South Carolina Worksheet - Trend Analysis

Description

How to fill out Worksheet - Trend Analysis?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a diverse array of legal document formats that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms like the South Carolina Worksheet - Trend Analysis in just moments. If you possess a subscription, Log In to download the South Carolina Worksheet - Trend Analysis from your US Legal Forms library.

The Download option will appear on each form you view. You can also access all previously acquired forms from the My documents tab in your account.

- To use US Legal Forms for the first time, follow these simple steps.

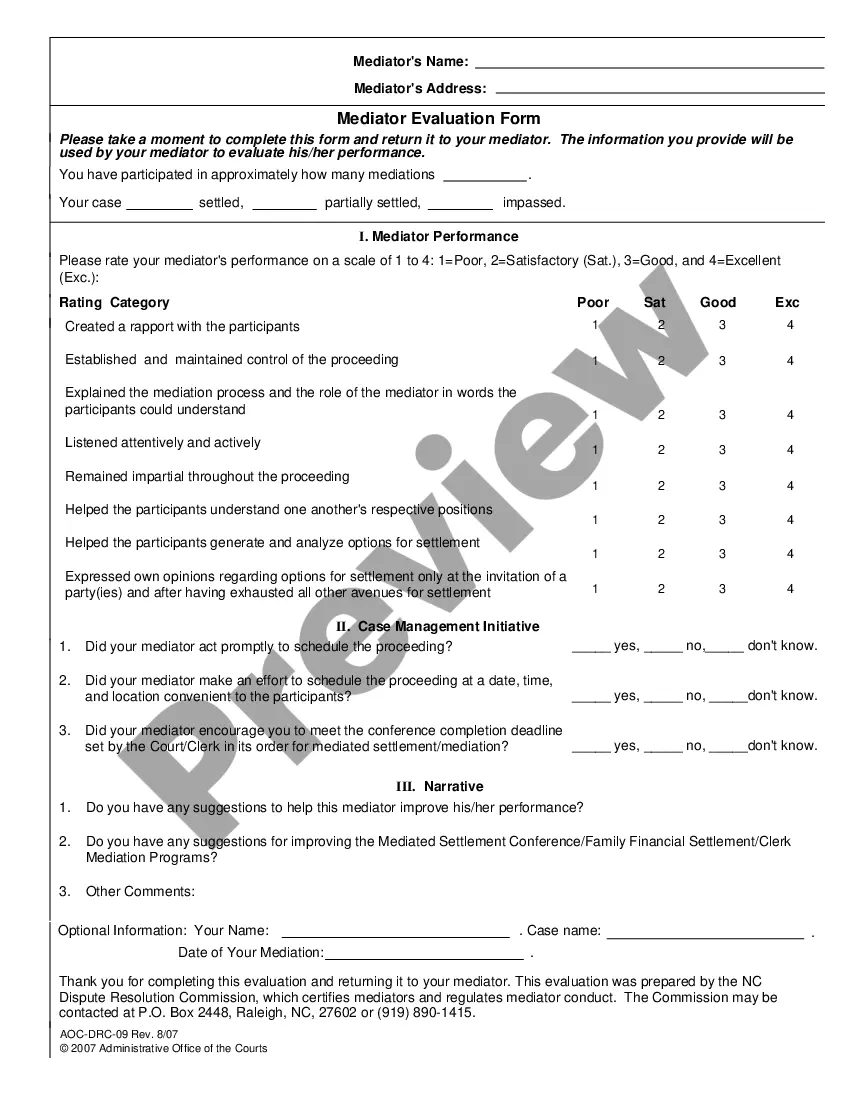

- Ensure you have selected the correct form for your jurisdiction. Click the Preview button to examine the form’s details.

- Review the form information to confirm that you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

If you are exempt, complete only line 1 through line 4 and line 7. Check the box for the reason you are claiming an exemption and write Exempt on line 7. Your exemption for 2022 expires February 15, 2023.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent? If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

MyDORWAY: Pay your withholding tax bill online. Electronic Funds Transfer (EFT): Visit GovOne to make SCDOR tax payments online OR call 1-800-834-7733 to make tax payments with operator assistance or over the Interactive Voice Response system.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

How do I fill out a W-4?Step 1: Enter your personal information. In this section you'll enter your name, address, filing status and Social Security number.Step 2: Complete if you have multiple jobs or two earners in your household.Step 3: Claim Dependents.Step 4: Other Adjustments.Step 5: Sign your form.

(1) Active trade or business income or loss means income or loss of an individual, estate, trust, or any other entity except those taxed or exempted from tax pursuant to Sections 12-6-530 through 12-6-550 resulting from the ownership of an interest in a pass-through business.

The income tax withholding for the State of South Carolina includes the following changes: The maximum standard deduction in the case of any exemptions has changed from $3,820 to $4,200. The exemption allowance has changed from $2,590 to $2,670.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.