South Carolina Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

Are you currently in a scenario where you frequently need documents for business or personal purposes.

There are numerous legal template documents accessible online, but finding reliable forms can be challenging.

US Legal Forms offers a vast selection of document templates, such as the South Carolina Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner, designed to comply with state and federal regulations.

If you find the right form, click Purchase now.

Choose the payment plan you prefer, provide the required details to create your account, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you’ve bought in the My documents section. You can download an additional copy of the South Carolina Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner anytime if needed. Simply follow the required form to obtain or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally drafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

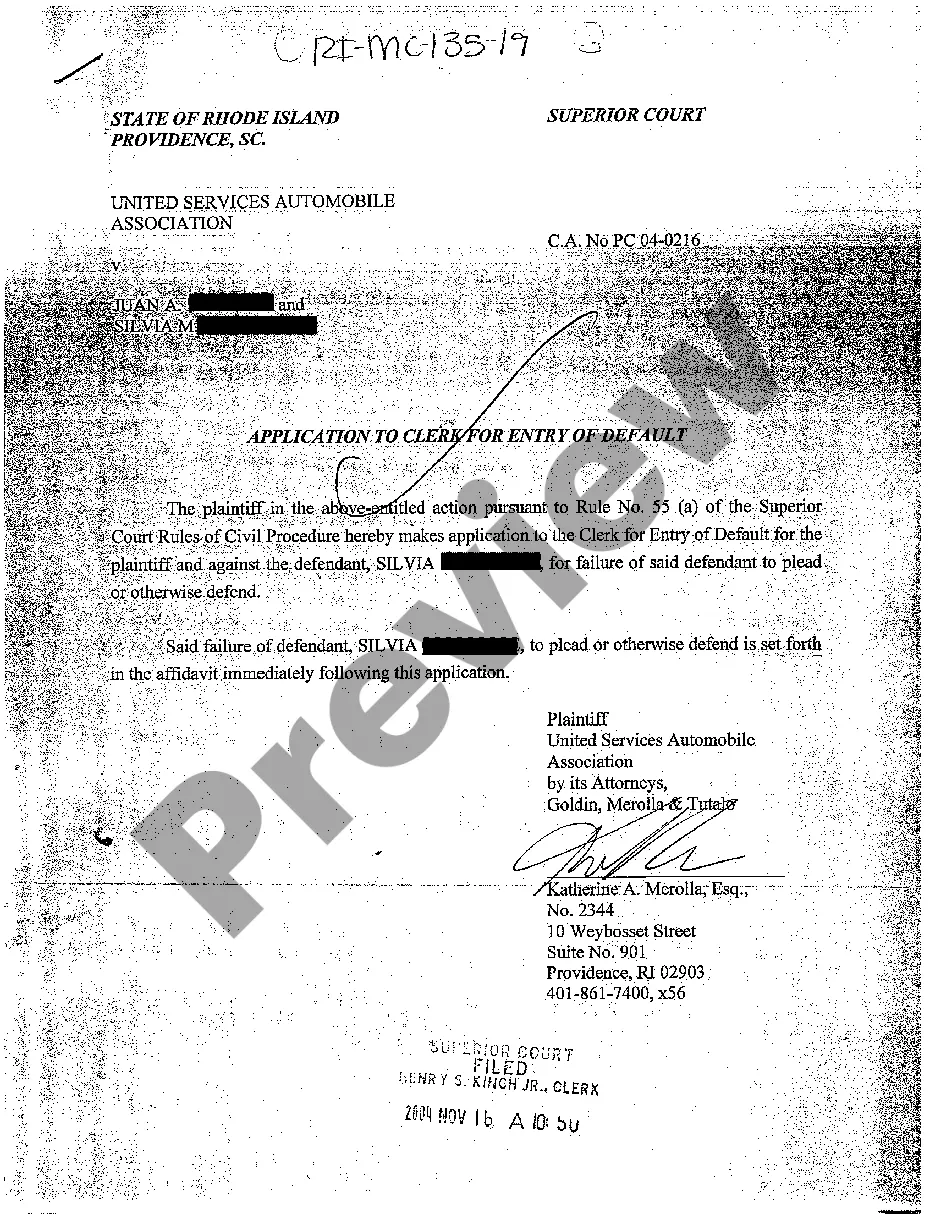

- Utilize the Preview button to review the document.

- Read the description to make sure you've chosen the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Is there a time limit on applying for probate? Though there is no time limit on the probate application itself, there are aspects of the process which do have time scales. Inheritance tax for example, is a very important part of attaining probate in the first place and must be done within 6 months of date of death.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

How Long Do You Have to File Probate After a Death in South Carolina? South Carolina offers a generous timeline for filing probate. According to Section 62-3-108 of Title 62, a petition for probate must be filed within ten years of the person's death to be considered.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

Probate is the only legal way to transfer the assets of someone who has died. Without probate, titled assets like homes and cars remain in the deceased's name indefinitely. You won't be able to sell them or keep registrations current because you won't have access to the individual's signature and consent.

Leaving Your Property Some Other Way Before you list those specific bequests, you will name a beneficiary or beneficiaries to get "everything else" in your estate-- that is, all of the property that is left over after the specific gifts are distributed.

If you live in South Carolina and die without a valid will and have only a surviving spouse (but no children), your spouse gets everything. If you have children and you die intestate in South Carolina, your spouse inherits half of your estate while your children get the other half evenly.

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In South Carolina, each owner, called a joint tenant, must own an equal share.

In South Carolina, it will take a minimum of eight months to probate even a modest estate because the law requires probate to remain open that long to allow creditors to file claims.

A gift given by means of the will of a decedent of an interest in real property.