South Carolina Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

US Legal Forms - one of the most prominent collections of legitimate documents in the United States - provides an extensive assortment of legal document templates that you can either download or print.

By utilizing the website, you can discover numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest versions of forms such as the South Carolina Contract for Sale of Goods on Consignment.

If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

If you're satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your credentials to create an account.

- If you already have a membership, Log In and acquire the South Carolina Contract for Sale of Goods on Consignment from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to guide you.

- Ensure you've selected the correct form for your city/county. Click the Preview button to review the form's content.

- Examine the form description to confirm that you have selected the right form.

Form popularity

FAQ

Yes, proceeds from consignment sales typically count as income for the seller. If you receive payments from selling goods under a South Carolina Contract for Sale of Goods on Consignment, this income will be subject to taxation. Keeping detailed records of sales is crucial for accurate tax reporting.

Yes, you should issue a 1099 for consignment sales if the payments meet the reporting threshold. This ensures proper tax documentation and compliance for both parties involved in the transaction. Utilizing a South Carolina Contract for Sale of Goods on Consignment can streamline this process and clarify any tax obligations.

Some vendors are exempt from 1099 reporting, including C corporations and certain tax-exempt organizations. Additionally, payments made to estates and for merchandise purchased are usually exempt. If you are working under a South Carolina Contract for Sale of Goods on Consignment, it's wise to confirm a vendor's status to avoid unnecessary reporting.

Yes, consignment sales can require a 1099 if certain thresholds are met. Typically, if you make payments to a vendor or individual totaling $600 or more during the year, you'll need to issue a 1099 form. This includes payments for items sold under a South Carolina Contract for Sale of Goods on Consignment. It's essential to keep accurate records to ensure compliance with tax regulations.

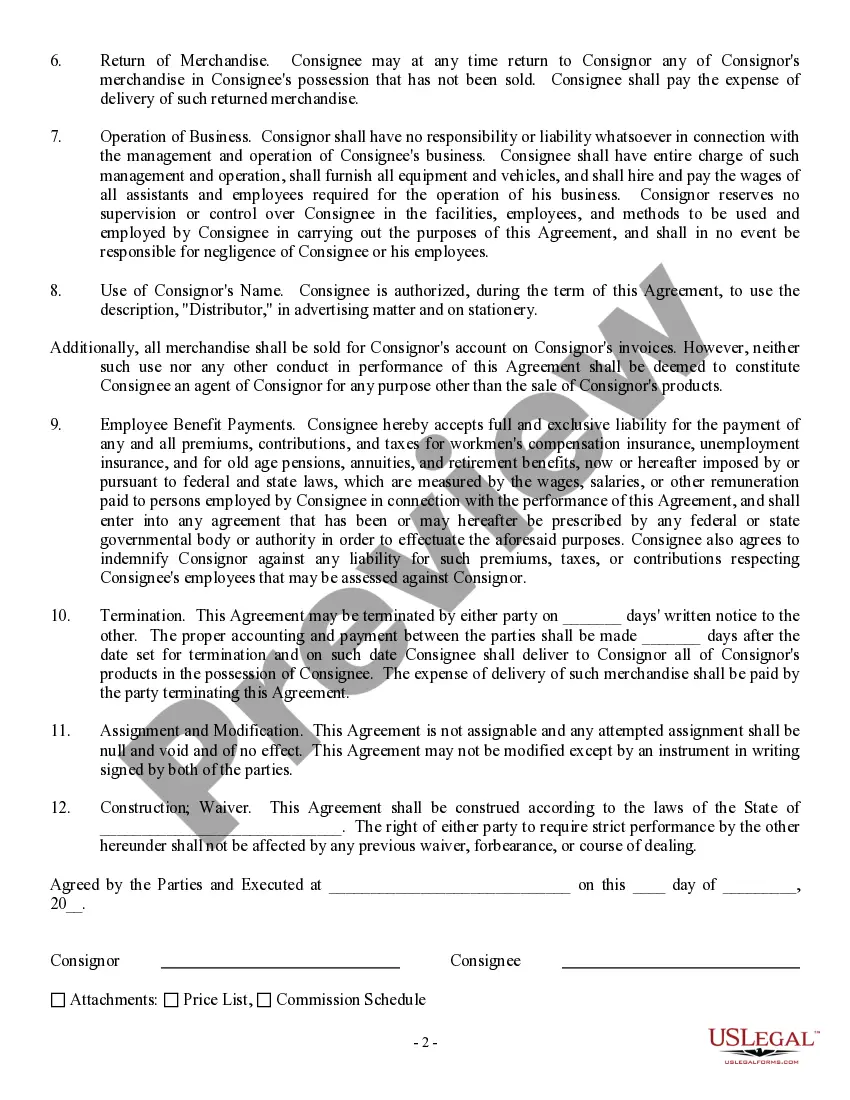

Yes, goods sold on consignment can often be returned, but this depends on the specific terms of the consignment agreement. Many agreements allow for unsold items to be returned to the original owner. Therefore, understanding the details of your South Carolina Contract for Sale of Goods on Consignment is essential to clarify return policies.

Consignment refers to goods provided to another party for resale, where the original owner retains ownership until the sale occurs. This arrangement allows sellers to market their items without upfront costs. For example, within a South Carolina Contract for Sale of Goods on Consignment, items could range from artwork to clothing, depending on market demand.

The consignment sale policy outlines the terms under which goods are sold on consignment. This typically includes the responsibilities of both the consignor and consignee, the duration of the agreement, and the percentage of sales proceeds that each party retains. Understanding this policy is crucial for anyone engaging in a South Carolina Contract for Sale of Goods on Consignment.

A consignment is not a traditional sale. Instead, it involves one party transferring goods to another for the purpose of selling them on their behalf. In the context of a South Carolina Contract for Sale of Goods on Consignment, the original owner retains ownership until the goods are sold, creating a unique relationship between the parties.

A fair split for consignment sales generally ranges from 40% to 60%, depending on the arrangement between the consignor and the consignee. The selling parties should negotiate this split based on their respective contributions, risks, and market conditions. Keeping in mind the South Carolina Contract for Sale of Goods on Consignment can help both parties agree on a fair and clear financial arrangement.

Writing a consignment contract involves outlining essential elements such as the description of the goods, terms of sale, and any applicable fees. It is also important to define the responsibilities of both parties regarding the sale and care of the goods. To ensure your contract is comprehensive, consider utilizing the South Carolina Contract for Sale of Goods on Consignment available on uslegalforms, which provides a reliable framework.