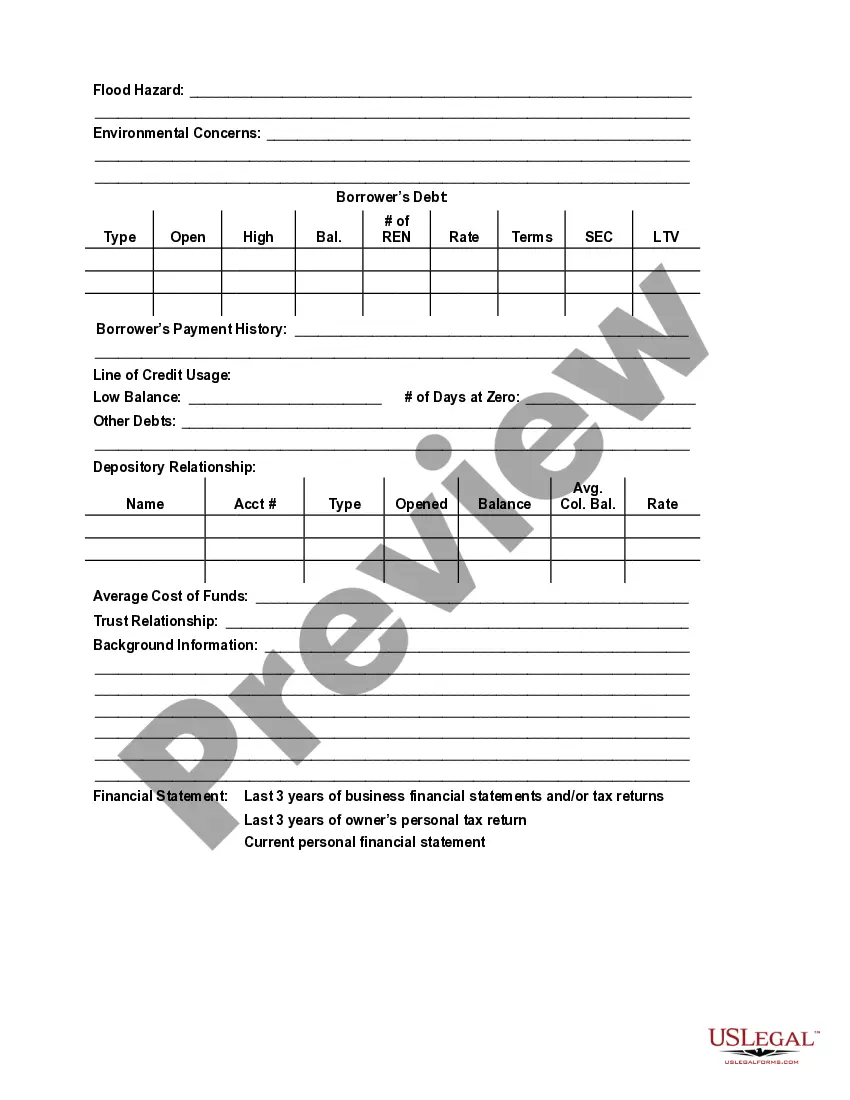

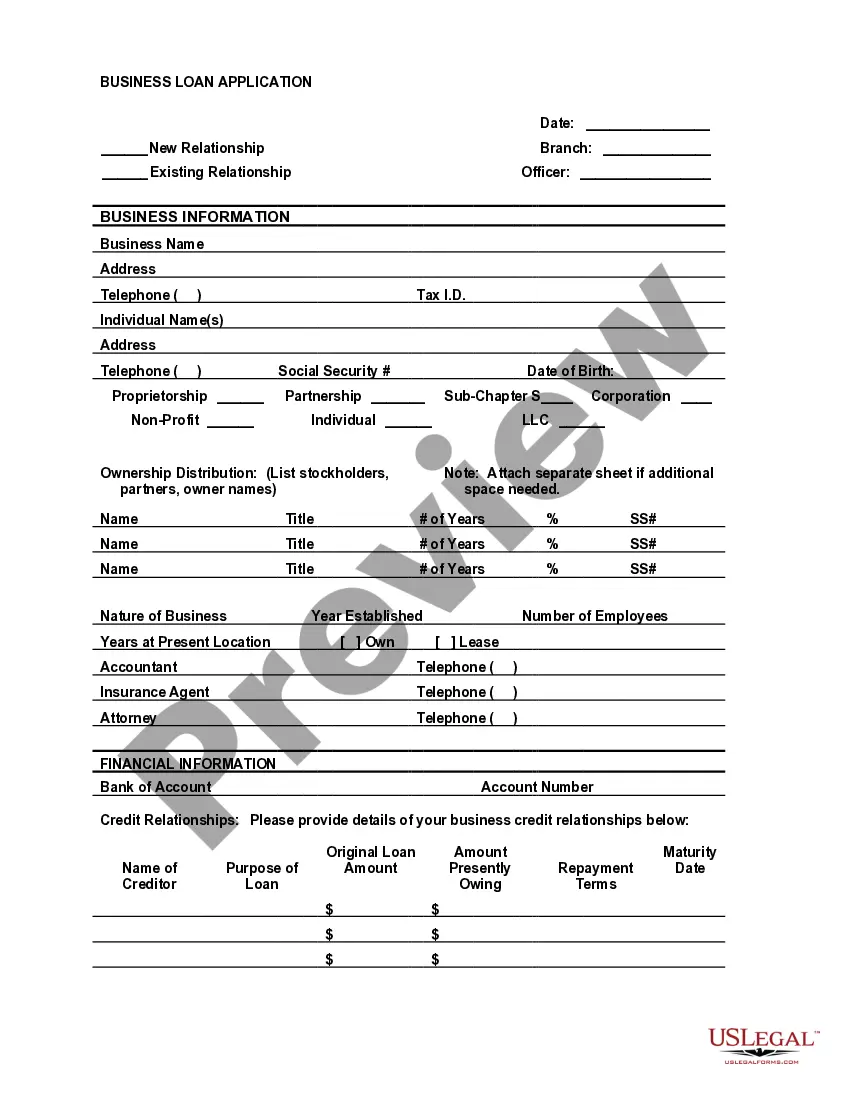

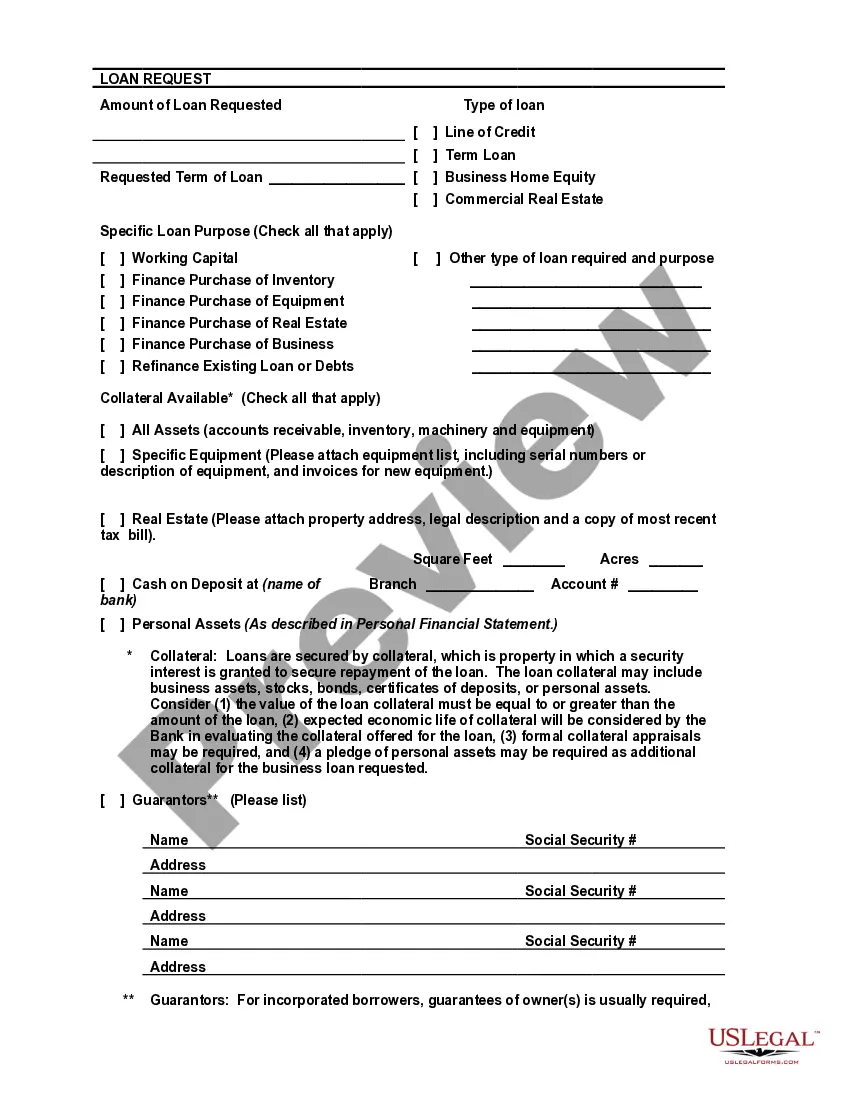

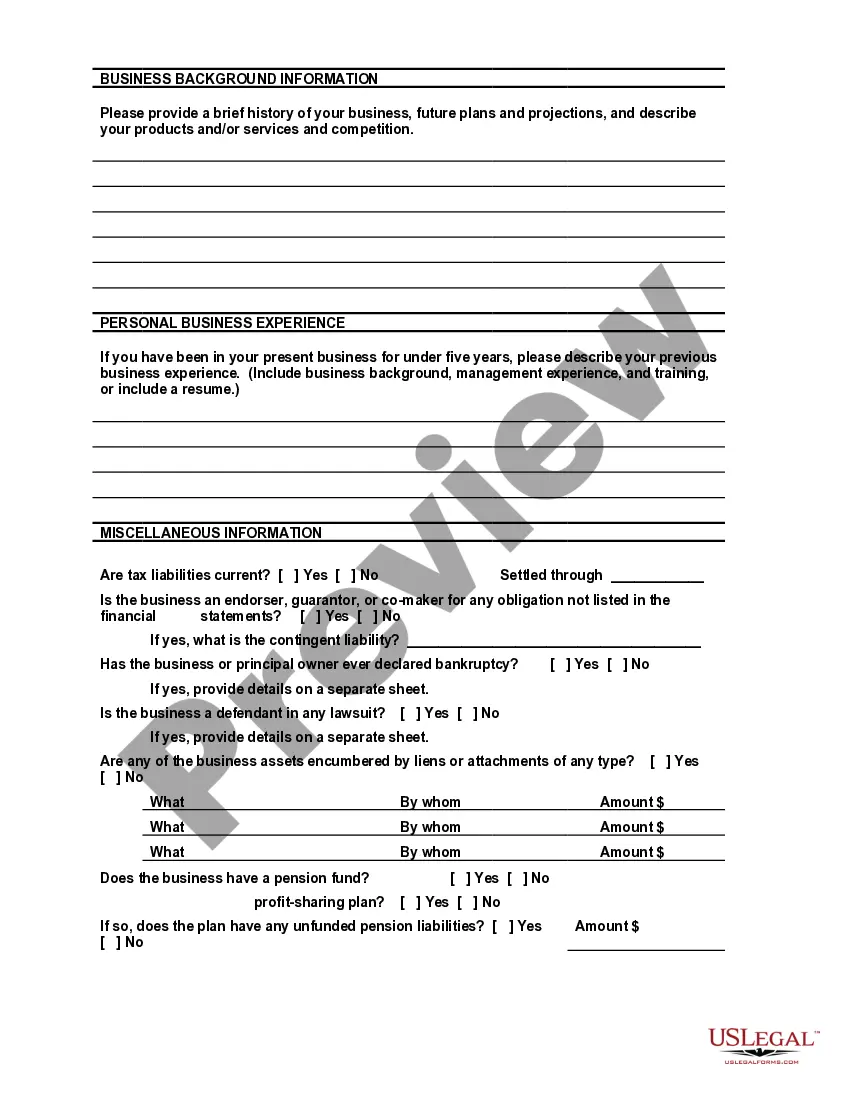

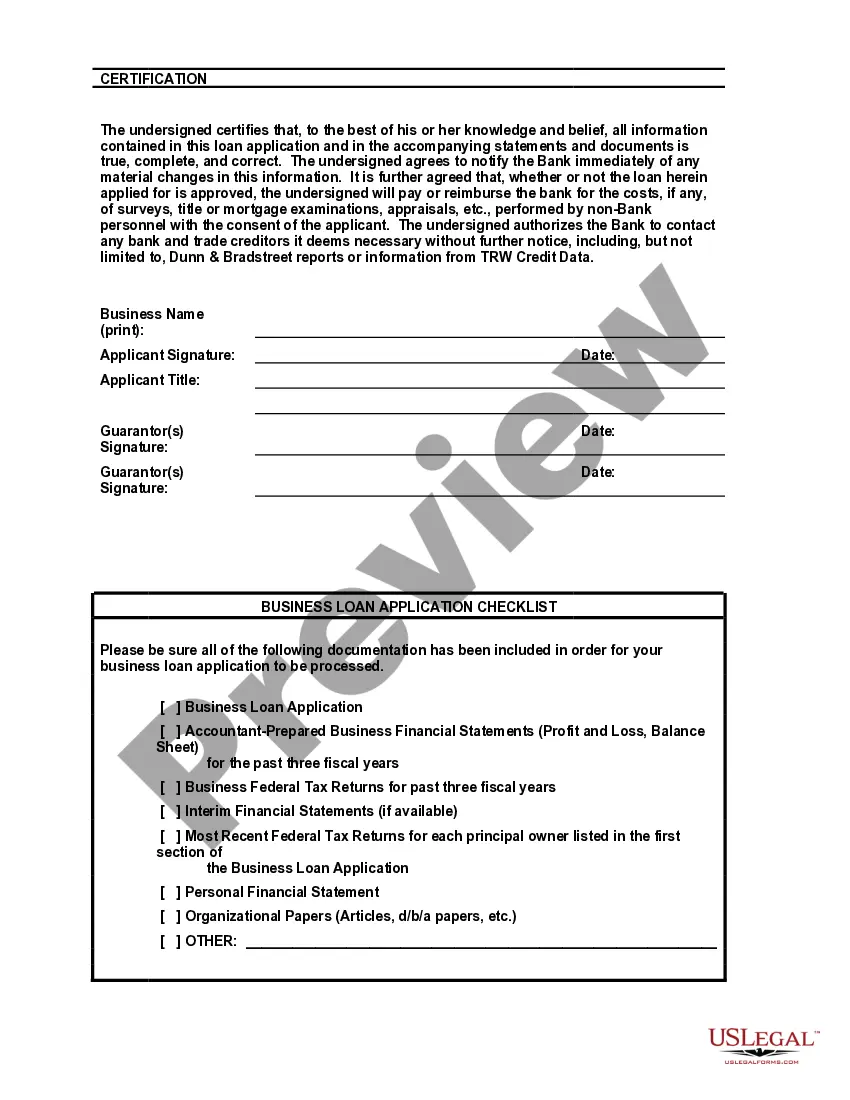

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

South Carolina Bank Loan Application Form and Checklist - Business Loan

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

Have you been within a position where you will need papers for sometimes business or individual uses nearly every day time? There are a lot of authorized papers themes available on the Internet, but discovering ones you can depend on is not straightforward. US Legal Forms provides a huge number of form themes, such as the South Carolina Bank Loan Application Form and Checklist - Business Loan, which are composed to meet state and federal demands.

In case you are already informed about US Legal Forms internet site and possess your account, simply log in. Next, it is possible to download the South Carolina Bank Loan Application Form and Checklist - Business Loan design.

Unless you have an accounts and want to begin to use US Legal Forms, adopt these measures:

- Obtain the form you want and ensure it is for the proper area/state.

- Make use of the Preview option to examine the form.

- Look at the outline to ensure that you have chosen the appropriate form.

- In case the form is not what you`re trying to find, utilize the Research discipline to obtain the form that suits you and demands.

- If you discover the proper form, simply click Acquire now.

- Select the pricing strategy you want, fill in the desired info to make your bank account, and pay money for an order with your PayPal or Visa or Mastercard.

- Pick a handy data file formatting and download your version.

Get all of the papers themes you possess bought in the My Forms menus. You can get a more version of South Carolina Bank Loan Application Form and Checklist - Business Loan whenever, if possible. Just click the required form to download or produce the papers design.

Use US Legal Forms, the most considerable assortment of authorized kinds, in order to save some time and avoid faults. The service provides appropriately produced authorized papers themes which you can use for a range of uses. Make your account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

Lenders generally look at your time in business, credit scores (both business and personal), cash flow, collateral, and the industry the business is in. You may also have a better chance of approval if you have a previous relationship with the lender. 7 Key Things to Consider When Getting a Business Loan businessinsider.com ? personal-finance ? ho... businessinsider.com ? personal-finance ? ho...

Financial documents Up to one year of business bank account statements. Personal and business tax returns from the most recent three years. Most recent and projected balance sheets. Income statement and cash flow statement.

Purpose of the Loan First, give the bank a business plan. Show them that your business is solid and you have a strong track record of performance. Convince the bank that you don't really need their money, but if you had it, here's what you could do with it. Banks get queasy about lending to desperate borrowers. Things for a Bank to Consider Before Lending Money to a Business chron.com ? things-bank-consider-b... chron.com ? things-bank-consider-b...

Taking out a small-business loan from a bank can be difficult if you've been in business less than two years or don't have consistent revenue. Add bad personal credit or no collateral to that, and many small-business owners come up empty-handed. How to Apply for and Get a Business Loan in 6 Steps - NerdWallet nerdwallet.com ? article ? how-to-apply-sma... nerdwallet.com ? article ? how-to-apply-sma...

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

How to apply for a business loan in 7 steps Prepare documentation. ... Review your credit score. ... Gather financial documents. ... Create a business plan. ... Consider your collateral. ... Consider which loan to apply for. ... Assemble and submit your application.

Here's everything you need to know about how to get a business loan from a bank. Check your business and personal credit scores. ... Calculate how much money you need ? and how much you can afford to repay. ... Choose a loan type. ... For secured loans, choose your collateral. ... Compare lenders. ... Prepare any documentation you need.

One of the first items lenders try to determine when assessing business credit is the owner's capacity to repay the loan. They'll consider household income, business revenue, cash flow, outstanding debt, unused credit lines, and the amount of money the owner has personally invested into the business. What Lenders Look at When You Apply for a Business Loan capitalone.com ? commercial ? insights ? w... capitalone.com ? commercial ? insights ? w...