South Carolina PLLC Operating Statement

Description

How to fill out PLLC Operating Statement?

US Legal Forms - among the biggest libraries of authorized forms in the States - gives an array of authorized record templates you may acquire or print. Making use of the web site, you can find a large number of forms for enterprise and specific reasons, categorized by classes, says, or key phrases.You can get the most up-to-date types of forms such as the South Carolina PLLC Operating Statement within minutes.

If you already have a registration, log in and acquire South Carolina PLLC Operating Statement from the US Legal Forms library. The Down load switch will show up on each develop you perspective. You have access to all previously delivered electronically forms in the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, listed below are basic guidelines to obtain began:

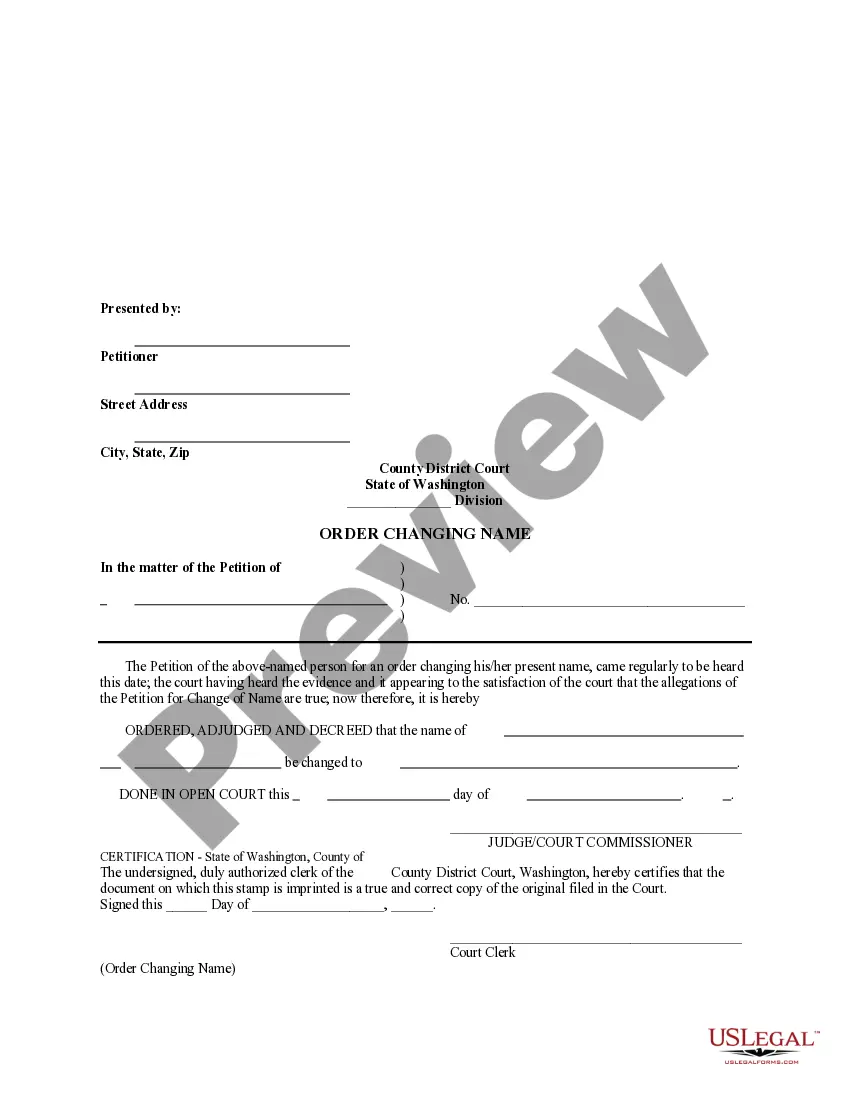

- Be sure you have picked the best develop to your city/county. Click on the Review switch to check the form`s content material. Browse the develop outline to ensure that you have selected the right develop.

- When the develop does not fit your requirements, use the Search industry on top of the display to find the one that does.

- In case you are happy with the form, validate your option by visiting the Purchase now switch. Then, choose the costs prepare you prefer and offer your credentials to register to have an account.

- Approach the deal. Make use of bank card or PayPal account to perform the deal.

- Find the structure and acquire the form on the gadget.

- Make changes. Fill up, change and print and indicator the delivered electronically South Carolina PLLC Operating Statement.

Each template you included with your bank account does not have an expiry day and it is yours eternally. So, if you would like acquire or print one more version, just proceed to the My Forms area and click on about the develop you will need.

Obtain access to the South Carolina PLLC Operating Statement with US Legal Forms, probably the most extensive library of authorized record templates. Use a large number of professional and express-certain templates that meet your small business or specific requirements and requirements.

Form popularity

FAQ

Unlike most states, all South Carolina LLCs don't need to pay an Annual Report fee. Only LLCs taxed as S-Corporations must pay a fee and file the report. So for most people who own an LLC in South Carolina, there are no state-required annual South Carolina LLC fees.

SECTION 33-44-202. Organization. (a) One or more persons may organize a limited liability company, consisting of one or more members, by delivering articles of organization to the office of the Secretary of State for filing.

Title 33 - Corporations, Partnerships and Associations. Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. Section 33-44-1002 - Application for certificate of authority. (8) whether the members of the company are to be liable for its debts and obligations under a provision similar to Section 33-44-303(c).

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

The document required to form an LLC in South Carolina is called the Articles of Organization. The information required in the formation document varies by state. South Carolina's requirements include: Registered agent.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

But while it's not legally required in South Carolina to conduct business, we strongly recommend having an Operating Agreement for your LLC. (It doesn't matter whether you have one or more Members in the company, a written Operating Agreement is an essential internal document.)

A South Carolina LLC operating agreement is a legal document that establishes how a company will conduct its affairs and run its operations. The agreement also includes financial information related to the company such as ownership interest, initial loans, capital contributions, and any other records.