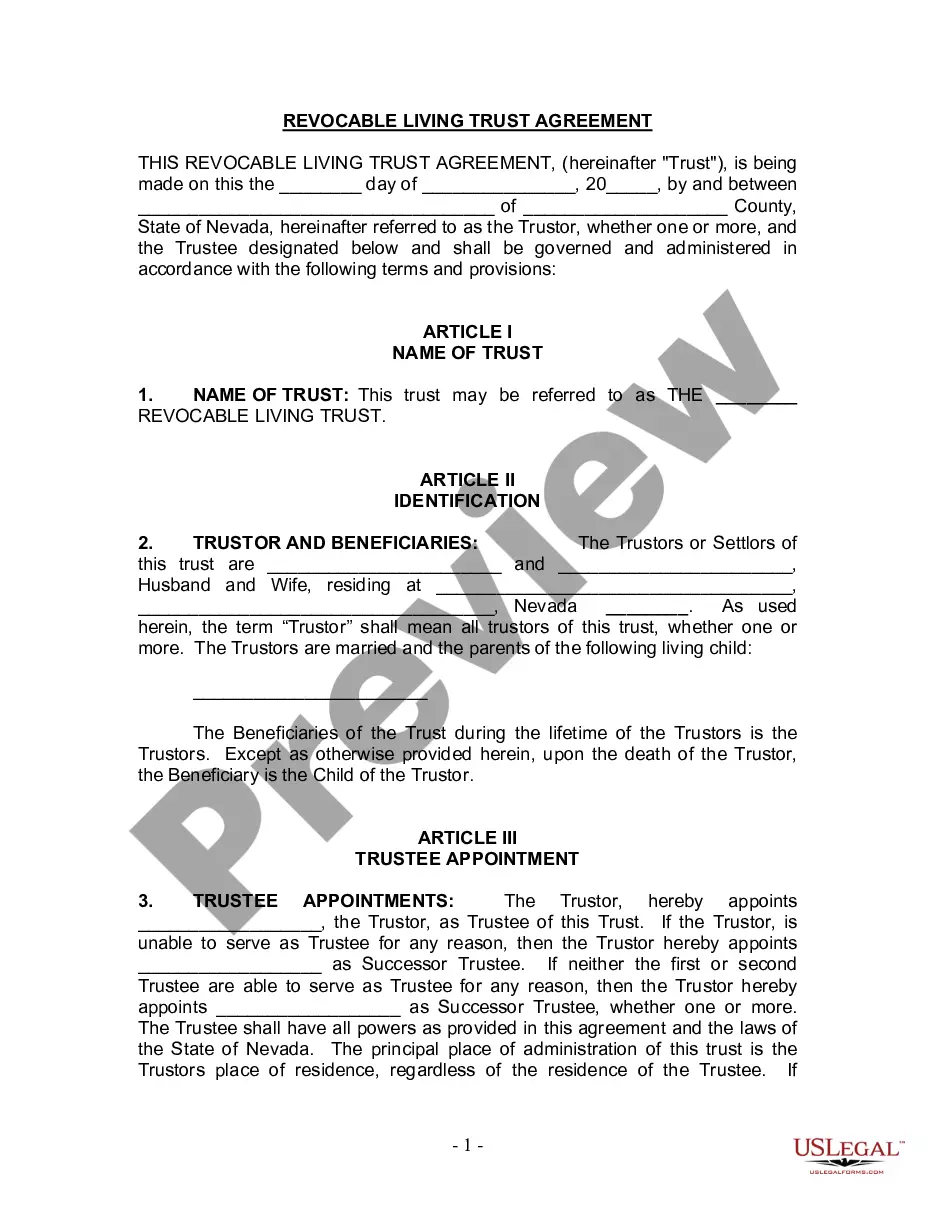

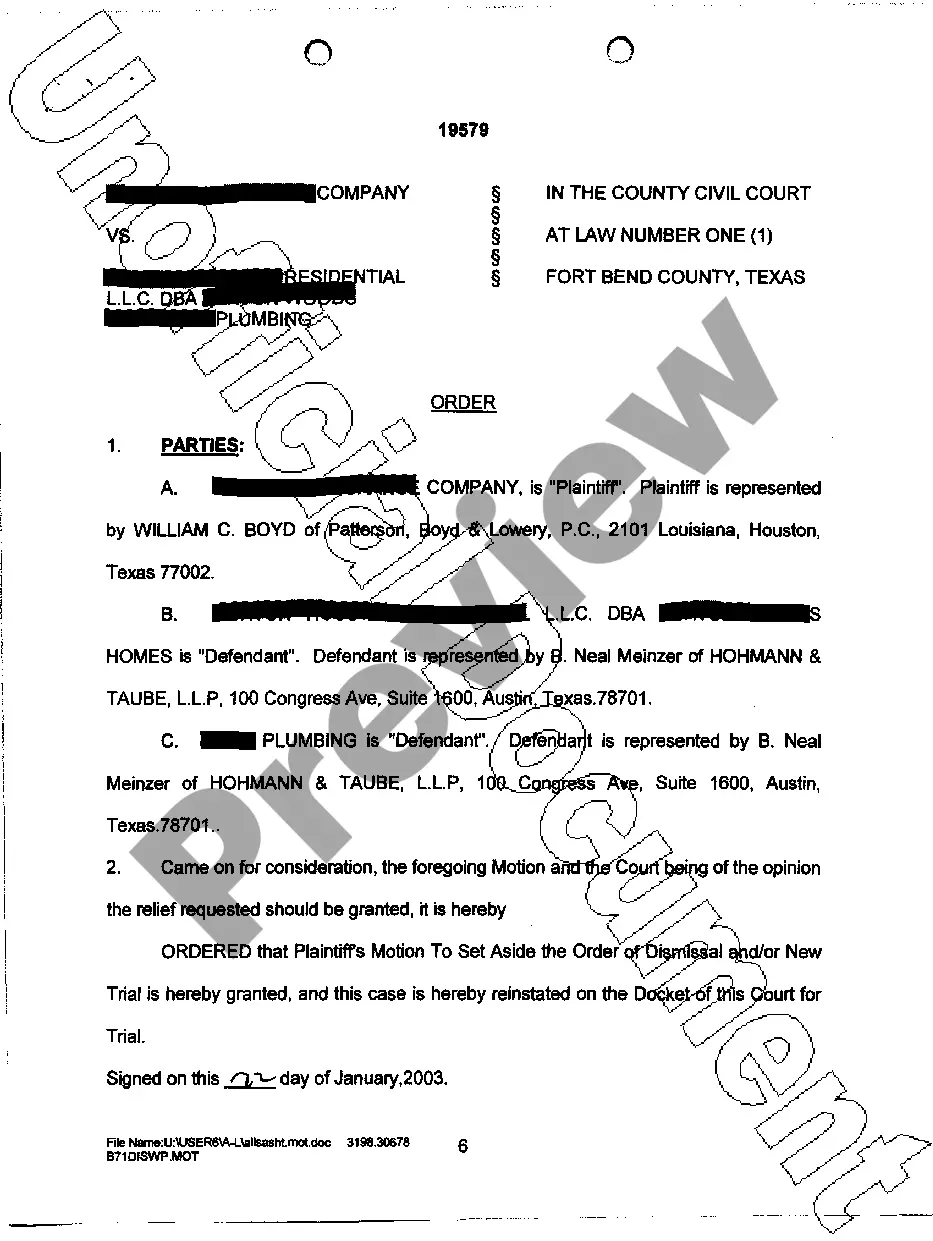

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Agreement to Extend Debt Payment

Description

How to fill out Agreement To Extend Debt Payment?

If you aim to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest array of legal forms accessible online.

Take advantage of the site’s user-friendly and convenient search option to find the documents you require.

Various templates for commercial and personal purposes are categorized by groups and jurisdictions, or by keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to retrieve the South Carolina Agreement to Extend Debt Payment with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and hit the Acquire button to get the South Carolina Agreement to Extend Debt Payment.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Form SC4868 is used to request an extension to file your South Carolina corporate tax return. This form provides businesses the additional time they may need to gather necessary documents and ensure accurate filings. By submitting the South Carolina Agreement to Extend Debt Payment along with SC4868, you can align your federal and state tax obligations seamlessly. It’s a valuable form for maintaining good standing with the state while managing your business's financial responsibilities.

Yes, South Carolina does accept federal extensions for corporations. When you file a federal extension, it allows your business additional time to submit your tax return. However, it is important to also file a South Carolina Agreement to Extend Debt Payment to ensure compliance with state tax regulations. By taking these steps, you can avoid penalties and manage your tax obligations effectively.

MyDORWAY SC is an online platform that allows residents of South Carolina to manage various tax-related services, including payment agreements. Specifically, for those looking to extend their debt payments, the South Carolina Agreement to Extend Debt Payment provides a formal way to request more time to settle tax dues. By using MyDORWAY, you can easily submit your request, monitor its status, and ensure compliance with state regulations. It simplifies the process for taxpayers, making it accessible and efficient.

To make an IRS payment plan online, visit the IRS website and look for the 'Payment Plans' section. You will need to provide your tax information, such as your Social Security number, filing status, and the amount you owe. Completing the online application is a straightforward process, and using the South Carolina Agreement to Extend Debt Payment can help you manage state and federal obligations effectively.

In South Carolina, there is no specific age at which you stop paying state taxes, as tax obligations depend on income rather than age. However, elderly individuals might receive certain tax exemptions if they meet specific criteria. Therefore, it's essential to consult with a tax advisor to determine any applicable deductions or exemptions related to state taxes.

To set up a payment plan with the South Carolina Department of Revenue (SCDOR), you need to visit their website and navigate to the payment option section. You may need to provide your taxpayer information to verify your identity. Once verified, you can complete the necessary forms, including the South Carolina Agreement to Extend Debt Payment, which outlines your repayment terms.

Even after a garnishment, you may still be able to establish a payment plan in South Carolina. You will need to negotiate a new arrangement based on the South Carolina Agreement to Extend Debt Payment. This approach can help you regain control over your financial responsibilities and alleviate stress. Resources on uslegalforms can provide guidance on navigating this situation effectively.

Yes, it is possible to set up a payment plan on sales tax in South Carolina. You will need to adhere to the South Carolina Agreement to Extend Debt Payment to manage your sales tax obligations. This structured arrangement can help you stay in good standing with the SCDOR. For a smoother experience, explore the options available through uslegalforms for easy access to necessary documentation.

South Carolina does offer eFile options for certain legal forms, including those related to debt payment agreements. Utilizing an eFile form can streamline the submission process for your South Carolina Agreement to Extend Debt Payment. This option saves time and can make tracking your request more manageable. Check uslegalforms for eFile templates that meet your needs.

Yes, South Carolina provides an extension form that you can use when seeking a delay in your debt payments. This form is essential for formally requesting a South Carolina Agreement to Extend Debt Payment. Make sure to follow the instructions carefully to ensure your request is successfully submitted. Platforms like uslegalforms can help you access the correct documentation.