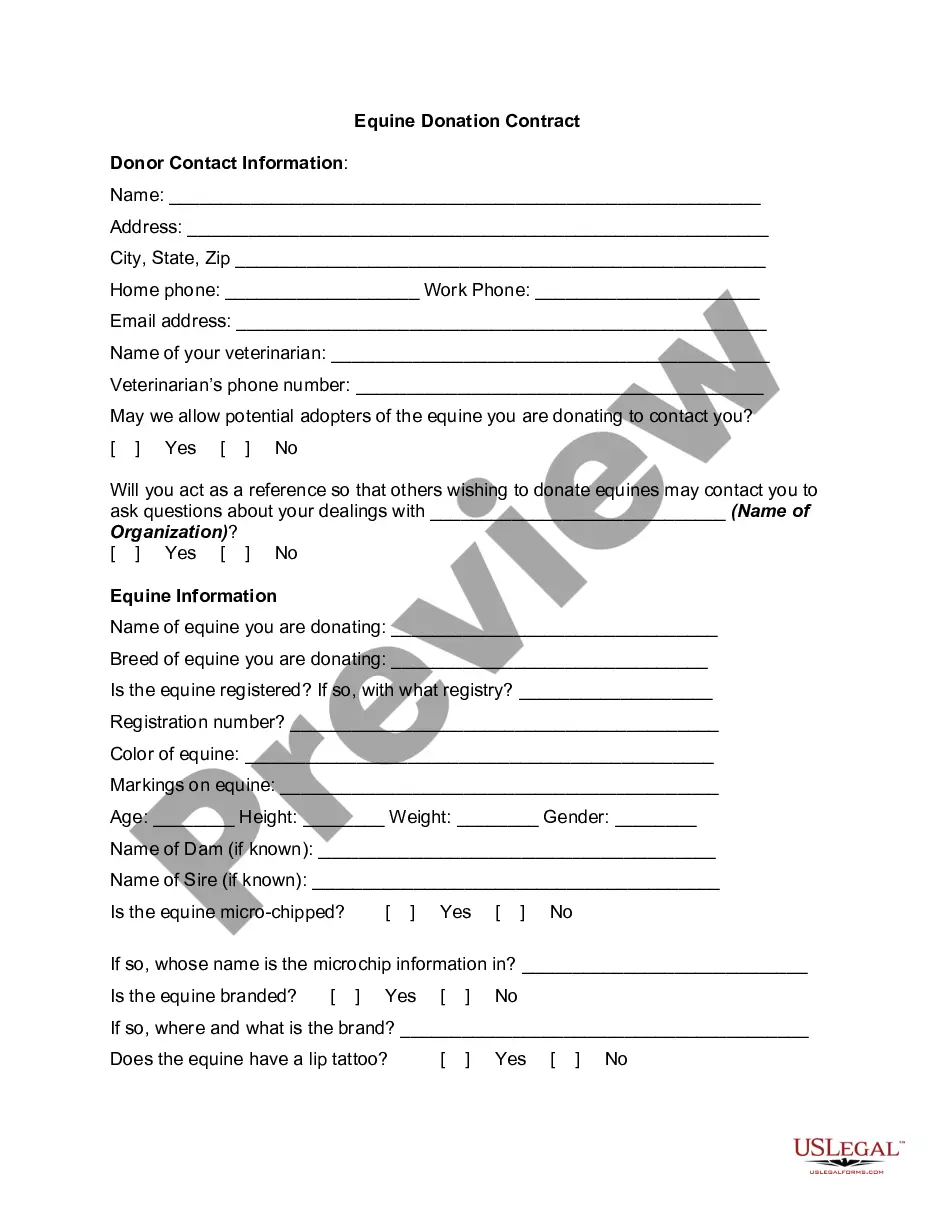

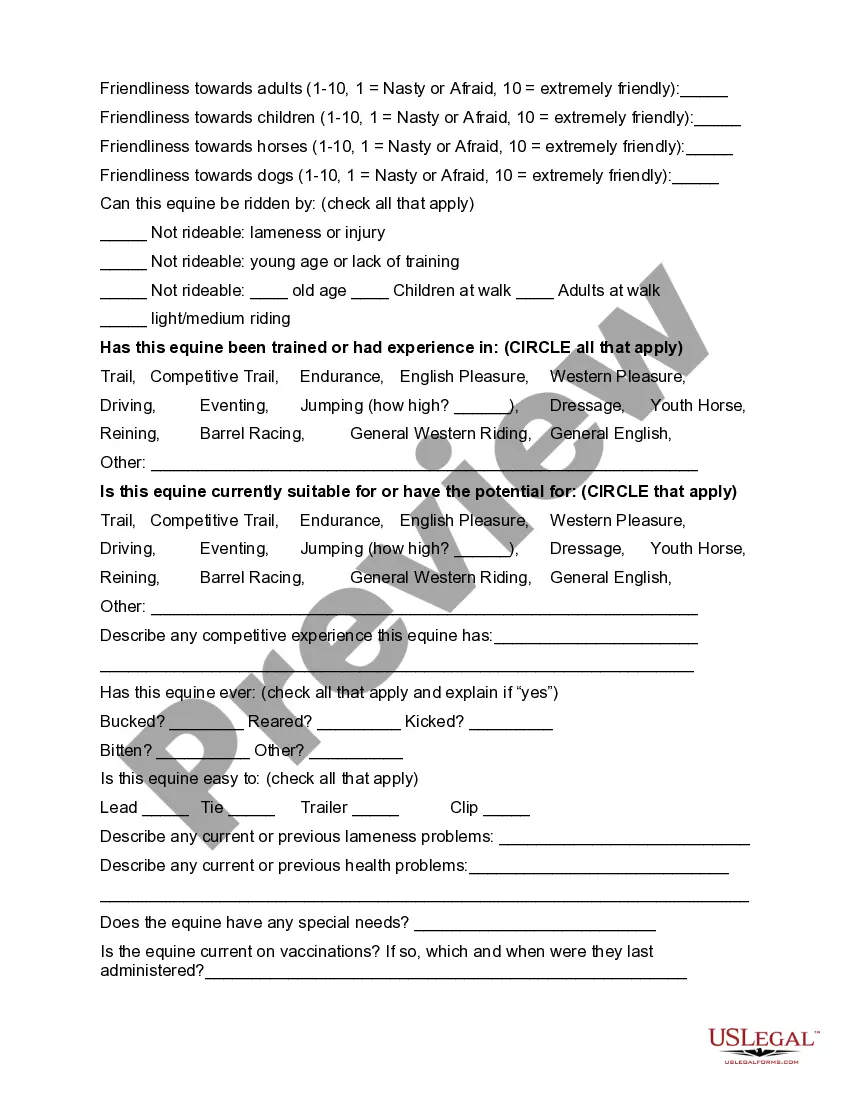

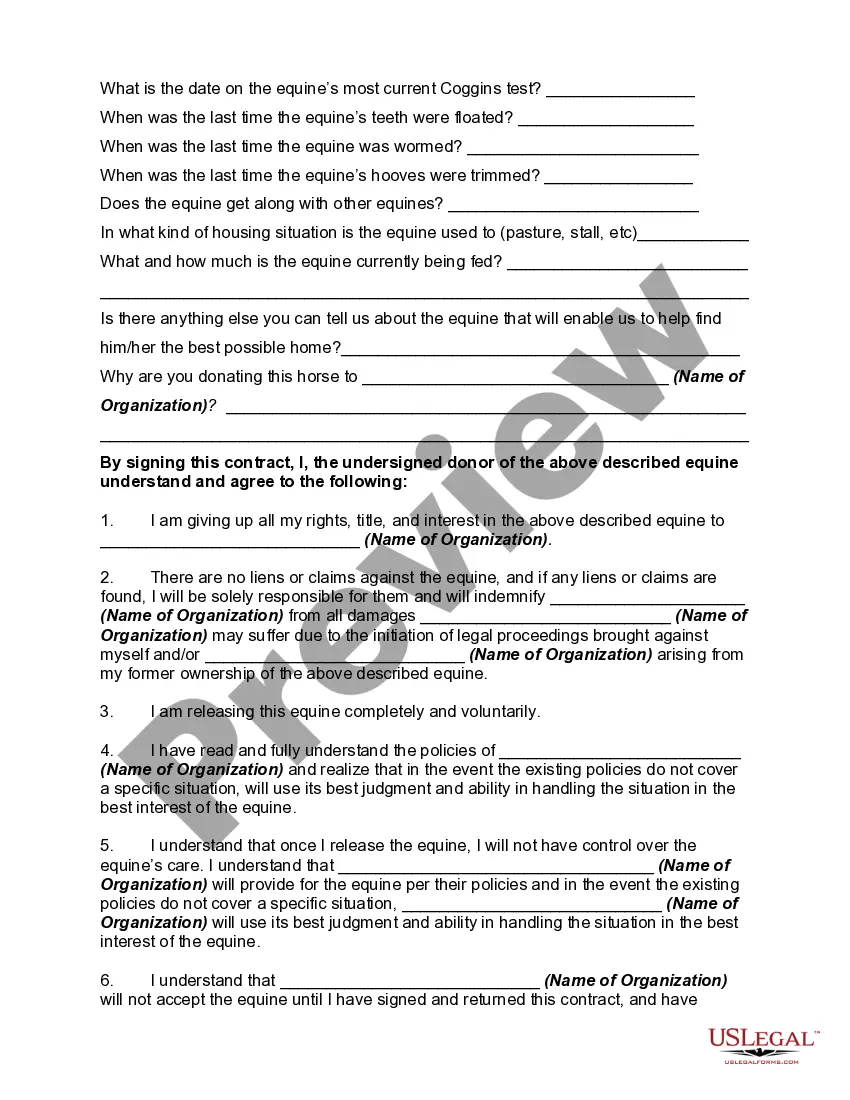

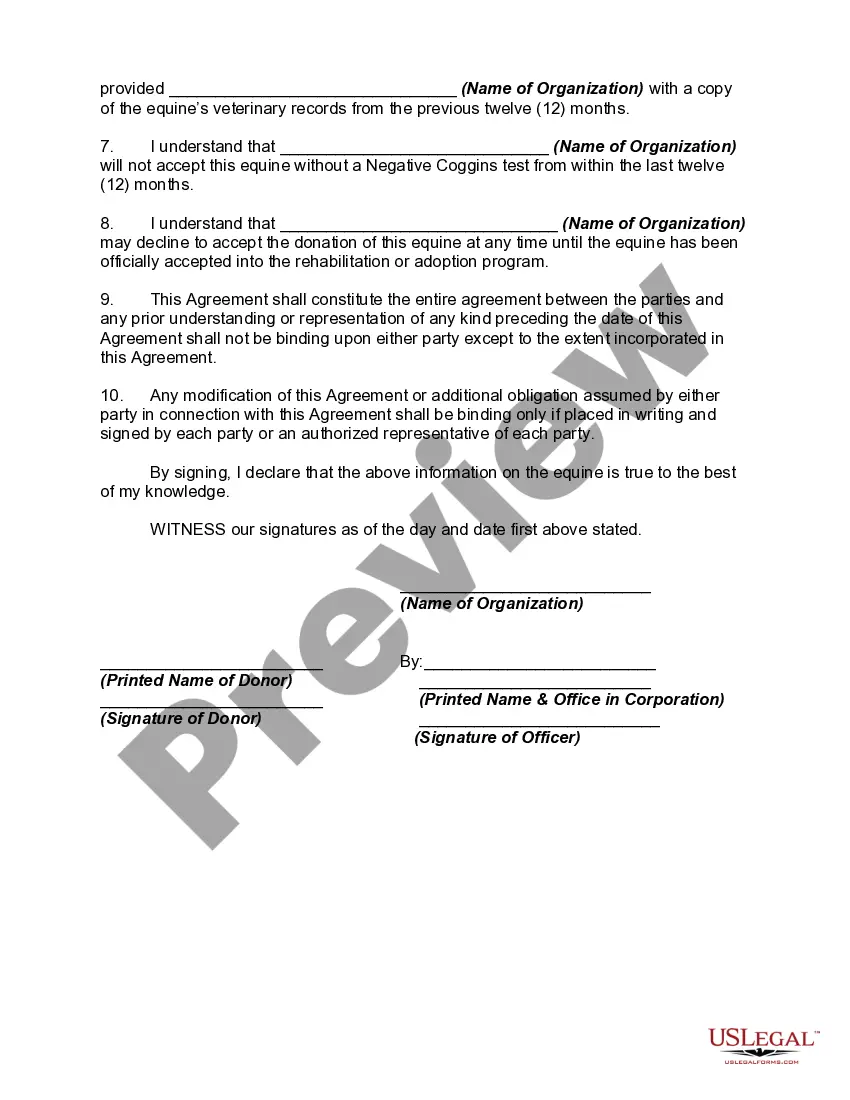

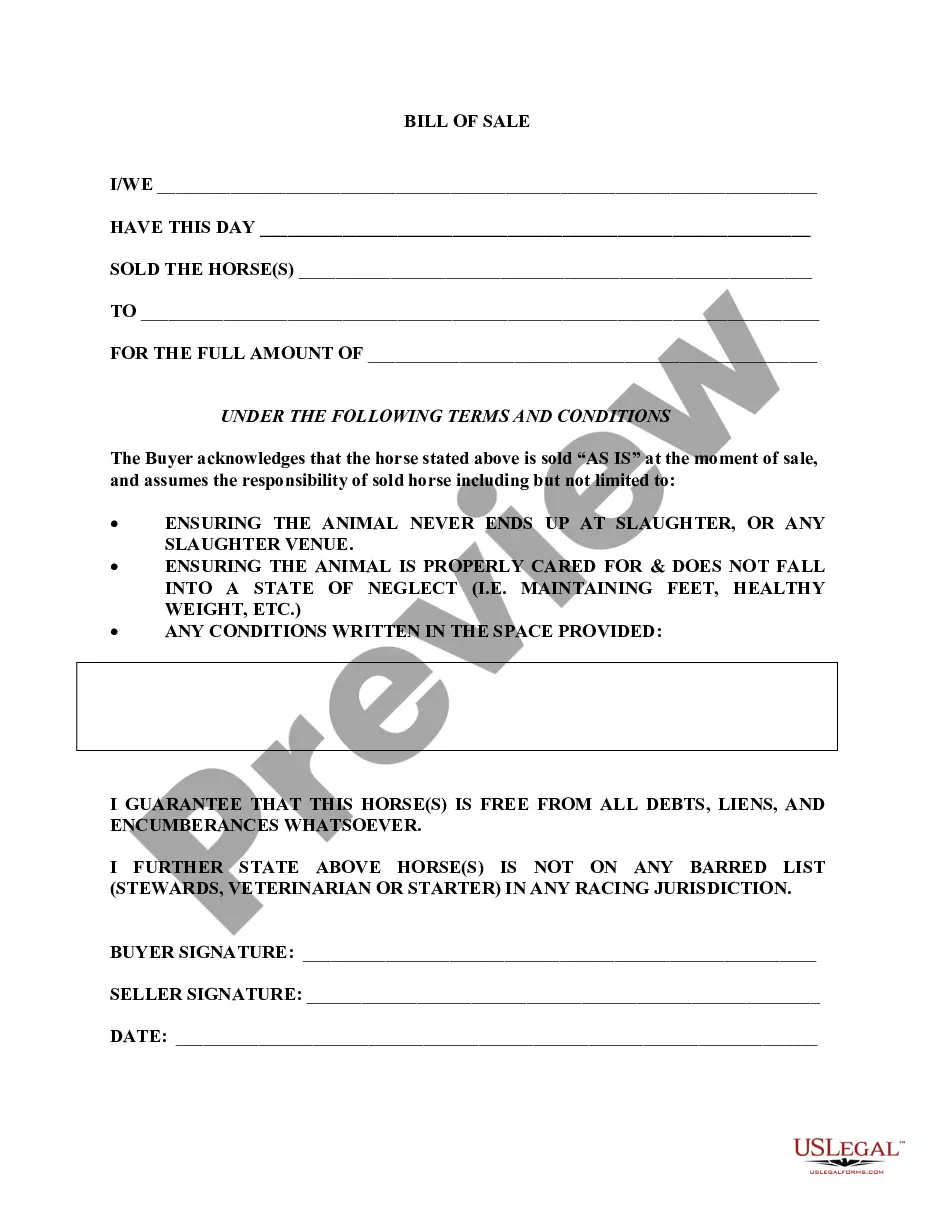

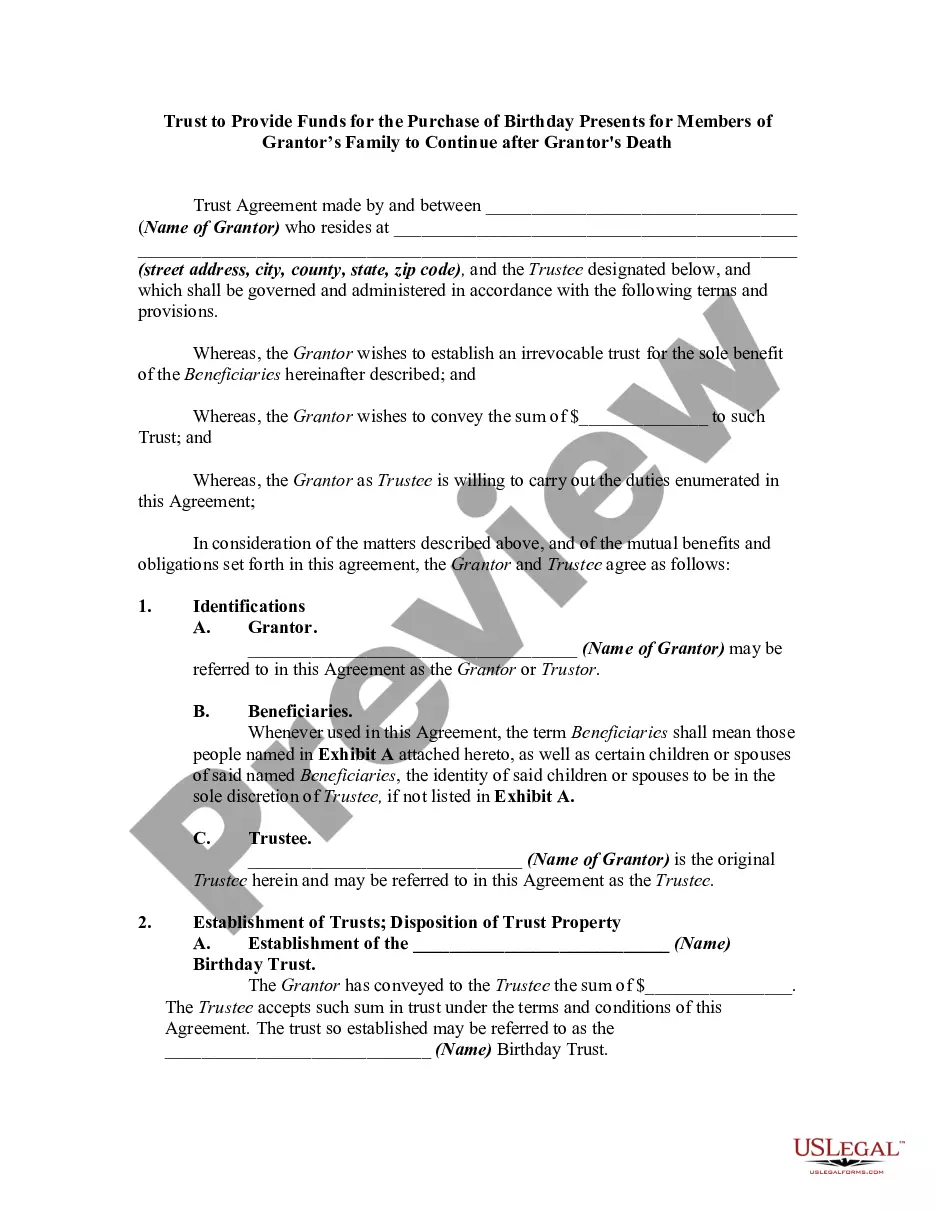

This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

Are you in a scenario where you require documents for occasional business or particular tasks almost daily.

There are numerous legal document templates available online, but finding reliable ones is not simple.

US Legal Forms provides thousands of templates, such as the South Carolina Equine or Horse Donation Contract, which can be tailored to meet state and federal requirements.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and make payment using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the South Carolina Equine or Horse Donation Contract at any time if needed. Just access the required form to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally designed legal document templates suitable for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Equine or Horse Donation Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

- Use the Review button to check the document.

- Read the description to ensure you have selected the proper form.

- If the form is not what you are looking for, use the Search box to find the form that suits your needs and requirements.

- When you locate the correct form, click Purchase now.

Form popularity

FAQ

The 123 rule in relation to horses means that for every hour of riding, a horse should have one hour of rest. This approach helps prevent fatigue and supports the horse's overall well-being. Proper rest is essential for maintaining a healthy equine life, and if you're unable to meet these needs, consider utilizing a South Carolina Equine or Horse Donation Contract to find an organization that can provide the proper care for your horse.

The 20% rule with horses refers to the guideline that suggests a horse's daily forage intake should be at least 1% of its body weight. This ensures the horse receives adequate nutrients and maintains a healthy digestive system. If your horse's feeding needs change, you might consider leveraging a South Carolina Equine or Horse Donation Contract to connect with experts who can guide you in proper horse care.

Getting rid of an unwanted horse can be challenging, but donating through a South Carolina Equine or Horse Donation Contract is a viable solution. This process not only ensures your horse finds a good home, but it also provides possible tax benefits. You can contact local equine rescues or nonprofits to see if they can accept your horse. Taking this step can help relieve your burden while giving your horse a second chance.

If you have a horse that you can't ride, consider looking into a South Carolina Equine or Horse Donation Contract. This option allows you to donate your horse to an organization that can offer it a new purpose. By donating, you can ensure the horse receives proper care and attention while helping others benefit from its companionship. Explore local charities or rescues that accept horse donations.

Donating a horse can be tax-deductible if done according to IRS regulations. The horse must be contributed to a qualified charity, and a South Carolina Equine or Horse Donation Contract should be completed to document the donation. This contract serves as evidence for your tax records, enabling you to potentially receive a write-off.

To donate a horse to UC Davis, start by contacting their equine hospital or veterinary school. They often have specific guidelines for horse donations and may require the completion of a South Carolina Equine or Horse Donation Contract. This ensures that all requirements are met, which can also help you in claiming potential tax benefits.

Yes, donations made to a qualified horse rescue can be tax-deductible, provided you follow IRS guidelines. When you donate a horse to such an organization, ensure to use a South Carolina Equine or Horse Donation Contract to validate the transaction. This helps you retain a record for your taxes and enhances your eligibility for a deduction.

For tax purposes, a horse is generally considered personal property. This classification can influence how it is valued when donated. By using a South Carolina Equine or Horse Donation Contract, you can properly document the donation and ensure that it meets the necessary requirements for tax deductions. Always consult a tax professional for the most accurate advice.

Giving away a horse involves several steps for a smooth process. Begin by finding a suitable recipient who can provide a good home for the horse. Next, you should draft a South Carolina Equine or Horse Donation Contract to outline the terms of the donation. This contract helps protect both parties and makes the donation official, which may offer tax benefits.

The amount you must donate to receive a tax write-off varies based on your income and the type of donation. For horse donations, the value is typically determined by fair market value at the time of donation. A South Carolina Equine or Horse Donation Contract can help establish this value, facilitating the tax deduction process. Consulting with a tax specialist will provide clarity on your specific situation.