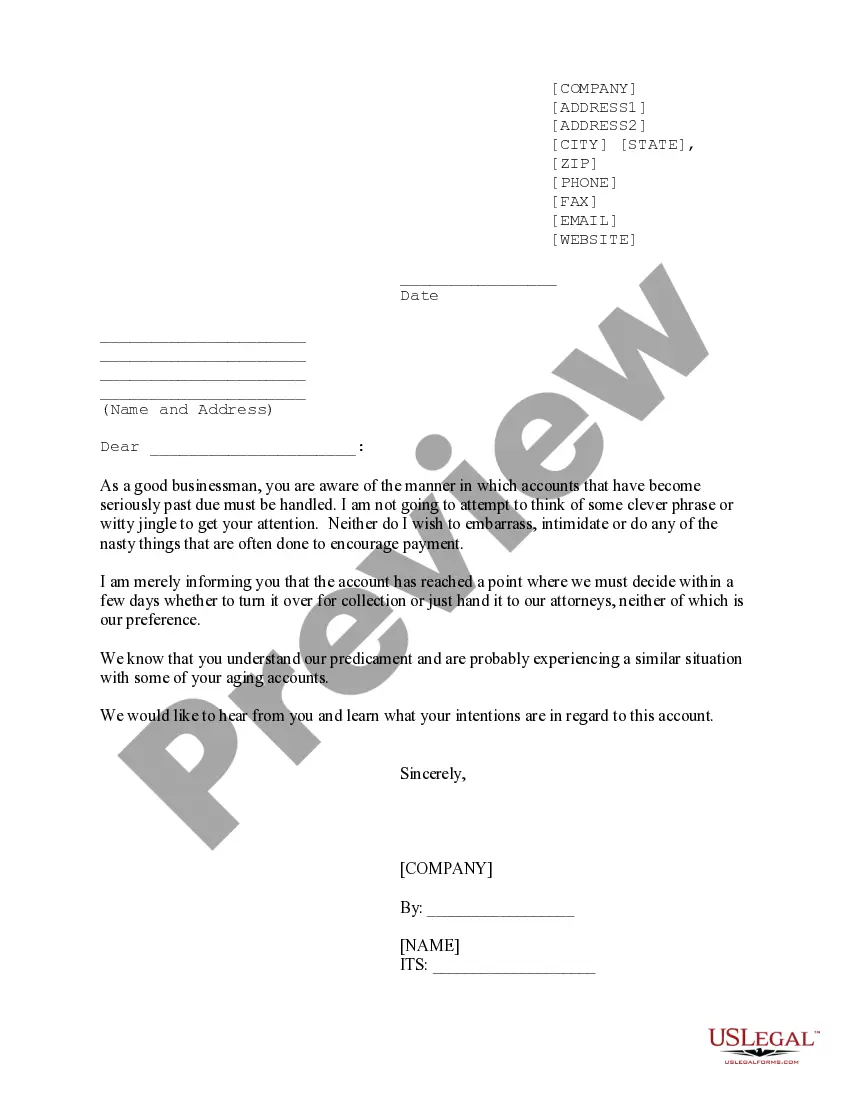

South Carolina Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - provides an extensive selection of legal form templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms like the South Carolina Sample of a Collection Letter to Small Business in Advance in mere seconds.

If you have a monthly subscription, Log In and download the South Carolina Sample of a Collection Letter to Small Business in Advance from the US Legal Forms library. The Download button will appear on every form you view. You gain access to all previously obtained forms in the My documents tab of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the acquired South Carolina Sample of a Collection Letter to Small Business in Advance. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Carolina Sample of a Collection Letter to Small Business in Advance with US Legal Forms, the most extensive library of legal document templates. Utilize countless professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form’s content.

- Check the form description to verify that you have chosen the suitable form.

- If the form does not meet your needs, use the Look for field at the top of the screen to find the one that does.

- If you are content with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and enter your credentials to create an account.

Form popularity

FAQ

To send someone to collections, you need concrete proof of the debt in question. This proof typically includes signed contracts, invoices, and any communication regarding payment reminders. It is essential to maintain clear records, as agencies will require these documents to verify the legitimacy of the debt. A South Carolina Sample of a Collection Letter to Small Business in Advance can guide you in the documentation needed to strengthen your case.

Sending a debt collection letter involves drafting a clear and concise message about the debt. Start by including your business information, the debtor’s details, and the amount owed. Ensure you specify the due date and outline consequences of non-payment. When you frame your communication using a South Carolina Sample of a Collection Letter to Small Business in Advance, you can ensure that your letter includes all critical elements that encourage a prompt response.

To send a bill to a collection agency, first compile all necessary documentation regarding the debt owed. Ensure you adhere to the guidelines of the collection agency by sending a formal request for them to act on your behalf. Include a copy of the original invoice and any related correspondence with the debtor. Utilizing a South Carolina Sample of a Collection Letter to Small Business in Advance can simplify this process and ensure you provide all needed information to the agency.

A collection letter typically follows a specific format to convey professionalism and clarity. Start with your company's letterhead, including your name, address, and contact information. Then, include the date, the recipient's information, and a clear subject line. Be direct in your message, outline the debt details, and ensure you express a call to action, encouraging the recipient to respond or make payment. For a South Carolina Sample of a Collection Letter to Small Business in Advance, following these formatting guidelines will help you communicate effectively.

The required language in a debt collection letter must be clear and professional, particularly when referencing a South Carolina Sample of a Collection Letter to Small Business in Advance. Use straightforward wording that specifies the debt amount, payment terms, and the consequences of non-payment. Moreover, ensure that the letter complies with the Fair Debt Collection Practices Act, which requires a summary of the debtor's rights. This clarity helps protect your interests while maintaining professionalism.

To send a bill for collection to a small business, first ensure that you follow the proper procedures outlined in a South Carolina Sample of a Collection Letter to Small Business in Advance. Start by clearly identifying the amount owed and the specific services or products provided. Include all relevant details such as invoice numbers and due dates. Finally, deliver the letter via certified mail to ensure receipt and maintain a record of communication.

collection letter is a communication sent to remind debtors about their obligations before further collection actions are taken. It often aims to maintain goodwill while encouraging prompt payment. You can refer to a South Carolina Sample of a Collection Letter to Small Business in Advance to craft a gentle yet effective precollection letter that resonates with your recipients.

When drafting an effective collection letter, always maintain a professional tone while clearly outlining the debt details. Be concise, include a call to action, and specify the next steps for the recipient. Following a South Carolina Sample of a Collection Letter to Small Business in Advance can guide you in adhering to these essential guidelines effectively.

An effective collection letter should start with a clear statement of the purpose, followed by essential details about the debt. Ensure you include any prior communication and a deadline for payment. Using a South Carolina Sample of a Collection Letter to Small Business in Advance can help you create a well-organized letter that facilitates understanding and encourages prompt payment.

A nice collection letter typically maintains a polite tone and respects the relationship with the recipient. It could start by acknowledging the previous business dealings and gently remind the recipient of the outstanding balance within the context of a South Carolina Sample of a Collection Letter to Small Business in Advance. The aim is to never come across as aggressive but rather supportive.