South Carolina Affidavit of Domicile for Deceased

Description

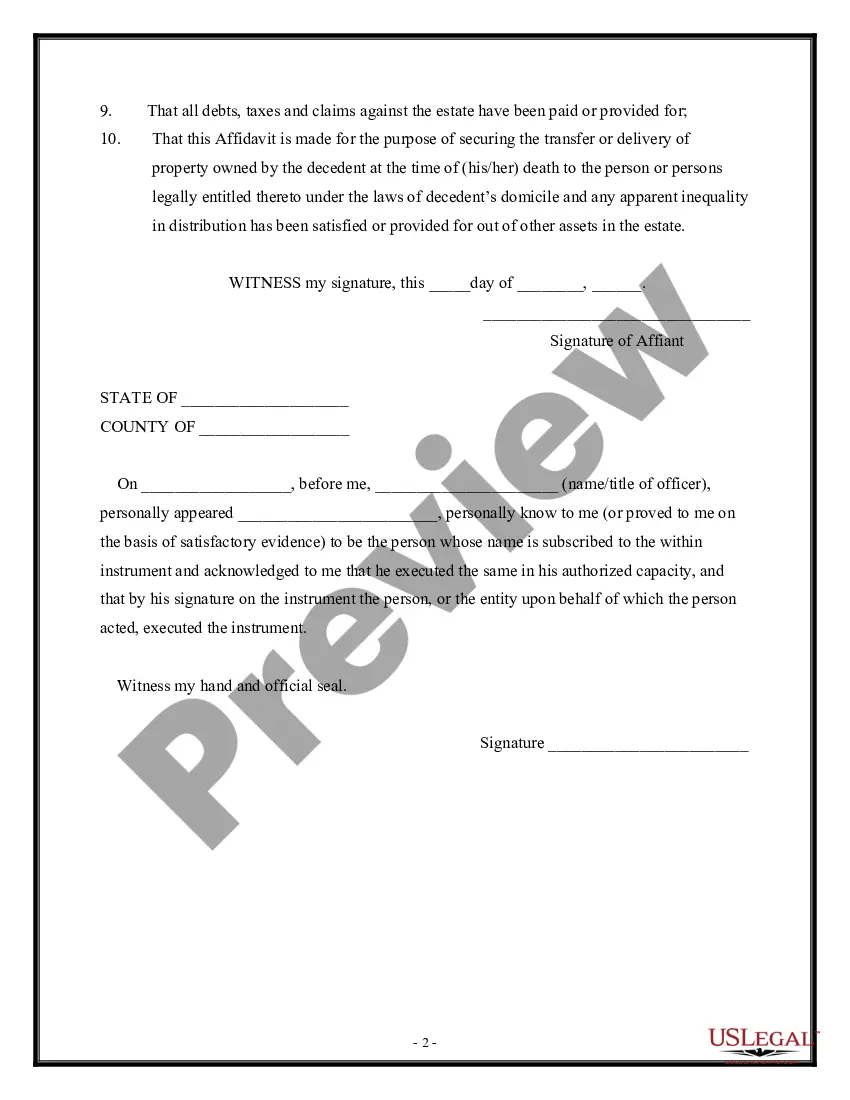

How to fill out Affidavit Of Domicile For Deceased?

Choosing the right legitimate record format might be a struggle. Of course, there are a lot of themes available on the net, but how can you obtain the legitimate type you need? Take advantage of the US Legal Forms site. The service provides 1000s of themes, for example the South Carolina Affidavit of Domicile for Deceased, that can be used for business and personal needs. All of the forms are examined by specialists and satisfy state and federal requirements.

When you are currently signed up, log in to your accounts and click the Down load switch to find the South Carolina Affidavit of Domicile for Deceased. Use your accounts to appear from the legitimate forms you possess bought formerly. Check out the My Forms tab of the accounts and get an additional backup of your record you need.

When you are a whole new consumer of US Legal Forms, listed here are straightforward directions that you should follow:

- Very first, be sure you have selected the correct type for the city/area. You can look over the shape using the Review switch and read the shape information to make sure this is the right one for you.

- In case the type fails to satisfy your preferences, use the Seach industry to discover the appropriate type.

- When you are sure that the shape is suitable, click on the Buy now switch to find the type.

- Select the prices program you need and enter in the needed info. Make your accounts and purchase your order with your PayPal accounts or credit card.

- Pick the document file format and download the legitimate record format to your product.

- Total, change and produce and indicator the received South Carolina Affidavit of Domicile for Deceased.

US Legal Forms is definitely the biggest catalogue of legitimate forms where you can discover a variety of record themes. Take advantage of the company to download appropriately-made papers that follow express requirements.

Form popularity

FAQ

While there is no specific deadline for this in South Carolina law, it is generally best to do so within a month to prevent unnecessary delays in the probate process.

If you have a spouse and no children, your spouse will inherit your entire estate. If you have a spouse and children, your spouse gets half and the remaining estate is split equally amongst the children. If you have no spouse or children, your parents would receive your estate.

In South Carolina, you can use an Affidavit if an estate value is less than $25,000. You must wait 30 days after the death, and a probate judge will need to approve it. There is also potential to use a summary probate procedure, which is a possibility when an estate value is less than $25,000.

One way to avoid probate in South Carolina is by using a transfer-on-death (TOD) deed for real estate. This allows the property to be transferred to the beneficiary upon the owner's death, bypassing the probate process.

In most cases, probate is a legal responsibility in South Carolina. However, probate can be avoided if the decedent's assets were placed in a living trust before they died with beneficiaries designated to inherit the estate.

Inheritance Laws for Children in South Carolina When a person dies intestate and has both a surviving spouse and children, the children receive half of the estate collectively. The half of the estate that goes to the children is then divided among them, depending on how many children the deceased had.

Petition to Determine Heirs To allow the Court to hold this hearing, an interested party (typically the spouse or child of the decedent) must formally Petition the Court setting forth the heirs or family members, the status of the family members and documents supporting the status and relationships.

Filing Will and Probatings - The South Carolina ( SC ) Probate Code of Laws requires that the Last Will and Testament be delivered to the Probate Court within 30 days of the decedent's death.

Beneficiaries May Request an Accounting There are situations when a beneficiary will request that the executor or trustee provide an accounting. This may be a formal or informal accounting, depending on the request. Regardless, the fiduciary has a responsibility to provide an accounting when requested.

If all inheritors do not agree then the property cannot be sold. Chill! If majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.