South Carolina Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

In the event that you need to fully, obtain, or print legal document templates, utilize US Legal Forms, the primary collection of legal forms accessible online.

Make use of the site's simple and user-friendly search feature to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and claims, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have found the required form, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Utilize US Legal Forms to locate the South Carolina Reorganization of Partnership by Modification of Partnership Agreement with just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click on the Download button to retrieve the South Carolina Reorganization of Partnership by Modification of Partnership Agreement.

- Additionally, you can access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

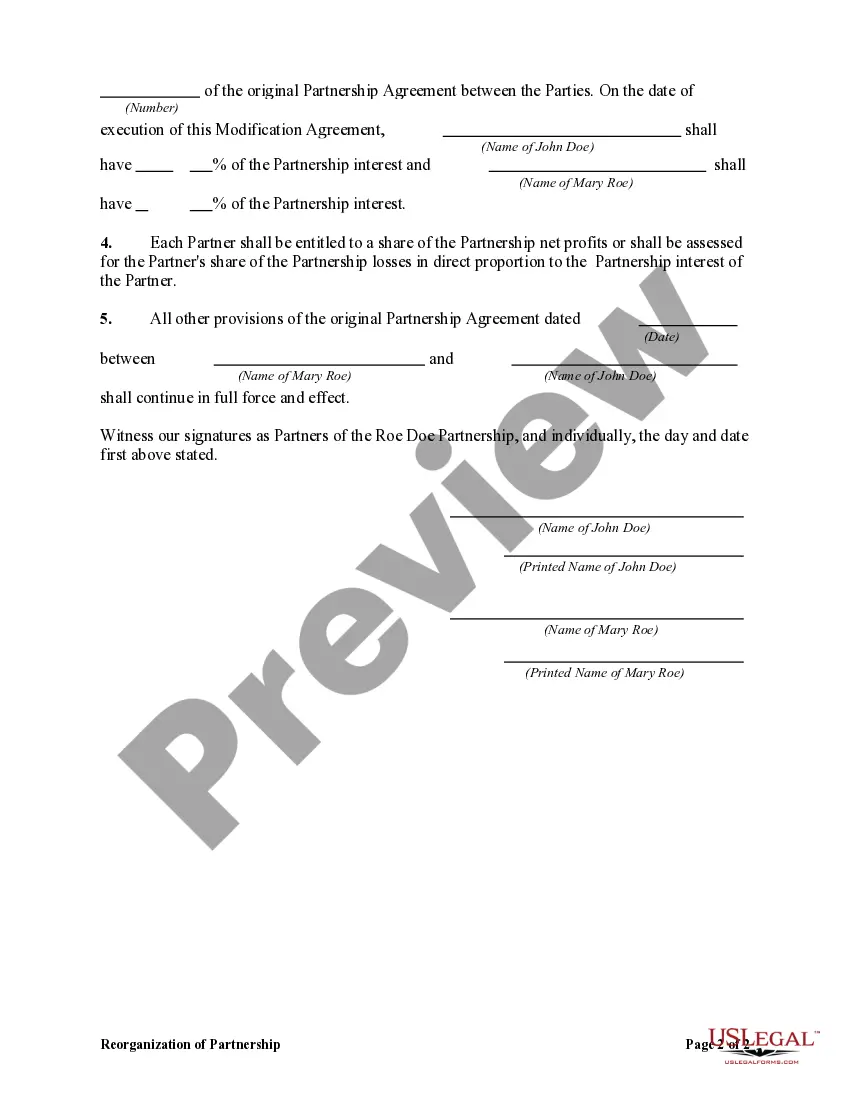

- Step 2. Utilize the Preview feature to review the document's content. Be sure to check the description.

Form popularity

FAQ

To change the terms of a partnership agreement, all partners must agree to the modification and document the changes formally. This includes specifying which terms are altered, and the effective date of the new agreement. Engaging in the South Carolina Reorganization of Partnership by Modification of Partnership Agreement ensures that these changes are legally recognized and operational.

Changing ownership of an LLC in South Carolina involves amending the operating agreement and potentially filing new documents with the state. It is crucial to follow the procedures outlined in the agreement, which may include obtaining approval from existing members. This process can support a smooth transition, aligning with the South Carolina Reorganization of Partnership by Modification of Partnership Agreement.

To dissolve a partnership in South Carolina, you must follow specific legal procedures, including settling debts and distributing assets. Additionally, partners should formally agree to the dissolution and document it appropriately. This ensures that all legal aspects of the South Carolina Reorganization of Partnership by Modification of Partnership Agreement are adhered to, preventing potential disputes.

Yes, a partnership agreement can be modified or changed through a formal process known as the South Carolina Reorganization of Partnership by Modification of Partnership Agreement. This process allows partners to update terms according to their evolving business needs. It is essential to document all changes in writing to ensure clarity and legal compliance.

Yes, South Carolina allows a Pass-Through Entity (PTE) election. This option enables pass-through entities to choose how they are taxed, potentially offering tax benefits under certain circumstances. If your partnership is undergoing a South Carolina Reorganization of Partnership by Modification of Partnership Agreement, exploring the PTE election can be a strategic decision for your tax approach.

Yes, you can amend a partnership agreement as long as all partners agree to the changes. Amending the agreement is often necessary to reflect changes in the partnership's business structure or goals. It's pivotal to document these changes properly during a South Carolina Reorganization of Partnership by Modification of Partnership Agreement to ensure that all partners are on the same page.

In South Carolina, partnerships must file for an extension if they cannot meet the regular filing deadlines. Failing to file can lead to penalties, so it's wise to stay informed about your obligations. When you conduct a South Carolina Reorganization of Partnership by Modification of Partnership Agreement, keeping track of deadlines and possible extensions can help maintain compliance.

Yes, South Carolina offers teacher reciprocity with several states. This means that teachers certified in certain states may be able to obtain licensure in South Carolina without starting from scratch. If your partnership involves educational services, understanding these regulations can be important during a South Carolina Reorganization of Partnership by Modification of Partnership Agreement.

As of now, several states have adopted a Pass-Through Entity Tax (PTET). South Carolina is among these states, which helps ensure that pass-through entities can manage their tax obligations effectively. When undergoing a South Carolina Reorganization of Partnership by Modification of Partnership Agreement, being aware of PTET in your state is essential for compliance and strategic planning.

South Carolina does tax IRA distributions at the state level. When you withdraw funds from your IRA, it is wise to account for the state tax impact. Knowing this can help you plan better during a South Carolina Reorganization of Partnership by Modification of Partnership Agreement, especially if partnerships involve retirement accounts.