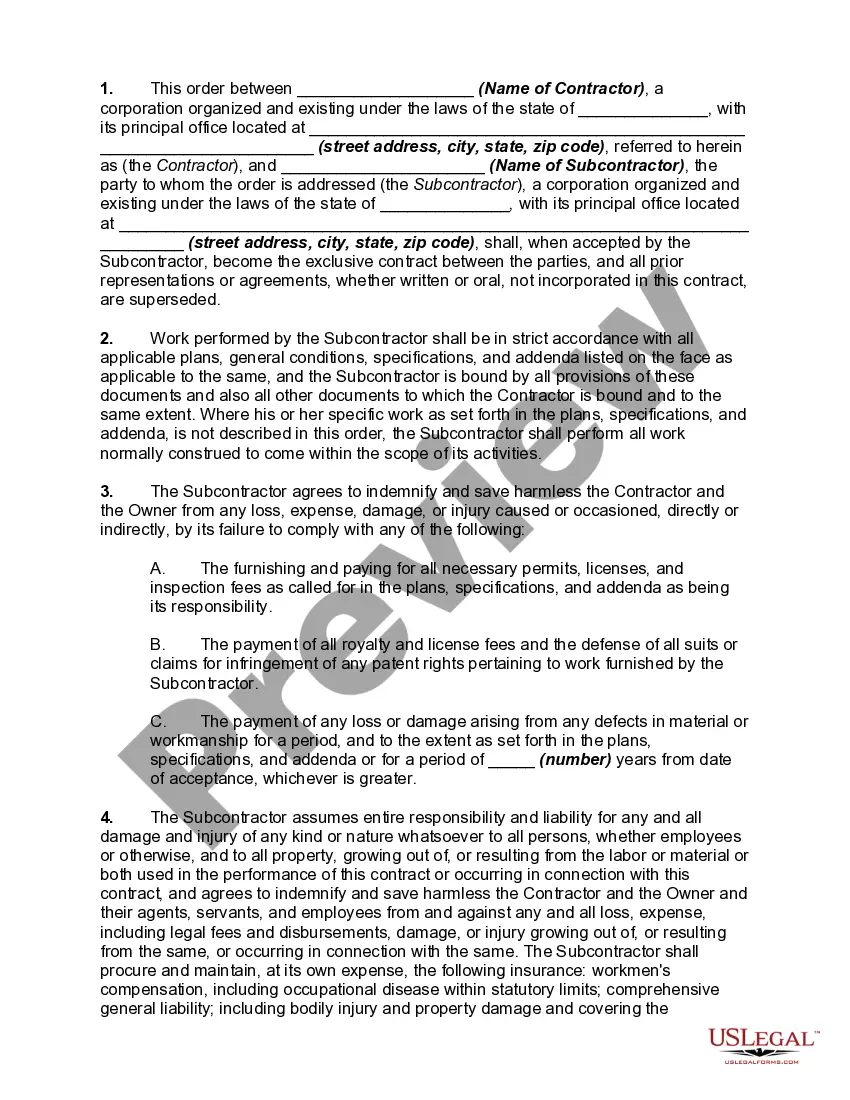

South Carolina Purchase Order for Labor and Materials to Subcontractor

Description

How to fill out Purchase Order For Labor And Materials To Subcontractor?

US Legal Forms - one of the largest collections of authentic documents in the USA - provides a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the South Carolina Purchase Order for Labor and Materials to Subcontractor in just moments.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your details to register for an account.

- If you already have an account, Log In and download the South Carolina Purchase Order for Labor and Materials to Subcontractor from the US Legal Forms collection.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your locale.

- Review the form's content by clicking the Review button.

Form popularity

FAQ

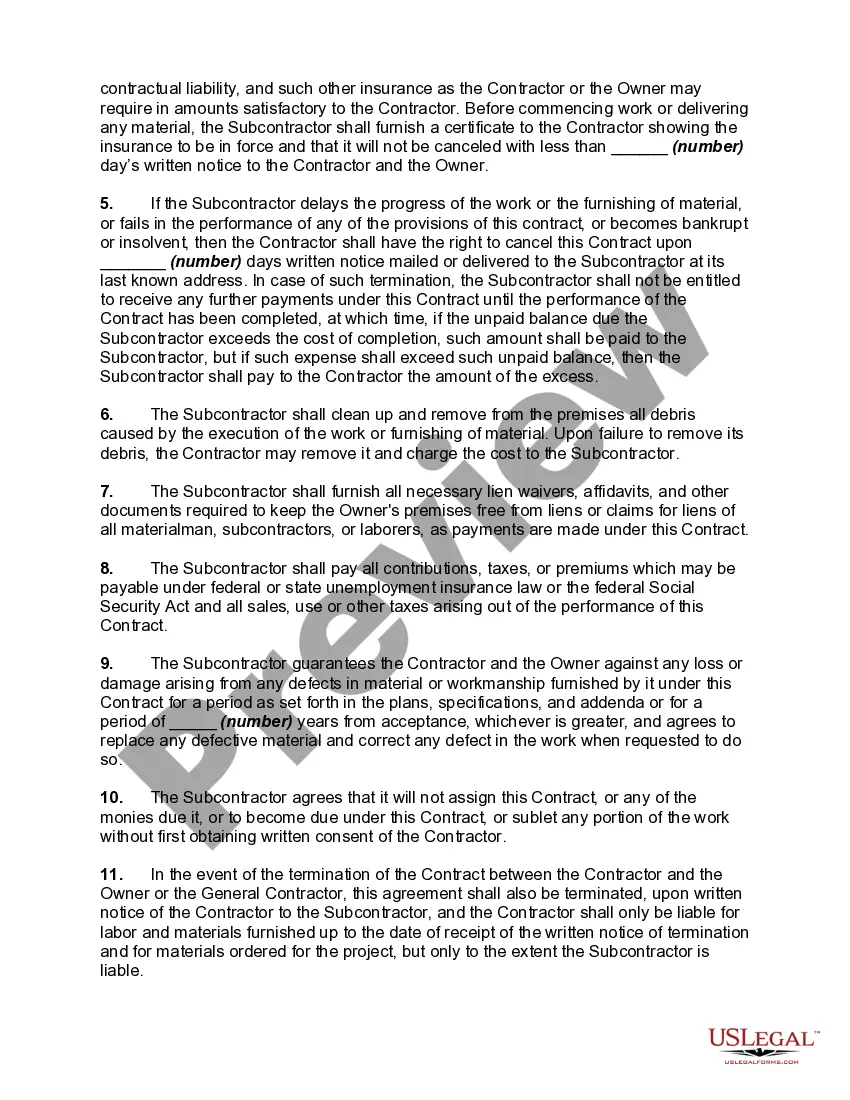

Labor is non-taxable when the labor is stated as a separate line item from the parts. Maintenance and warranty agreements may be taxable (check here for exemptions). CXML suppliers should collect sales tax.

Purchase Orders (PO's) Purchase Orders are documents issued from a Buyer (your organization) to a Seller (the vendor). They are an important tool for Buyers because they formalize requirements and pricing, and serve as legally binding documentation of the goods/services that were ordered.

REPAIR PARTS, SUPPLIES, AND LABOR SC Regulation 117-174.191 reads: (a) When repairs require only service or services with the use of an inconsequential amount of materials, the amount received is not subject to tax.

The main difference between the two documents is the duration. Purchase orders represent single business transactions. Contracts are used for long term arrangements between the buyer and seller. Contracts may also allow for renewal options.

SC Regulation 117-314.2 states: Building materials when purchased by builders, contractors, or landowners for use in adding to, repairing or altering real property are subject to either the sales or use tax at the time of purchase by such builder, contractor, or landowner.

The main difference between the two documents is the duration. Purchase orders represent single business transactions. Contracts are used for long term arrangements between the buyer and seller. Contracts may also allow for renewal options.

A PO may be a legally-binding agreement where there is no existing contract, it is only when the supplier accepts the PO that it become a legal contract. Invoices are documents issued by a suppliers to buyers, summarising the products or services that they have purchased (or have agreed to purchase).

Purchase orders are sent by the buyer to the vendor first, and they outline exactly what the order should contain and when it should arrive. It'll include things like quantity of items, detailed descriptions of the items, the price, date of purchase, and payment terms.

A purchase order is used by a buyer to place an order and is issued before delivery. An invoice is issued by a seller using invoicing software after an order is delivered. It defines the amount the buyer owes for the purchased goods and the date by which the buyer needs to pay.

In residential construction, purchase orders are used by builders + remodelers to request materials or services for a project from third party vendors, suppliers, or subcontractors. A detailed purchase order defines the scope, price, and terms of the expected materials or services.