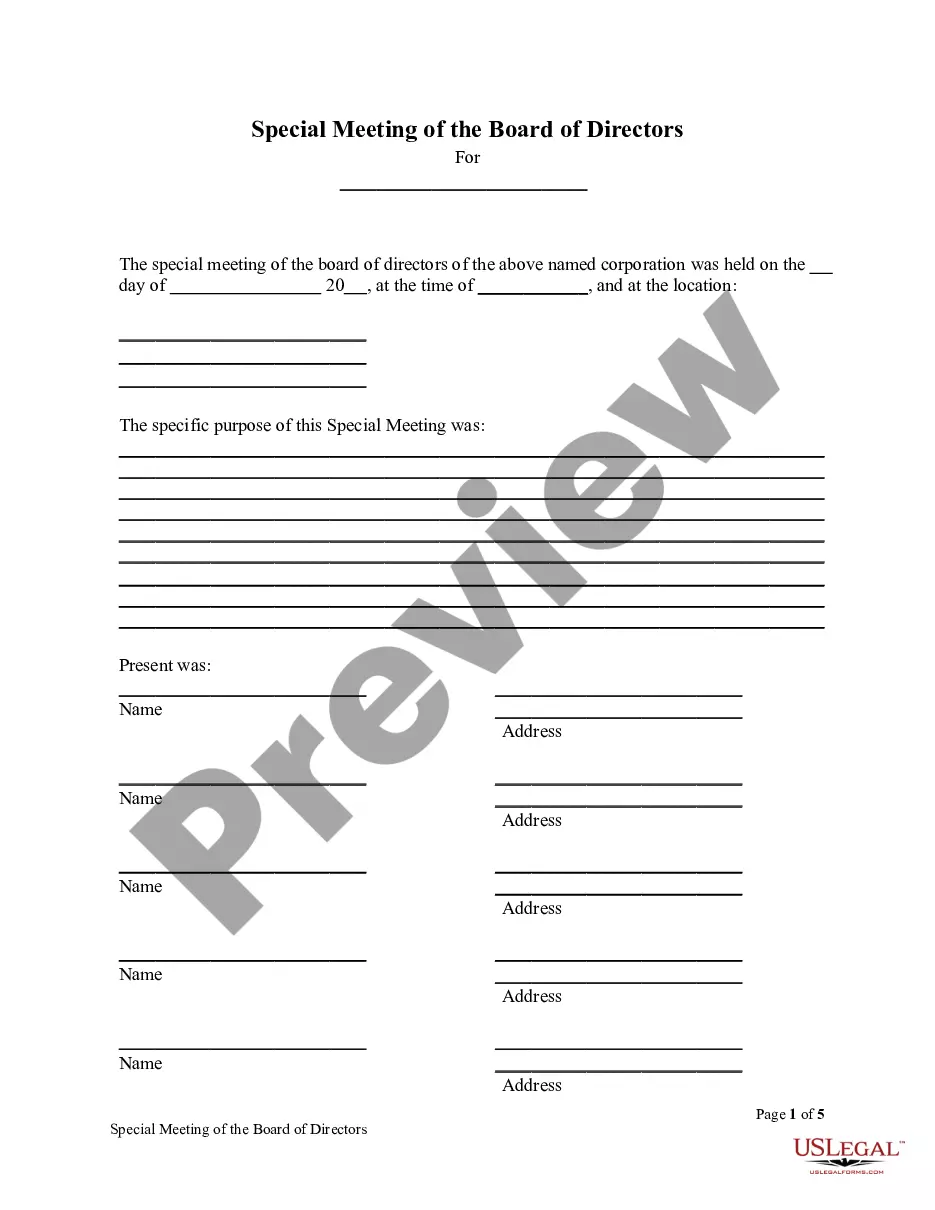

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, classified by categories, states, or keywords.

You can obtain the latest versions of forms like the South Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in minutes.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you desire and provide your information to register for an account.

- If you have a membership, Log In to download the South Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code from the US Legal Forms catalog.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your area/region.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

When should I hold a shareholder meeting? An annual shareholder meeting is typically scheduled just after the end of the fiscal year. This allows for the previous year's financial performance to be fully assessed and discussed.

Even for a big, popular firm like Warren Buffett's Berkshire Hathaway, the business portion of the agenda takes only about 20 minutes. The election of directors and votes on shareholder proposals are handled in a largely scripted manner. At the conclusion of the meeting, the minutes are formally recorded.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

File their definitive proxy statement by the later of 25 calendar days before the shareholder meeting or five calendar days after the company files its definitive proxy statement; and. Solicit shareholders of the company representing at least 67 percent of the voting power of the shares entitled to vote at the meeting.