South Carolina Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

US Legal Forms - one of the largest collections of authentic templates in the USA - provides a range of legitimate document templates that you can download or print.

By utilizing the website, you can access numerous forms for both business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms like the South Carolina Nonresidential Simple Lease in mere seconds.

If you have an existing subscription, Log In to access the South Carolina Nonresidential Simple Lease from the US Legal Forms library. The Download button will become visible on every form you view. You can find all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

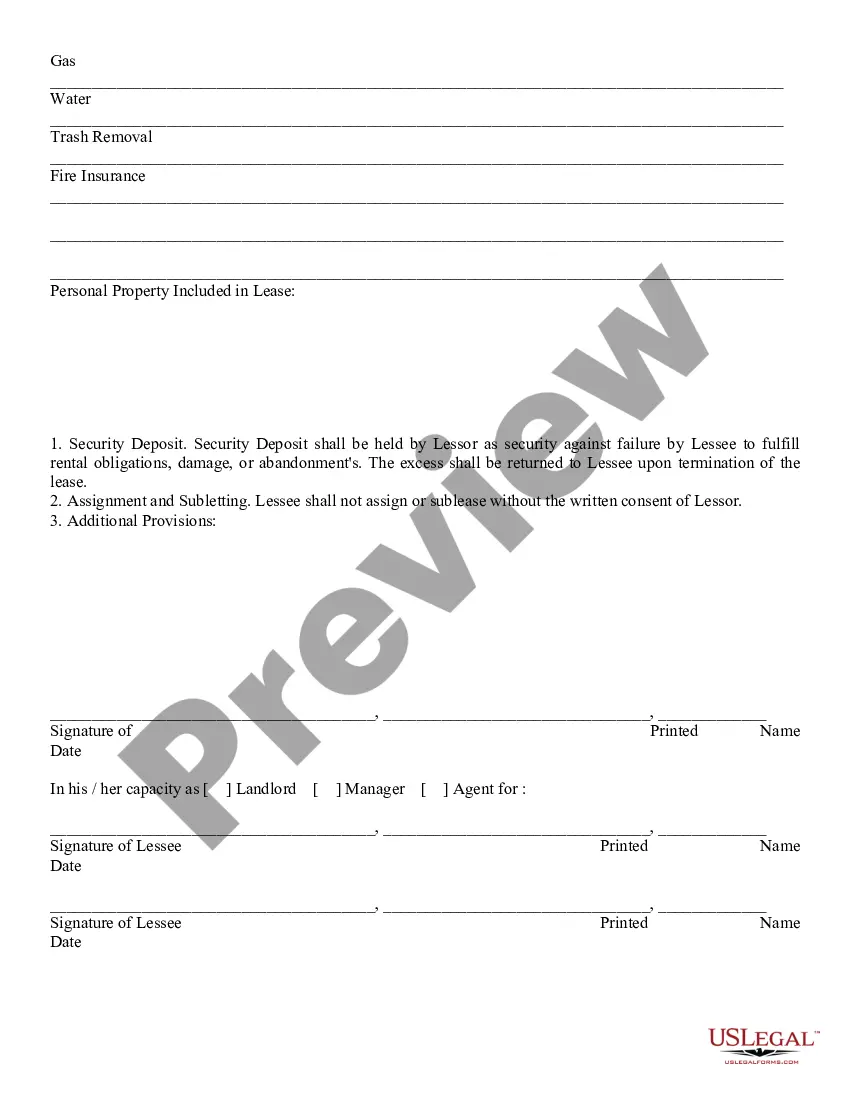

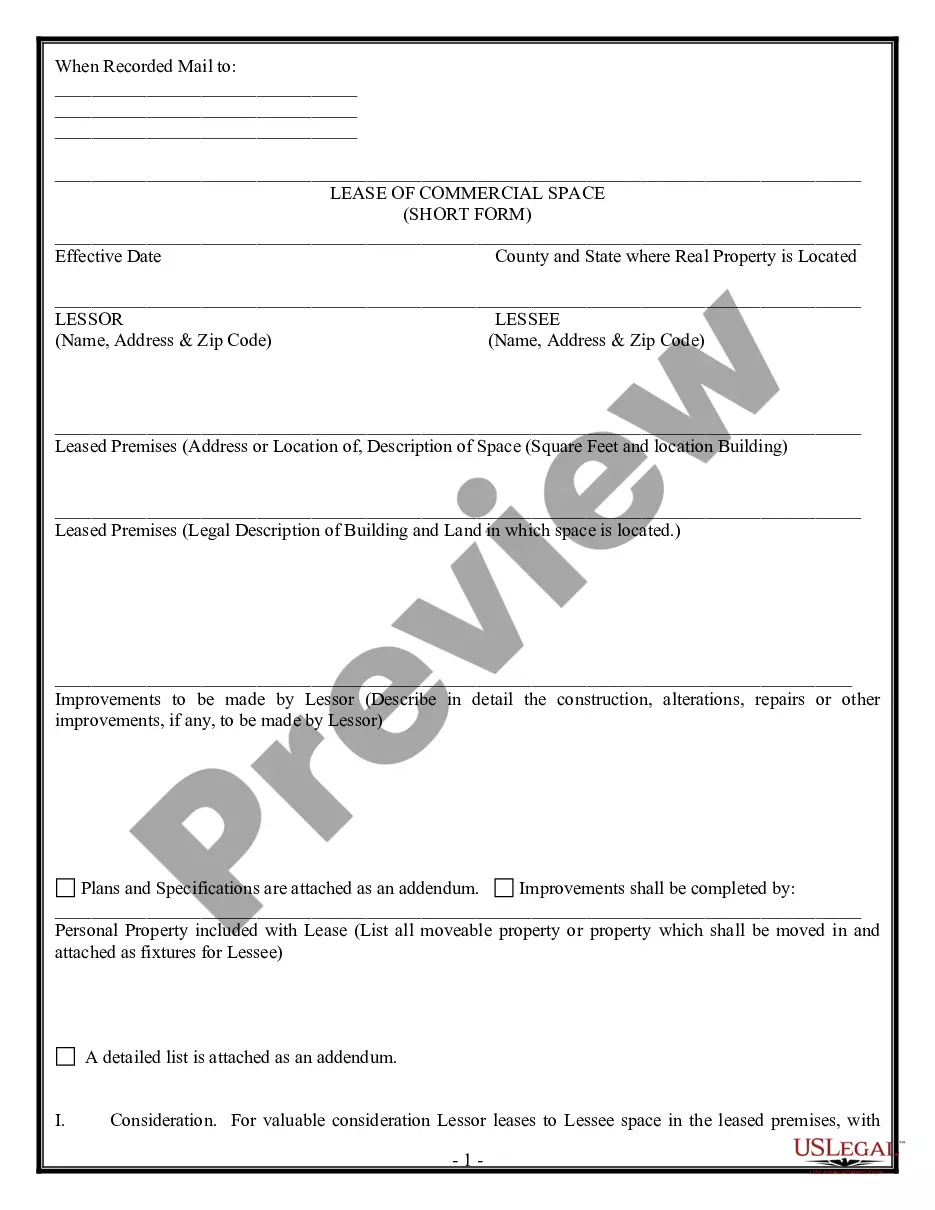

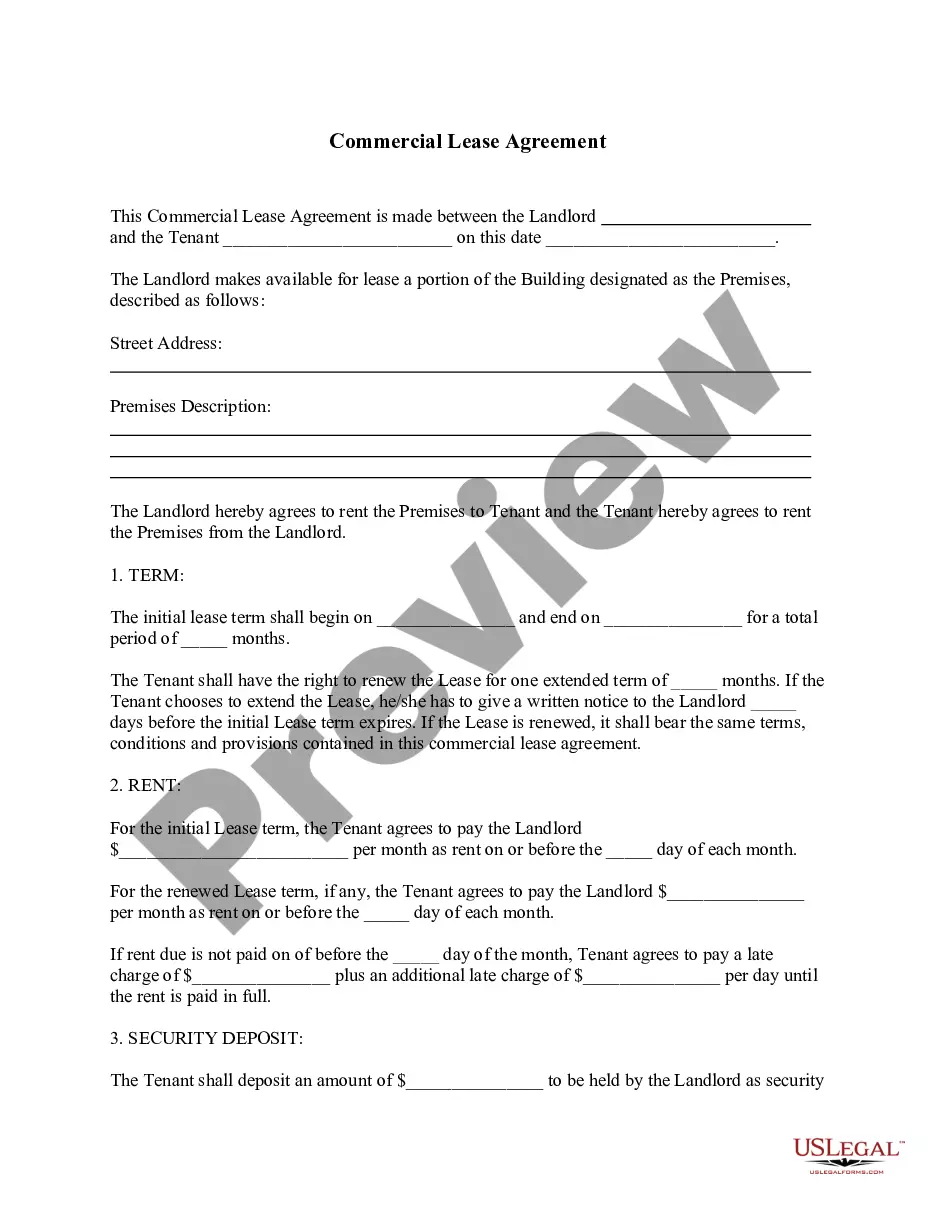

Select the format and download the form onto your device. Edit. Fill in, modify, print, and sign the saved South Carolina Nonresidential Simple Lease. Each document you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the South Carolina Nonresidential Simple Lease with US Legal Forms, one of the most extensive libraries of authentic document templates. Utilize countless professional and state-specific templates that meet your business or personal requirements.

- Make sure you've selected the appropriate form for your location/region.

- Click the Review button to examine the form’s content.

- Check the form summary to confirm you've picked the correct form.

- If the form doesn't meet your needs, utilize the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Next, choose your pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

The simplest type of lease is the South Carolina Nonresidential Simple Lease. This lease is designed to accommodate straightforward leasing arrangements between landlords and tenants without unnecessary complexity. By focusing on essential terms, this lease makes it easier for both parties to understand their rights and obligations. If you need a clear, concise agreement, consider using the South Carolina Nonresidential Simple Lease available through US Legal Forms.

The threshold for non-resident withholding in South Carolina generally applies to individuals or entities with taxable income sourced from the state. Any entity or individual earning more than the exclusion amount may face withholding. This includes earnings from properties governed by a South Carolina Nonresidential Simple Lease. For clarity on thresholds and compliance, exploring tools from US Legal Forms can be beneficial.

If you are a resident of New York City or an individual earning income within the city, you must file a New York City return. This includes non-residents who receive income from work, business, or real estate in the area. Understanding your filing obligations is crucial to remaining compliant. If you’re also dealing with real estate in South Carolina, resources from US Legal Forms can aid in managing both obligations.

Yes, non-residents must file a South Carolina tax return if they have income sourced from the state. This can include wages, rental income from property under a South Carolina Nonresidential Simple Lease, and other forms of income. It is important to address this requirement to avoid penalties. Consider checking out US Legal Forms for templates and guidance on filing your return.

Non-resident withholding for real estate transactions in South Carolina is generally 7%. This applies to sales proceeds when a non-resident sells property located in the state, including rental properties leased under a South Carolina Nonresidential Simple Lease. Properly understanding these regulations is essential for compliance. Utilize resources from US Legal Forms to ensure accurate documentation.

Form 565 is necessary for owners of partnerships and limited liability companies (LLCs) that earn income in South Carolina. This form is specifically for withholding on income sourced from non-resident partners. It helps ensure that the tax obligations for non-residents are met correctly. If dealing with a South Carolina Nonresidential Simple Lease, it’s wise to reference US Legal Forms for guidance on these filings.

The nonresident withholding rate in South Carolina is typically set at 7% for income generated from sources within the state. This applies to various income types, including income from a South Carolina Nonresidential Simple Lease. Understanding these rates is crucial for budgeting and tax planning. Using US Legal Forms can offer insights and tools to navigate this process effectively.

Form 8802 must be filed by individuals or businesses seeking to obtain a certificate of U.S. residency for tax purposes. This certificate helps to reduce or eliminate withholding taxes on income earned abroad. If you are engaged in business in multiple states, including South Carolina, ensure compliance to avoid double taxation. US Legal Forms can provide forms and assistance relating to the South Carolina Nonresidential Simple Lease.

The SC1065 form is required for partnerships operating in South Carolina that have income, deductions, or credits to report. Any partnership with members or organizations that earn income in South Carolina must file this form. Failing to file can result in penalties, so it's important to stay compliant. For a comprehensive guide, consider visiting US Legal Forms regarding the South Carolina Nonresidential Simple Lease.

Businesses operating as partnerships must file a South Carolina partnership return if they derive income from sources within the state. This includes partnerships with both resident and non-resident partners. Each partner's share of the income must also be reported on their individual tax returns. Using resources like US Legal Forms can help simplify the filing process for a South Carolina Nonresidential Simple Lease.