South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Are you currently in a situation where you require documents for either business or personal purposes on a daily basis.

There are numerous legitimate document templates available online, but finding ones you can rely on is not straightforward.

US Legal Forms offers a vast array of document templates, including the South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, which are designed to comply with federal and state regulations.

Once you find the right document, click Get now.

Choose the pricing plan you prefer, provide the necessary details to create your account, and pay for your order using PayPal or your credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct state/region.

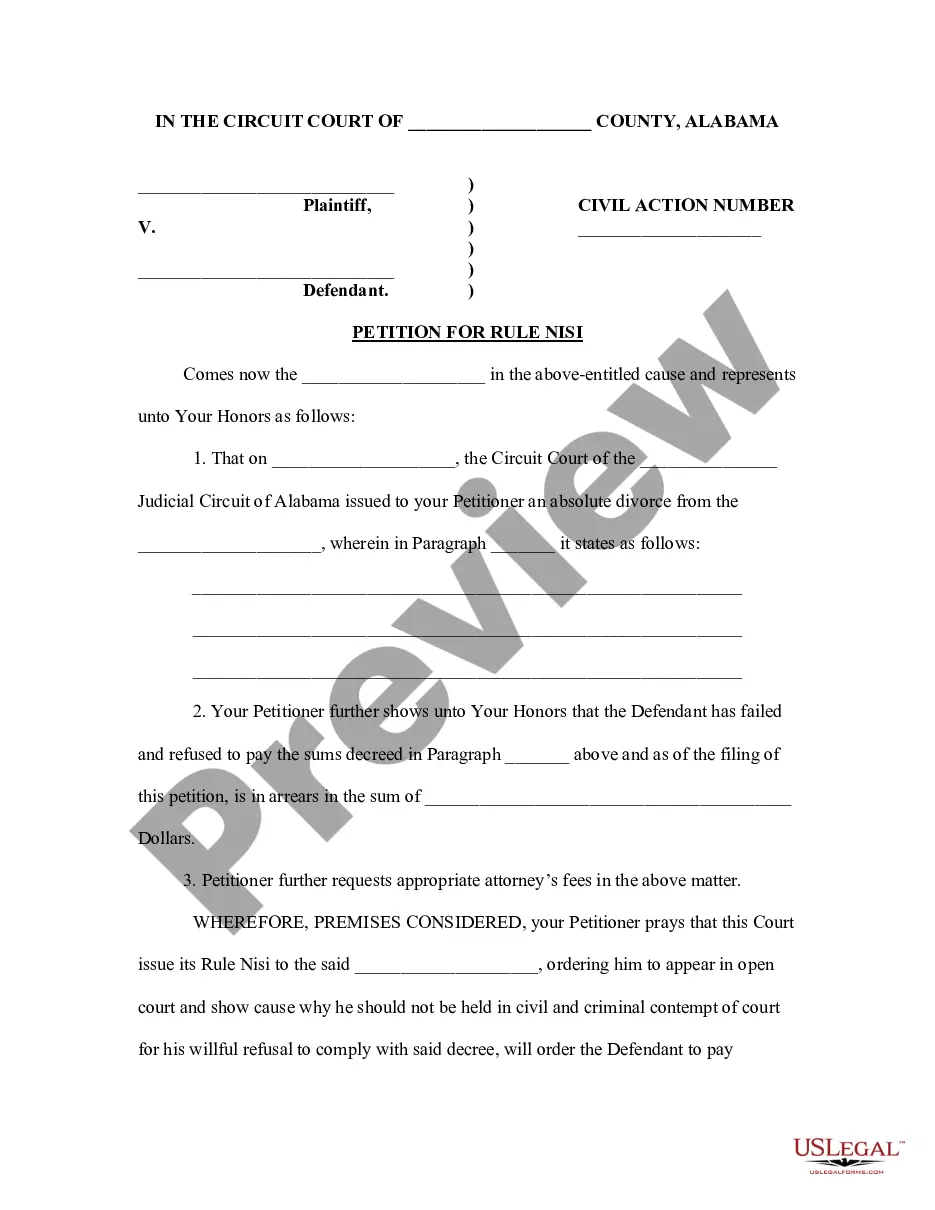

- Utilize the Review button to evaluate the form.

- Check the description to confirm that you have chosen the correct document.

- If the document isn’t what you’re looking for, use the Search box to find the form that meets your requirements.

Form popularity

FAQ

In the event of the annuitant's death, taxation of an annuity like the South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant can vary. Generally, any gains in the annuity may be subject to taxation in the year of death. Consulting with a financial advisor or using resources like US Legal Forms can help clarify potential tax implications and ensure beneficiaries understand their responsibilities.

When dealing with a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, taxation on the income depends on various factors. The seller typically recognizes a portion of each payment as taxable income, based on the sale's setup. This method can provide tax benefits, as only the earned income is taxed rather than the entire payment.

The South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant is designed to provide payments as long as the annuitant is alive. Once the annuitant passes away, the payments cease. This agreement can be an appealing option for those who want to ensure financial support during their lifetime without worrying about payments after they are gone.

The payout option that offers lifetime payments along with a guaranteed minimum term is often referred to as a period-certain annuity. With this option, you receive payments for your life, but if you pass away before the agreed upon minimum term ends, your beneficiaries will receive the remaining payments. This can be a reassuring feature in a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant. It strikes a balance between personal financial security and providing for your family.

A private annuity agreement is a contract between two parties, where one party agrees to make payments to the other for a specified period or for life. This arrangement helps the seller convert appreciated assets into income while potentially providing tax advantages. Entering into a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant can be an effective way to create a steady income stream. At USLegalForms, we guide you through the process, ensuring that you understand every aspect of this agreement.

The life only annuity payout option pays income solely for the lifetime of the annuitant, with no remaining benefits for heirs after their passing. This option typically offers a higher monthly payment compared to other options, as it does not include a death benefit. When considering a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, many individuals find this option appealing due to its simplicity and immediate financial benefits. It's essential to weigh the advantages and disadvantages based on your financial goals.

A lifetime payout annuity is a financial product that pays you income for the duration of your life. This arrangement can be beneficial, as it removes the risk of outliving your savings. Within a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, such annuities can provide peace of mind, ensuring that your financial needs are met. They serve as a reliable source of income as you navigate your retirement years.

The payout option that guarantees lifetime payments to the annuitant is called a lifetime annuity. This type of annuity ensures that you receive regular income for as long as you live, providing financial security throughout your retirement. When setting up a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, it is important to understand how this option works. It can be an excellent choice for those seeking predictable income now and into the future.

The type of annuity that stops all payments upon the annuitant's death is known as a life annuity, or life-only annuity. With this option, the payments are tied strictly to the lifetime of the annuitant, providing income only during their life. If you prefer security for your beneficiaries, consider a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, which supports ongoing payments even after an annuitant's passing. This choice may enhance your financial security and planning.

An irrevocable annuity is a type of annuity that cannot be altered or terminated once established. This commitment ensures that the payments are secure and predictable, making them beneficial for long-term planning. If you are considering a South Carolina Private Annuity Agreement with Payments to Last for Life of Annuitant, it may help to explore its irrevocable nature. Such structured payments can offer reassurance in your financial strategy.