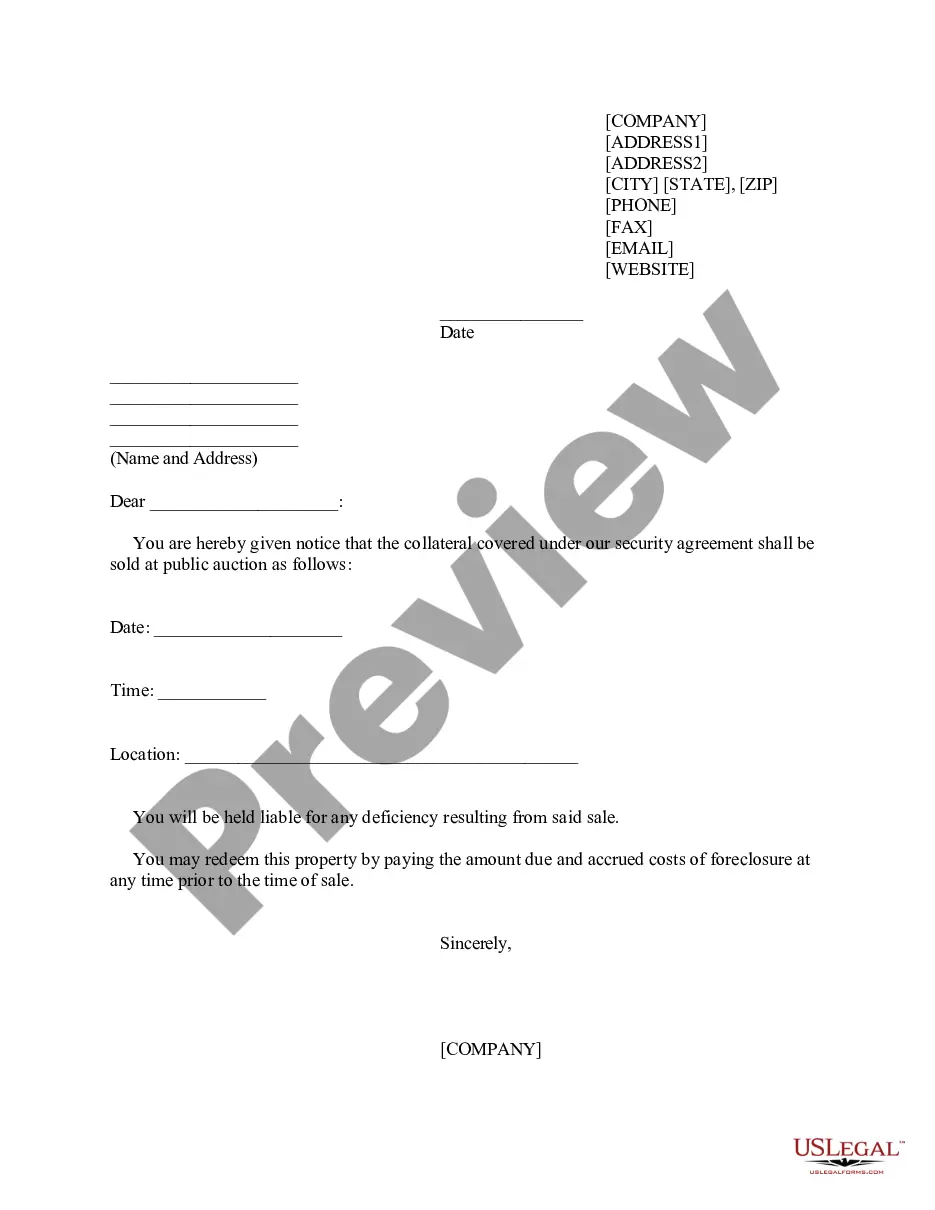

South Carolina Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

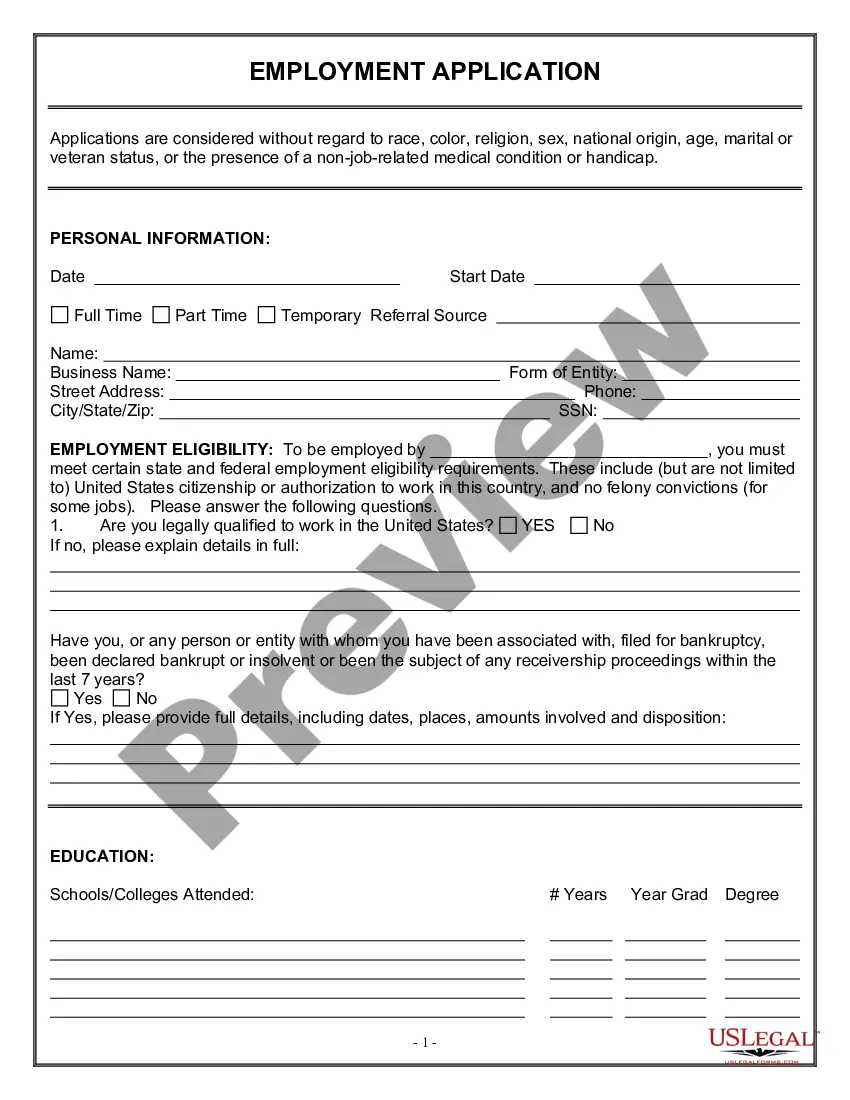

How to fill out Notice Of Public Sale Of Collateral (Consumer Goods) On Default?

Have you ever found yourself in a situation where you require documents for both business or personal purposes nearly every single day.

There is a multitude of legal document templates accessible online, but discovering reliable ones isn’t straightforward.

US Legal Forms provides thousands of form templates, such as the South Carolina Notice of Public Sale of Collateral (Consumer Goods) on Default, which can be generated to comply with state and federal regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Notice of Public Sale of Collateral (Consumer Goods) on Default template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct locality.

- Utilize the Review option to examine the form.

- Check the details to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

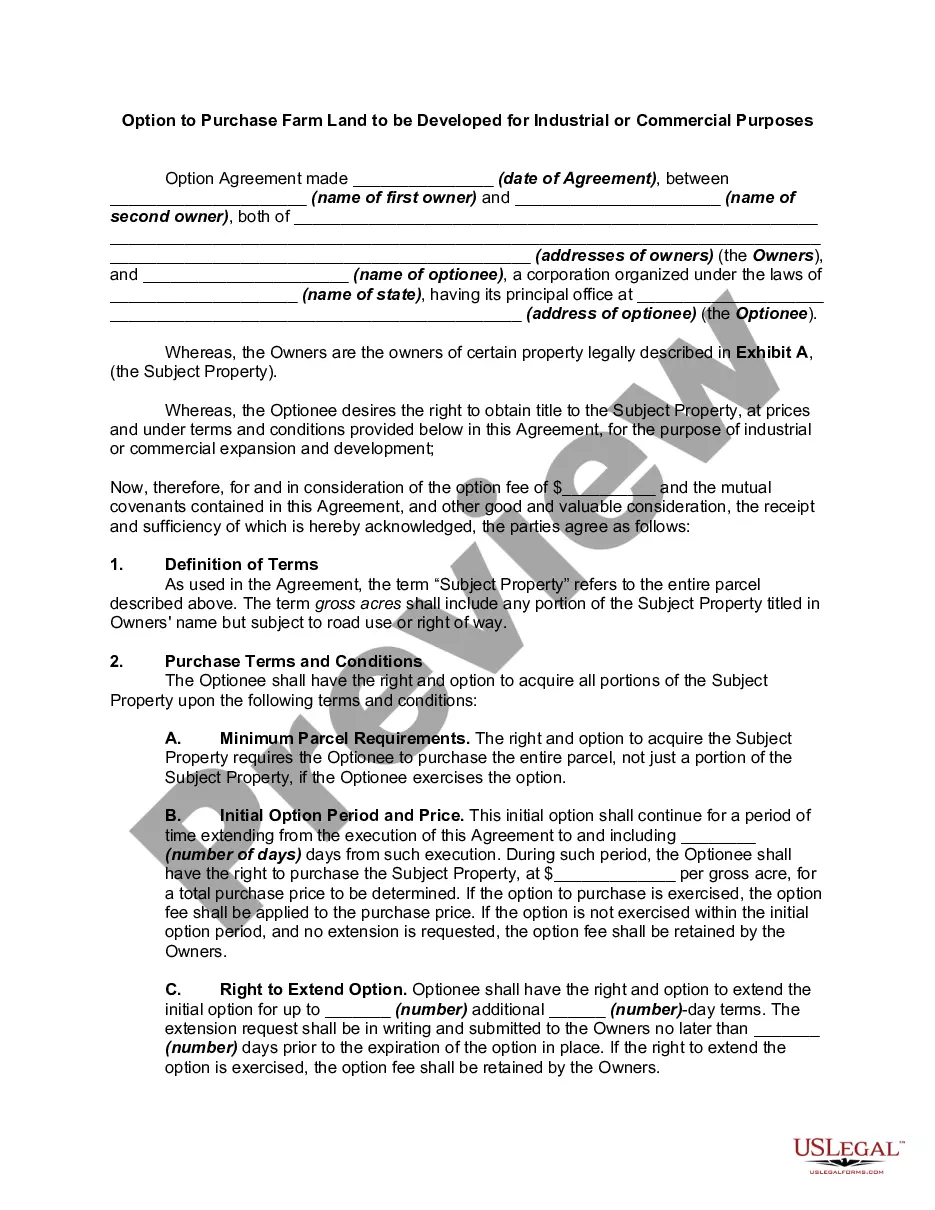

Article 9 of the Uniform Commercial Code (UCC) addresses the debtor's rights to redeem collateral after repossession. This section outlines the conditions under which a debtor can reclaim their property, typically by paying off the outstanding debt. Knowing your rights under the UCC can empower you during challenging financial times. For more information on these legal rights, consider using resources from US Legal Forms.

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

A PMSI is created in goods when a seller retains a security interest in the goods sold on credit by a security agreement. A debtor need not sign the financing statement. Attachment must occur in order to make a security interest enforceable against the debtor and against third parties.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

A sale is commercially reasonable if it is a disposition in any recognizable market, is otherwise in conformity with reasonable commercial practices among dealers in the type of property that was the subject of the disposition, or is approved in a judicial proceeding, by a bona fide creditor's committee, by a

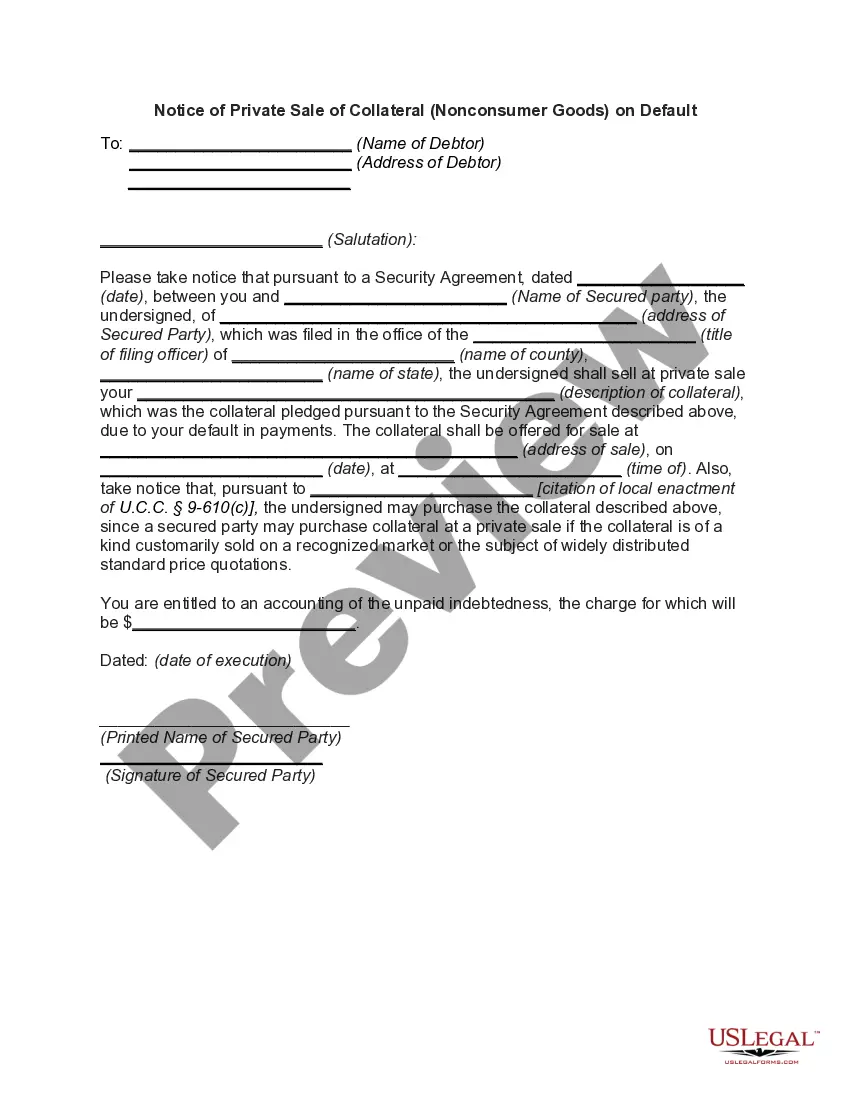

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

If two or more creditors are properly perfected, then the priorities among such competing secured creditors is spelled out in the UCC, but the general rule is that the first to perfect has priority, whether the competing security interests and liens are consensual or nonconsensual.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Key Points for the Secured Party to Remember Upon Debtor's Default. The term default is not defined under Article 9; the debtor and Secured Party are left to define events of default within their contract. The collateral may be repossessed.

Cash proceeds consist of money, checks, deposit accounts, or the like. U.C.C. § 9-102 (a)(9). Article 9 further assists secured parties by continuing indefinitely perfection of security interests in identifiable cash proceeds if the security interest in the original collateral was properly perfected.