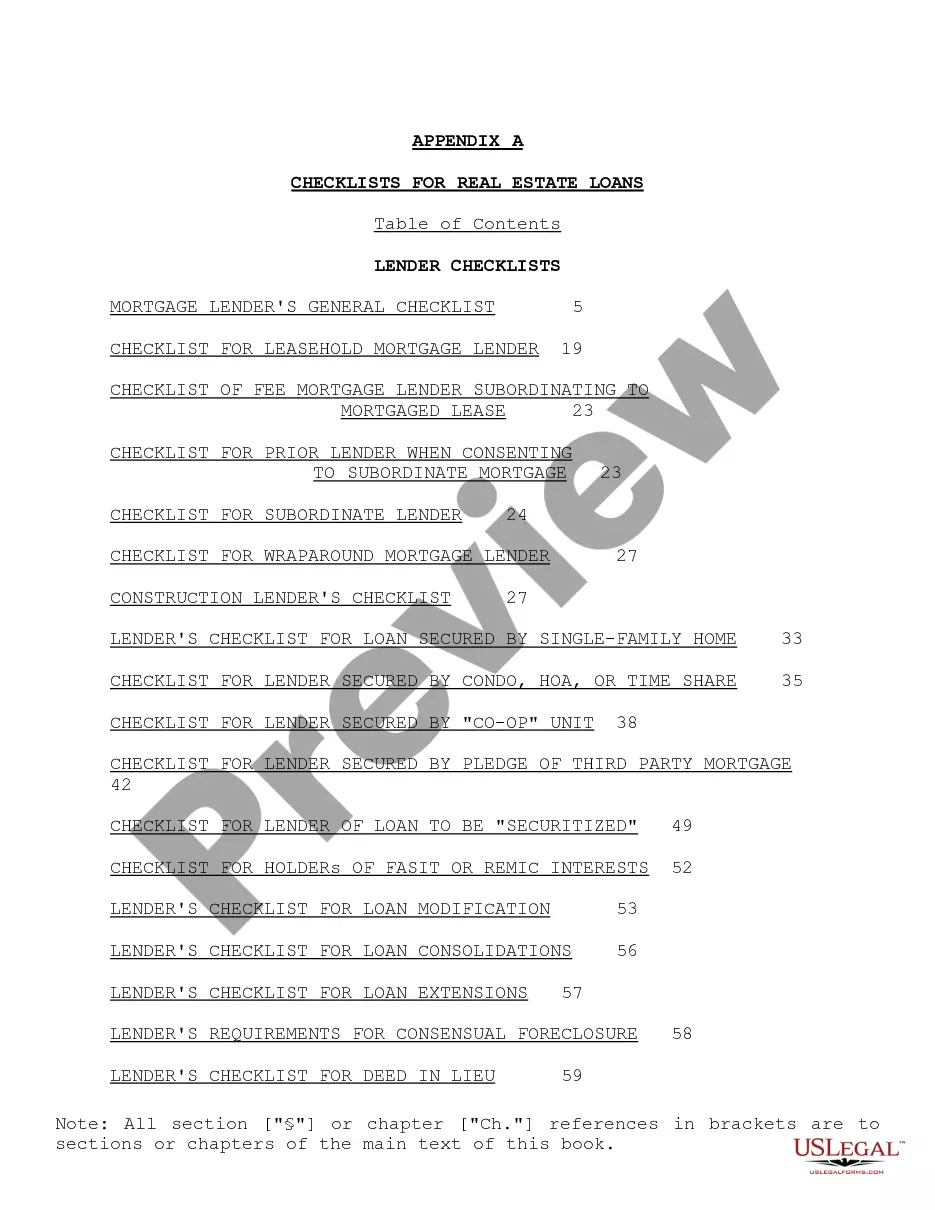

South Carolina Checklist for Business Loans Secured by Real Estate

Description

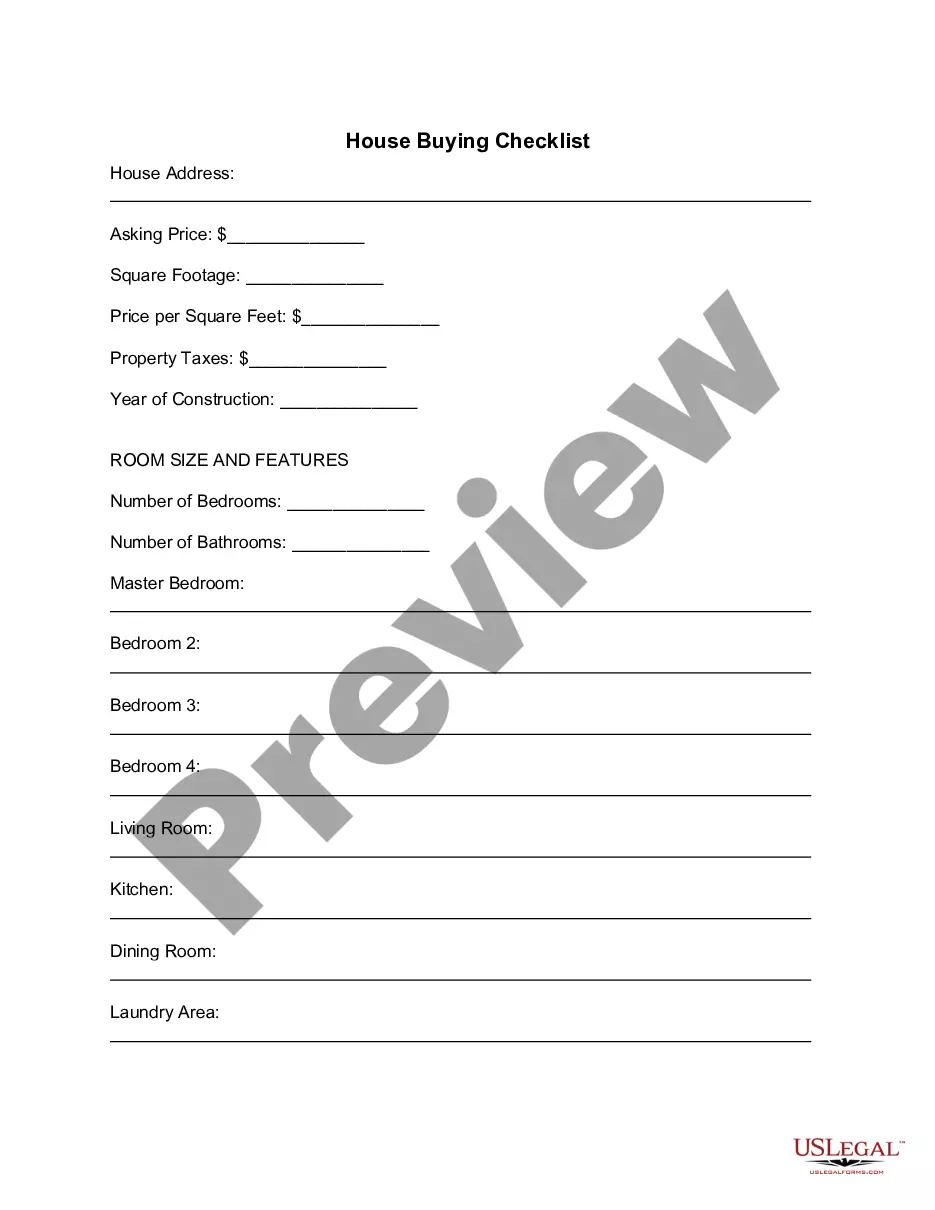

How to fill out Checklist For Business Loans Secured By Real Estate?

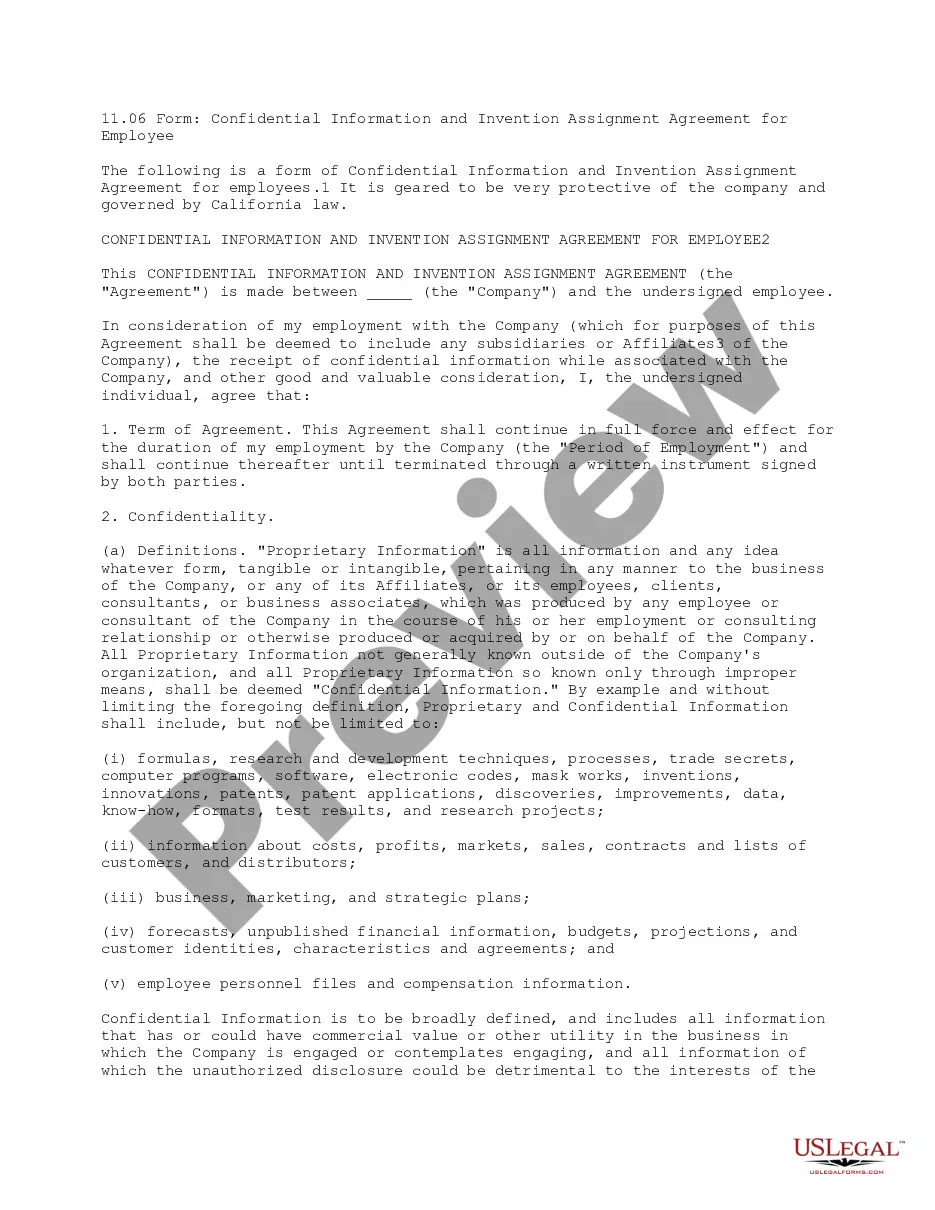

US Legal Forms - one of many biggest libraries of lawful varieties in the USA - offers a variety of lawful papers themes it is possible to download or produce. Utilizing the site, you may get a huge number of varieties for company and personal functions, sorted by types, suggests, or key phrases.You can get the latest types of varieties like the South Carolina Checklist for Business Loans Secured by Real Estate in seconds.

If you have a membership, log in and download South Carolina Checklist for Business Loans Secured by Real Estate through the US Legal Forms local library. The Download option will appear on every form you perspective. You have access to all formerly acquired varieties within the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, listed here are straightforward recommendations to obtain began:

- Make sure you have picked the right form for the metropolis/region. Click the Review option to examine the form`s content. Browse the form explanation to ensure that you have chosen the correct form.

- When the form doesn`t fit your needs, utilize the Lookup industry towards the top of the display screen to find the one which does.

- If you are pleased with the form, validate your choice by visiting the Purchase now option. Then, choose the costs program you favor and offer your qualifications to sign up for an account.

- Procedure the deal. Utilize your Visa or Mastercard or PayPal account to perform the deal.

- Choose the file format and download the form on your product.

- Make alterations. Fill out, edit and produce and signal the acquired South Carolina Checklist for Business Loans Secured by Real Estate.

Each and every format you put into your bank account does not have an expiration date and is also your own for a long time. So, in order to download or produce another duplicate, just visit the My Forms section and click about the form you need.

Get access to the South Carolina Checklist for Business Loans Secured by Real Estate with US Legal Forms, by far the most considerable local library of lawful papers themes. Use a huge number of specialist and condition-distinct themes that meet up with your organization or personal demands and needs.

Form popularity

FAQ

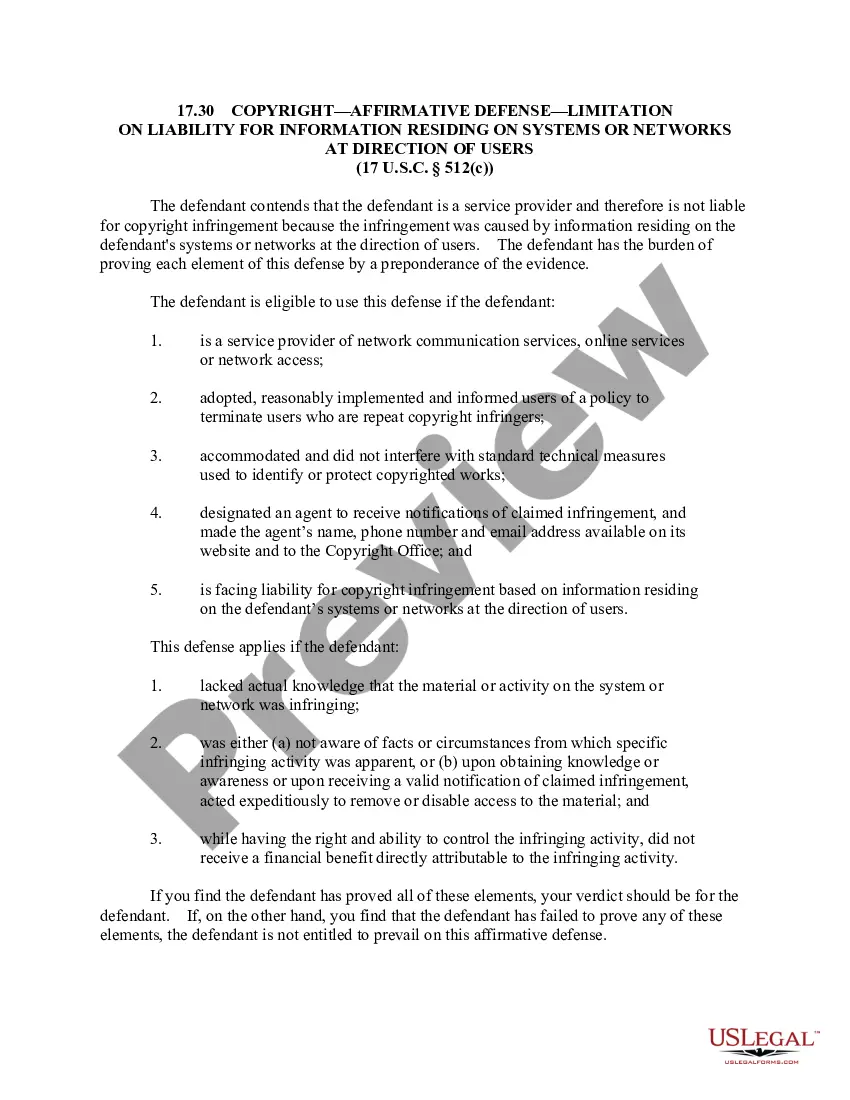

Real estate and home equity are the most commonly offered collateral for small businesses because a house is typically the most valuable asset an individual possesses. However, most banks will only take a small fraction of equity accrued on a house as collateral because they follow stringent debt-to-income ratios.

The types of collateral that lenders commonly accept include cars?only if they are paid off in full?bank savings deposits, and investment accounts. Retirement accounts are not usually accepted as collateral. You also may use future paychecks as collateral for very short-term loans, and not just from payday lenders.

Collateral can be a physical asset, such as a home, business real estate or equipment; or a non-physical asset, like accounts receivable or cash in the bank. Collateral requirements vary from lender to lender and depend on the type of loan you want and how much you'd like to borrow.

In general, banks prefer to have collateral that is easily converted into cash, such as deposits, cars, equipment, or real estate. Their advance rates against these assets will be higher than against inventory or receivables, which are much harder to convert into cash.

What can I use as collateral for a business loan? Cash is the most liquid form of collateral, while securities like treasury bonds, stocks, certificates of deposit (CDs) and corporate bonds can also be used. Tangible assets, such as real estate, equipment, inventory and vehicles, are another popular form of collateral.

A secured business loan requires a specific piece of collateral, such as a business vehicle or commercial property, which the lender can claim if you fail to repay your loan.

Using property as collateral on a business loan Lenders prefer assets of a high value that can be resold relatively quickly in the event of default. This allows them to recoup their money with few issues and as property is one of the highest value assets available, it's commonly used to secure a business loan.