South Carolina Checklist - Action to Improve Collection of Accounts

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

If you need to finalize, obtain, or print valid document templates, utilize US Legal Forms, the leading collection of legal forms, which are accessible online.

Take advantage of the site's easy and straightforward search to find the documents you need.

Many templates for commercial and personal purposes are categorized by type and state, or keywords.

Step 4. After locating the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to get the South Carolina Checklist - Action to Enhance Collection of Accounts with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to access the South Carolina Checklist - Action to Enhance Collection of Accounts.

- You can also retrieve forms you previously downloaded under the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidelines outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

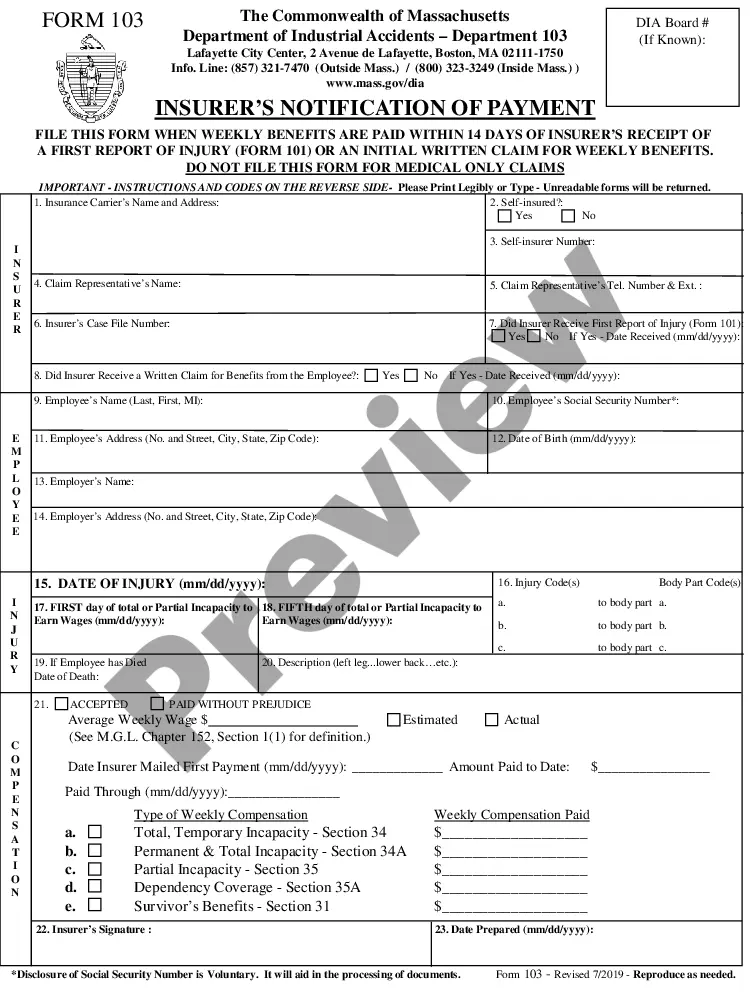

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

An estimated assessment notice is a statement sent by the South Carolina Department of Revenue indicating that they believe you owe a specific amount in taxes based on available information. This notice is crucial as it can lead to further collection actions if not addressed. Following the South Carolina Checklist - Action to Improve Collection of Accounts can help you understand your rights and options in responding to such notices.

An offer of compromise is a settlement agreement between you and the South Carolina Department of Revenue to resolve tax debts for less than the full amount owed. This option is available for individuals in financial difficulties, allowing you to clear your tax burden. Utilizing the South Carolina Checklist - Action to Improve Collection of Accounts can assist you in determining your eligibility for this option.

Receiving a letter from the South Carolina Department of Revenue typically indicates they have concerns regarding your tax filings or payments. This communication may require your immediate attention to avoid further action. Reviewing the South Carolina Checklist - Action to Improve Collection of Accounts can help clarify your obligations and guide you on how to respond effectively.

Yes, the South Carolina Department of Revenue can garnish wages to collect unpaid taxes. If you owe taxes and do not respond to their requests, they may secure a wage garnishment order. Understanding the South Carolina Checklist - Action to Improve Collection of Accounts can help you navigate your tax obligations and potentially avoid wage garnishment.

The 5 C's of accounts receivable management include Character, Capacity, Capital, Conditions, and Collateral. These elements help assess the creditworthiness of clients and manage risks effectively. Integrating the South Carolina Checklist - Action to Improve Collection of Accounts can provide a structured approach to applying these principles in your own collection efforts.

South Carolina has specific guidelines regarding garnishment, which often limits the amount that can be garnished from a debtor's wages. However, certain exceptions apply, and understanding these nuances is essential. Using the South Carolina Checklist - Action to Improve Collection of Accounts can help you navigate these laws effectively.

Yes, South Carolina is considered business-friendly due to its favorable tax regulations and proactive economic development initiatives. The state provides various incentives for businesses, making it an appealing place to operate. If you're a business owner, referring to the South Carolina Checklist - Action to Improve Collection of Accounts can further enhance your operational effectiveness.

Debt collector laws in South Carolina are designed to protect consumers from unfair practices. Collectors must adhere to the Fair Debt Collection Practices Act as well as local regulations. Familiarizing yourself with the South Carolina Checklist - Action to Improve Collection of Accounts will help you stay informed and safeguard your rights.

South Carolina provides certain protections for debtors, such as limits on garnishment and exemptions on various assets. However, the level of debtor-friendliness can vary depending on specific circumstances. To better understand your options, turn to the South Carolina Checklist - Action to Improve Collection of Accounts for guidance.

States such as California, Texas, and Florida are often considered debtor-friendly due to their protective laws. However, South Carolina also has features that can benefit debtors. Familiarizing yourself with the South Carolina Checklist - Action to Improve Collection of Accounts can help you navigate local laws and protect your financial interests more effectively.