South Carolina LLC Operating Agreement for Shared Vacation Home

Description

How to fill out LLC Operating Agreement For Shared Vacation Home?

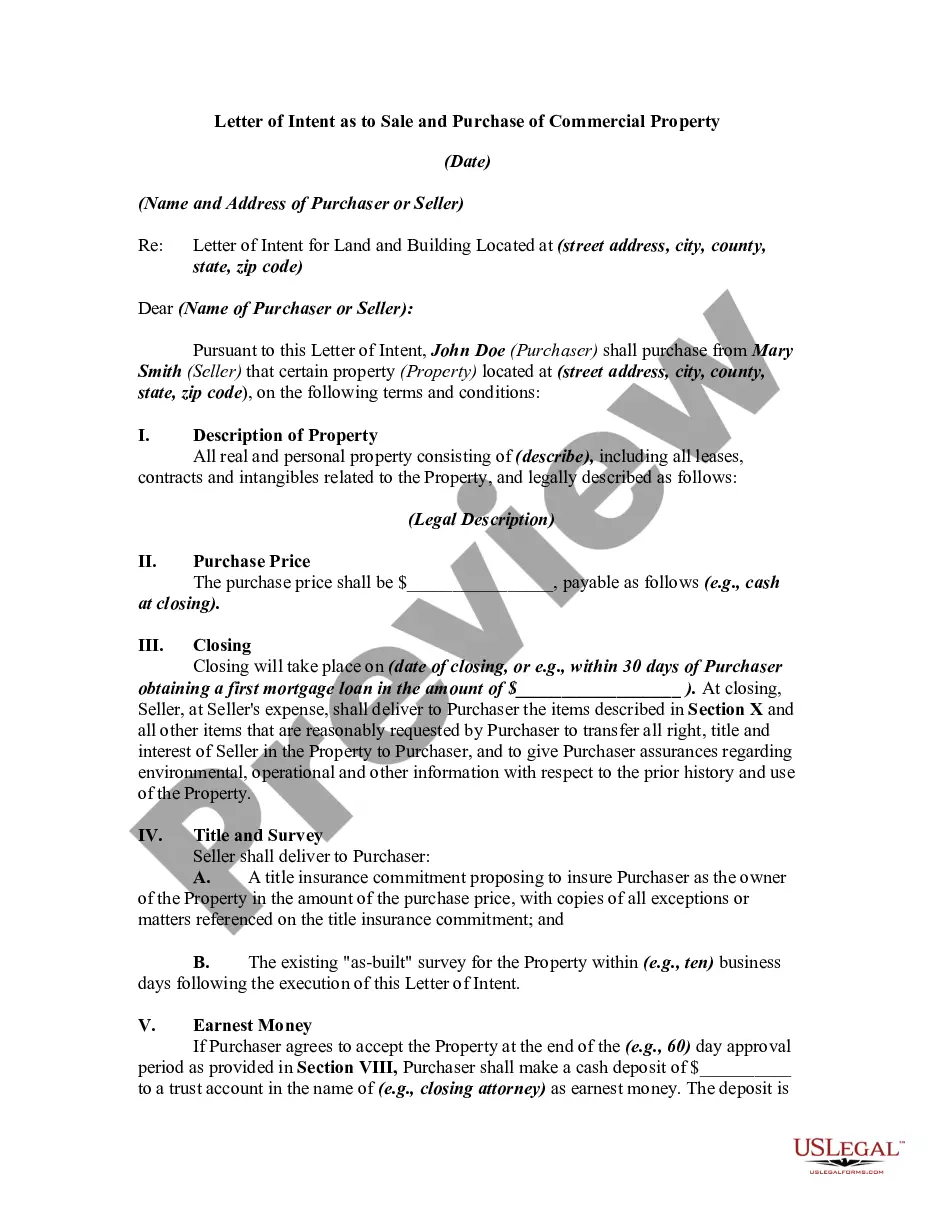

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse assortment of legal document templates that you can download or print.

Through the website, you can access thousands of documents for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents such as the South Carolina LLC Operating Agreement for Shared Vacation Home within moments.

If you already have a subscription, Log In and download the South Carolina LLC Operating Agreement for Shared Vacation Home from your US Legal Forms library. The Download button will appear on each document you view. You have access to all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Make adjustments. Fill out, edit, and print and sign the downloaded South Carolina LLC Operating Agreement for Shared Vacation Home. Each document you included in your purchase does not have an expiration date and is yours permanently. Thus, to download or print another copy, simply go to the My documents section and click on the document you need. Gain access to the South Carolina LLC Operating Agreement for Shared Vacation Home with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- Ensure you have selected the correct document for your city/county.

- Click the Review button to examine the document's content.

- Check the document description to make sure you have selected the right one.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The goal of a family beach house is to be a fun place to hang out. But there have to be a few rules for maintaining order and comfort as a sandy crowd moves in and out....Create a beach command center.Provide a laundry bin for each bedroom.Build in a dedicated charging station.Make it easy for everyone to pitch in.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

5 Things to Know When Sharing a Vacation Home With Other FamiliesCHOOSE YOUR PARTNERS CAREFULLY. You may think sharing a vacation home is something you do with close friends.MAKE CLEAR RULES. Solid rules are the foundation of a happy partnership.PLAN AN EXIT STRATEGY.DIVVY UP THE TIME.BUDGET FOR COMMON EXPENSES.

Georgia does not require an SMLLC to have an operating agreement. However, even though an SMLLC has just one member, an operating agreement is highly recommended. An SMLLC operating agreement does not need to be filed with the state.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

An LLC operating agreement is not required in South Carolina, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

For some people, they find that they can save money by having another person go in on the vacation home purchase deal. By jointly owning the vacation house, also called fractional homeownership, each party pays a percentage of the home's mortgage loan, property taxes, homeowners insurance, and maintenance upkeep.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

An SMLLC operating agreement offers various benefits, such as: providing rules that will supercede the default provisions of your state's LLC Act. serving as an additional document to show potential lenders regarding the organization of your business.

Limited Liability Companies (LLCs) Like S corporations, standard LLCs are pass-through entities and, generally speaking, are not required to pay income tax to either the federal government or the State of South Carolina. Instead, an individual LLC member will owe tax on his or her share of the company's income.