South Carolina Minutes of Preliminary Meeting of Organizers and Approval of Proposed Articles or Certificate of Incorporation

Description

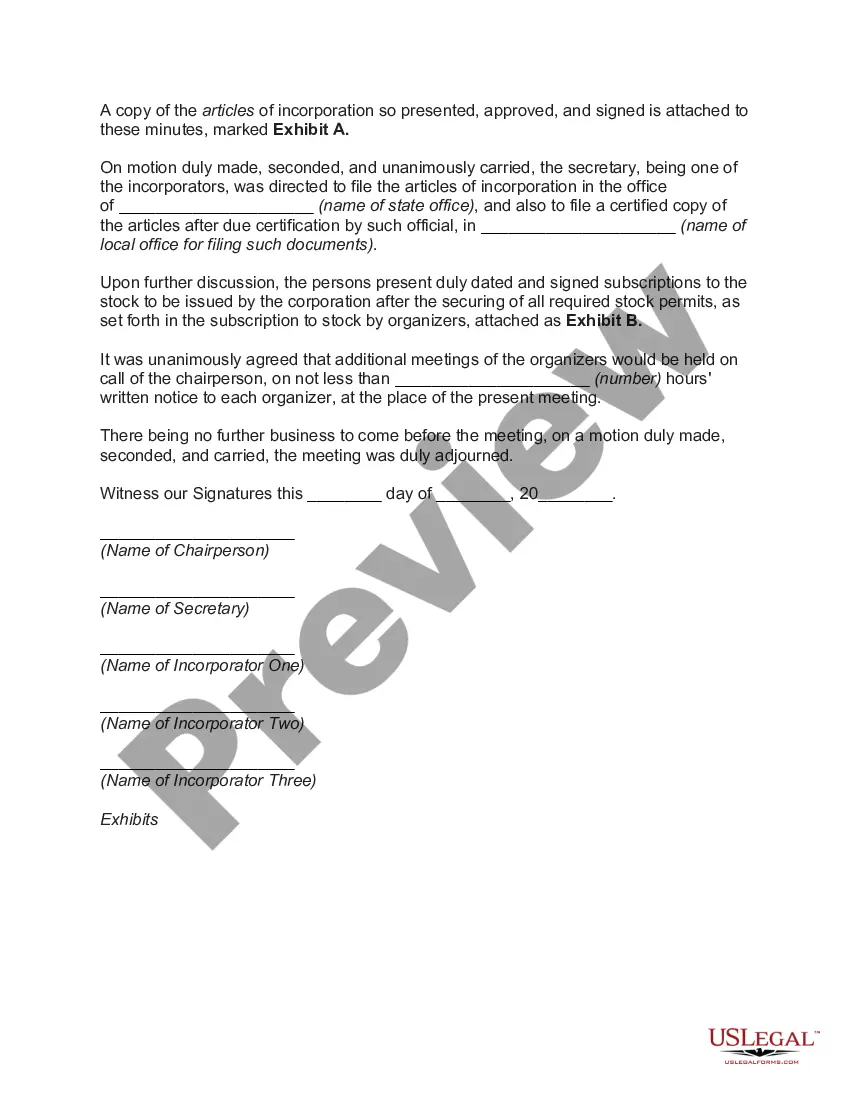

How to fill out Minutes Of Preliminary Meeting Of Organizers And Approval Of Proposed Articles Or Certificate Of Incorporation?

If you wish to total, acquire, or produce legal record templates, use US Legal Forms, the largest collection of legal varieties, which can be found on the Internet. Utilize the site`s simple and easy handy research to discover the files you require. Various templates for company and person reasons are sorted by categories and states, or search phrases. Use US Legal Forms to discover the South Carolina Minutes of Preliminary Meeting of Organizers and Approval of Proposed Articles or Certificate of Incorporation in just a couple of mouse clicks.

Should you be presently a US Legal Forms consumer, log in to your bank account and click on the Down load button to obtain the South Carolina Minutes of Preliminary Meeting of Organizers and Approval of Proposed Articles or Certificate of Incorporation. You can even gain access to varieties you earlier downloaded from the My Forms tab of your bank account.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have selected the form for your proper metropolis/region.

- Step 2. Make use of the Review solution to check out the form`s content. Don`t forget about to see the explanation.

- Step 3. Should you be not happy with the type, use the Search field at the top of the display to discover other types in the legal type web template.

- Step 4. When you have discovered the form you require, go through the Buy now button. Opt for the pricing strategy you prefer and add your references to sign up for the bank account.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the deal.

- Step 6. Select the structure in the legal type and acquire it on the system.

- Step 7. Total, edit and produce or sign the South Carolina Minutes of Preliminary Meeting of Organizers and Approval of Proposed Articles or Certificate of Incorporation.

Each and every legal record web template you purchase is the one you have forever. You might have acces to every type you downloaded within your acccount. Select the My Forms portion and select a type to produce or acquire once again.

Remain competitive and acquire, and produce the South Carolina Minutes of Preliminary Meeting of Organizers and Approval of Proposed Articles or Certificate of Incorporation with US Legal Forms. There are millions of professional and express-specific varieties you may use for your personal company or person needs.

Form popularity

FAQ

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

So for most people who own an LLC in South Carolina, there are no state-required annual South Carolina LLC fees. If you hired a Registered Agent service, you'll have an annual subscription fee to pay each year. This is usually about $125 per year. Some LLCs may need a business license in South Carolina.

Businesses that are incorporated in another state will typically apply for a South Carolina certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

South Carolina Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

The minutes must include the name of the attendees at the meeting, the time and day of the meeting, as well as the focus and decisions made at the meeting. The minutes must record what happened at the meeting, even if nothing of importance occurred.

LLC taxes and fees The following are taxation requirements and ongoing fees for South Carolina LLCs: Annual report. South Carolina does not require LLCs to file an annual report.